Is Capital.com Good for Day Trading? | My Honest Review

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Verdict:

Capital.com suits active day traders looking for low trading costs, quick order execution, and a clean, modern platform. It provides commission-free CFD and spread betting trading (additional charges may apply, with spread betting limited to UK users), competitive spreads on major instruments, and regulation across multiple jurisdictions. As with any leveraged trading, the risks are high and disciplined risk control is essential.

Top Rated

Top Rated

Platform Overview

Award-winning CFD trading platform featuring AI-powered trade insights. Access over 3,000 global markets with tight spreads.

62% of retail investor accounts lose money when trading CFDs with this provider.

Can You Day Trade Effectively on Capital.com?

Yes, you can day trade effectively on Capital.com using fast execution, tight published spreads, and tools like TradingView charts and alerts. The platform works well for discretionary intraday trading, short term swing trading, and news driven strategies when you control risk and position size.

What Features Make Capital.com Suitable for Active Day Traders?

Key features include zero commission (other fees apply), example spreads from 0.6 pips on EURUSD, one click trading, advanced charting, and integrated news. TradingView support and mobile apps help you monitor markets all day. Price alerts help traders stay informed about key market movements without constantly monitoring the platform.

Who Will Benefit Most from Day Trading on Capital.com?

Capital.com works best for retail traders who value simplicity and education rather than raw institutional style infrastructure. Ideal users include:

- Intraday technical traders

- Newer traders who want guidance

- Cost conscious traders running moderate frequency strategies

Some traders may prefer ECN style brokers.

Day Trading Snapshot

| Metric | Value |

|---|---|

| Min Deposit | £20 / €20 / $20 (most methods) |

| Trading Commissions | None |

| EUR/USD Typical Spread | 0.6 pips |

| UK100 Spread | From 1 point |

| Overnight Fee Example | 0.01096% daily (select GBP markets) |

| Regulation | FCA, CySEC, ASIC, SCA, SCB |

Table Description: Table summarising core day trading suitability metrics for Capital.com including minimum deposit, trading costs, spreads, and regulation.

Capital.com Overview – What Does the Broker Offer?

Capital.com is a multi asset derivatives broker offering forex, indices, commodities, and shares. In the UK, cryptocurrency CFDs are available for professional clients only. The broker provides its own web and mobile platforms plus access to TradingView and MT4, and is regulated in several regions. It offers negative balance protection for retail clients, although this feature is unavailable for Professional clients.

What Makes Capital.com Unique Compared to Other Day Trading Platforms?

Capital.com combines commission free pricing with strong education, behavioural style analysis, and a clean interface. It targets everyday traders who want low friction access, price alerts, and integrated learning while still keeping headline spreads competitive on widely traded instruments.

Which Markets Can You Day Trade on Capital.com?

You can day trade major and minor forex pairs, global indices such as UK100 and US500, commodities like gold and crude oil, and many share CFDs. Cryptocurrency CFDs are not available for retail clients in the UK.

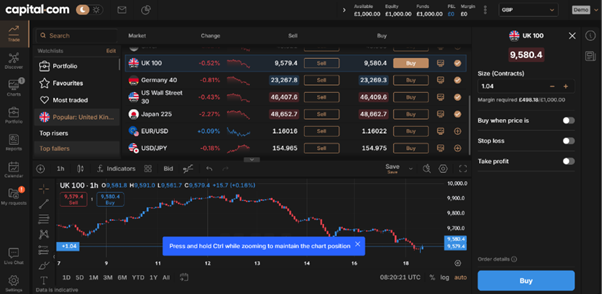

What Trading Platform Tools Support Intraday Strategies?

Platform tools include advanced charts, multiple time frames, technical indicators, drawing tools, watchlists, and price alerts. TradingView integration lets you use familiar chart layouts and custom indicators. An economic calendar and market news help you prepare for events that often trigger intraday volatility.

How Fast and Stable Is Capital.com During Volatile Sessions?

Capital.com is designed to process orders quickly, with 0.014-second average execution (October 2025 servers). Most users report good uptime even around news releases. Like any retail broker, spreads can widen and slippage can occur when markets move extremely fast or liquidity thins.

How Much Does It Cost to Day Trade on Capital.com?

Capital.com uses a spread only pricing model for most CFD and spread bet trades, so you do not pay separate dealing commissions. Example EURUSD spreads start around 0.6 pips and UK100 from about one point. For pure intraday traders who close positions the same day, costs mainly come from spreads.

Overnight funding charges apply if you hold leveraged trades past the session cutoff. The broker's daily fee is set at 4 percent per year, divided by 360 or 365 days depending on currency, so GBP markets use about 0.01096 percent per day plus benchmark rates. Guaranteed stop loss orders add a premium when triggered.

