Capital.com vs Trading 212 – Which Broker Is Better for You?

Capital.com and Trading 212 are two of the most popular brokers for retail traders in Europe and the UK. Capital.com specialises in CFD and spread betting, while Trading 212 combines CFDs with zero-commission stock and ETF investing. The better choice depends on how you trade.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Should You Choose Capital.com or Trading 212?

Capital.com is usually the better choice for active CFD traders who want education, TradingView support, clear costs, and fast withdrawals. Trading 212 suits long-term investors who primarily want commission-free stock or ETF investing with occasional CFD trading inside one app.

Top Rated

Top Rated

Platform Overview

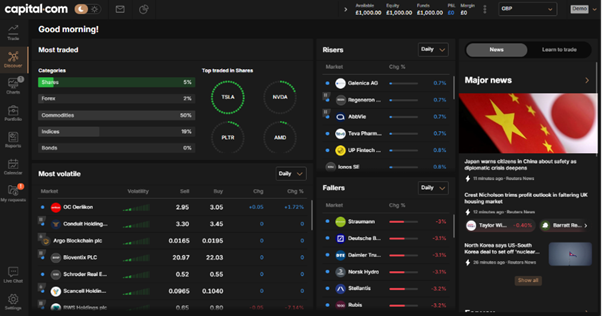

Award-winning CFD trading platform featuring AI-powered trade insights. Access over 3,000 global markets with tight spreads.

62% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com vs Trading 212 Snapshot Comparison

| Metric | Capital.com | Trading 212 |

|---|---|---|

| Founded | 2016 | 2004 |

| Business model | CFDs and spread betting only | CFD plus Invest and ISA stock accounts |

| Minimum deposit | From 20 base currency | No official minimum |

| Trading commissions | 0 percent | 0 percent |

| FX conversion fee | 0.7 percent CFD | 0.5 percent CFD and 0.15 percent Invest |

| Platforms | Web, Mobile, TradingView, MT4 | Web, Mobile, proprietary only |

| Trustpilot score | About 4.0 from 13,000+ reviews | About 4.6 from over 70,000 reviews |

| Reported growth | 800,000 new funded accounts in one quarter | Over 5 million lifetime funded accounts |

Table showing key differences between Capital.com and Trading 212 including pricing models, platform approach, account types, and public review volume.

Who Is Capital.com Best For vs Who Is Trading 212 Best For?

Choose Capital.com if you are primarily a CFD day trader who wants structured education, TradingView charts, and simple spread-only pricing. Choose Trading 212 if you want one app for long-term investing, ISA stock accounts, and occasional CFD trading without leaving the same interface.

For a complete breakdown, see our Capital.com review.

Platform Safety and Regulation Compared

Which Broker Has Stronger Regulatory Coverage?

Both brokers hold major licences including FCA authorisation. Capital.com and Trading 212 must segregate client funds and display risk warnings. Trading 212 is older, but Capital.com publishes detailed fee and execution breakdowns, supporting transparency for active traders.

Are Client Funds Protected the Same Way at Both Brokers?

Both brokers use segregated accounts under regulatory rules. Eligible clients benefit from negative balance protection. Trading 212 applies this across CFD accounts, while Capital.com extends protection across its CFD and spread bet offering depending on jurisdiction.

Fees, Spreads, and Trading Costs Compared

Capital.com uses a spread only cost model with no ticket commission on CFDs and spread bets. Trading 212 also offers commission-free CFD trading, but applies a 0.5% FX fee when instruments differ from account currency. In selected regions, Capital.com applies a 0.7% FX conversion but only on the cash adjustment, not the full trade value.

Overnight funding differs. Capital.com applies a published annual four percent fee divided daily plus benchmark rates. Trading 212 applies overnight interest that may be positive or negative depending on direction and instrument.

Does Capital.com or Trading 212 Have Lower CFD Costs?

For purely intraday CFD trading, Capital.com often works out cheaper due to the way its FX fee applies only to adjusted cash flows. Trading 212 can be cheaper for occasional trades, but frequent multi-currency CFD activity may produce accumulated FX conversion costs.

What About Stock and ETF Investing Costs?

Trading 212 offers zero-commission stock and ETF investing through Invest and ISA accounts, with only a 0.15% FX fee. Capital.com does not offer physical share ownership, focusing mostly on leveraged trading.

Are There Hidden FX Conversion or Funding Fees?

Both brokers disclose FX and overnight costs publicly. Capital.com applies 0.7% FX on relevant conversions and clearly shows overnight funding rates. Trading 212 applies 0.5% FX for CFD accounts and 0.15 percent for Invest accounts.

Full Cost Comparison

| Cost type | Capital.com | Trading 212 |

|---|---|---|

| CFD commission | 0 percent | 0 percent |

| FX fee CFD | 0.7 percent | 0.5 percent |

| FX fee Invest | Not applicable | 0.15 percent |

| Overnight funding | Broker fee 4 percent per year plus benchmark | Swap interest positive or negative |

| Guaranteed stop fee | Only if triggered | Not offered as separate feature |

| Stock ownership | No | Yes (Invest and ISA) |

Side-by-side cost comparison showing how each broker charges for FX, funding, and stock investing.

Platform and Execution Quality Compared

Which Platform Is Better for Active Traders?

Capital.com offers advanced charts, one-click trading, TradingView integration, and optional MT4. Trading 212 keeps everything inside its proprietary platform.

Can You Use MT4 or TradingView on Either Broker?

Capital.com supports TradingView and MT4 access in supported jurisdictions. Trading 212 does not support TradingView, MT4, or MT5.

Which Broker Has Faster Order Execution?

Both brokers report fast execution, but Capital.com highlights that over 99 percent of withdrawals were processed within 24 hours.

Markets and Instruments Compared

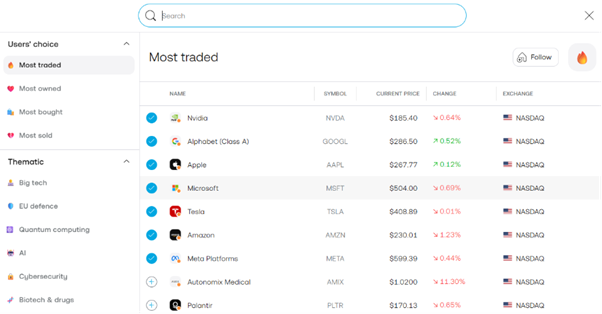