Does Capital.com Charge Commissions on Day Trades?

No standard dealing commission is charged on most CFD and spread bet trades with Capital.com. You pay through the spread instead of a ticket fee. This keeps pricing simple for day traders, who can estimate costs per trade by watching live spreads on their chosen instruments.

How Competitive Are Capital.com’s Spreads for Day Traders?

Example spreads from about 0.6 pips on major forex pairs and around one point on UK100 place Capital.com on par with many leading retail brokers. They may not beat the very tightest raw spread ECN accounts, but they are reasonable for most discretionary intraday strategies.

What Are Typical Spreads Fees and Overnight Charges?

Typical forex spreads on popular pairs often sit near 0.6 pips in normal conditions, based on published and third party examples. Indices usually trade at one or a few points. Overnight funding blends the broker fee with relevant interest benchmarks, charged on leveraged exposure rather than just account balance.

Are Volume Discounts or Reduced Costs Available for Active Traders?

Capital.com does not run a separate tiered commission discount structure, because most products are already commission free. Active traders can reduce realised costs by focusing on times with the tightest spreads, such as main session hours on liquid forex pairs and widely traded equity indices.

| Cost type | Detail | Notes |

|---|---|---|

| Account opening | Free | No charge to open or close accounts |

| Minimum deposit | 20 GBP EUR or USD for most methods | Some bank transfers may require higher minimums |

| Deposit fee | Free | Broker does not charge deposit fees |

| Withdrawal fee | Free | Most withdrawal methods are free at broker side |

| Trading commission | None | CFD and spread bet trading mainly spread only |

| Typical EURUSD spread | 0.6 pips | Published examples and external reviewers |

| Typical UK100 spread | From 1 point | Common example on index CFD |

| Overnight funding fee | 0.01096 percent daily plus benchmark | Illustrative figure for some GBP markets |

| Guaranteed stop loss fee | Variable premium | Shown on ticket when a GSL is set and triggered |

| Currency conversion fee | Free | No conversion fee when trading markets in another currency |

Table Description: Table outlining key account, trading, and funding costs for Capital.com that matter most to intraday traders.

How Fast Is Trade Execution on Capital.com?

Capital.com is built for fast order handling suitable for intraday trading on major markets. One click trading and quick order modification help you react during sharp moves. Slippage can still occur during news or low liquidity periods, which is standard for retail CFD and spread betting brokers.

What Technology Supports Order Routing and Stability?

The broker uses cloud based servers, load balancing, and distributed infrastructure to keep the platform responsive across sessions. Web, mobile, and TradingView connections feed into the same backend. Regular maintenance and scaling aim to minimise outages, though no system can guarantee perfect uptime in all conditions.

What Trading Tools and Features Help Day Traders on Capital.com?

Capital.com offers technical indicators, drawing tools, market sentiment gauges, price alerts, and watchlists. TradingView charts provide advanced analysis and layout saving. An economic calendar and news flow help you align trades with scheduled releases. The platform also tracks your trading behaviour to highlight potentially risky patterns.

What Risk Management Tools Does Capital.com Provide?

Risk tools include standard stop loss and take profit orders, trailing stops, margin alerts, and negative balance protection for retail clients. Guaranteed stop loss orders are available and remove gap risk when triggered, in exchange for a clearly displayed premium on the deal ticket.

Is Capital.com Beginner-Friendly for Day Trading?

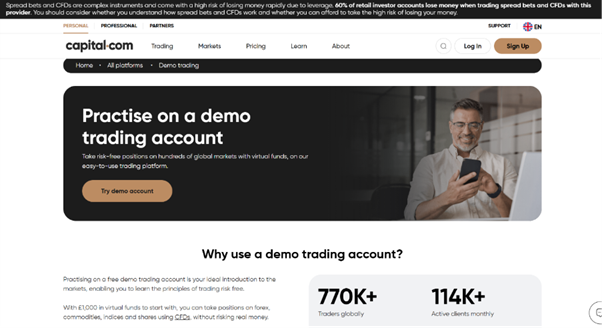

Capital.com is friendly for beginners thanks to its clean interface, structured learning content, and risk warnings. Order tickets are simple to understand, and demo mode lets you practice before committing real funds. The combination helps new traders transition into live intraday trading more cautiously and gradually.

What Educational Resources Help Day Traders Learn Faster?

The broker offers articles, video tutorials, platform guides, and a separate learning app. Topics range from basic market concepts to strategy ideas and risk management. Many resources are integrated into the platform, so you can learn contextually while you explore charts, indicators, and order windows.

Can You Practice Day Trading Safely with a Demo Account?

Yes, a free demo account mirrors live pricing with virtual funds. You can switch between demo and live modes quickly, test strategies, and become comfortable with order placement. This reduces the chance of costly mistakes when you eventually move into real money day trading on the live platform.

What Account Types Suit New and Intermediate Day Traders?

Retail CFD and spread bet accounts suit most new and intermediate users, providing leverage within regulatory limits and negative balance protection. Professional accounts may offer higher leverage but require eligibility checks and waive some protections. For most retail intraday traders, the standard retail setup is usually more appropriate.

Who Is Capital.com Best For?

Capital.com is best for retail day traders who value straightforward pricing, modern tools, and education. It fits those who want to trade actively without managing complex commission schedules. It is less suited to traders who demand raw spread ECN feeds, depth of market ladders, and advanced colocation infrastructure.

Is Capital.com Good for Beginners Who Want to Day Trade?

Yes, beginners benefit from low minimum deposits from 20 in key base currencies, a demo account, and educational material tailored for new traders. Sensible beginners still start with small size, clear rules, and realistic expectations about learning curves.

Is Capital.com Good for Experienced or High-Frequency Traders?

Experienced discretionary traders can benefit from fast execution, TradingView charts, and a wide market range. High frequency or algorithmic traders who depend on ultra tight raw spreads, specialist routing, or colocation will likely find dedicated ECN style brokers more suitable than a standard retail CFD and spread betting setup.

How Does Capital.com Compare with Other Day Trading Platforms?

Compared with many retail brokers, Capital.com offers stronger education and behavioural guidance, with costs that are competitive for most intraday strategies. Brokers like Pepperstone or XTB may edge ahead on raw spread pricing for high volume traders, while Trading 212 focuses more on investing than active multi asset CFD trading.

How Does Capital.com Compare with Other Day Trading Platforms?

| Feature | Capital.com | Pepperstone Razor | XTB Pro | Trading 212 |

|---|---|---|---|---|

| Commission on CFDs | None | Yes | Yes | None on many products |

| Pricing style | Spread only | Raw spread plus commission | Raw spread plus commission | Spread only |

| Education strength | High | Moderate | Moderate | Lower |

| TradingView access | Yes | Yes | No | No |

| Minimum deposit | From 20 base currency | Varies by region | Varies by region | Low or none |

| Focus segment | Retail day traders | Active traders | Active traders | Investors and casual traders |

Table Description: Table comparing key features and positioning of Capital.com against three popular competitor brokers for intraday trading.

Should You Choose Capital.com for Day Trading?

You may want to consider Capital.com if you prefer a straightforward, commission-free pricing model, accessible educational resources, and technology that supports intraday trading without unnecessary complexity. The platform is especially appealing for traders who value behavioural insights and alerts designed to discourage emotional or impulsive decisions.

Capital.com may be less suitable if your strategy relies on ultra-tight raw spreads, deep market liquidity, or advanced algorithmic trading infrastructure. In those cases, an ECN-style account with full depth-of-market tools may be a better fit. For most retail day traders, however, Capital.com delivers a well-rounded mix of usability, tools, and cost efficiency.

FAQs

Does Capital.com Charge Withdrawal or Inactivity Fees?

Capital.com does not charge withdrawal fees according to its fees page, which helps keep non trading costs low. The broker also does not list a separate inactivity fee there. Your payment provider might still charge its own fees, so it is worth checking card, bank, or wallet terms.

Is Day Trading on Capital.com Legal in My Country?

Day trading on Capital.com is generally legal where the broker is authorised and contracts for difference are permitted. The firm is regulated by authorities such as the FCA, CySEC, ASIC, and others. You must still check local rules, tax obligations, and any restrictions on leveraged trading in your jurisdiction.

What Is the Minimum Deposit Required for Day Trading?

The standard minimum deposit is 20 EUR, USD, or GBP for most supported payment methods, with some bank transfers requiring higher minimums. This low entry level makes it easier to start small. Sensible day traders still size positions conservatively, especially when they are learning strategies or the platform.

Can I Use Leverage for Intraday Trades on Capital.com?

Yes, you can use leverage when trading CFDs or spread bets on Capital.com. Maximum leverage depends on regulation, with many European retail clients limited to 30 to 1 on major forex pairs. Leverage amplifies both gains and losses, so day traders should plan risk per trade very carefully.

References

- ✓ 0% Commission (other fees apply)

- ✓ 5,000+ CFD Markets — Crypto, FX, Stocks

- ✓ Free to open · No minimum deposit

62% of retail investor accounts lose money when trading CFDs with this provider.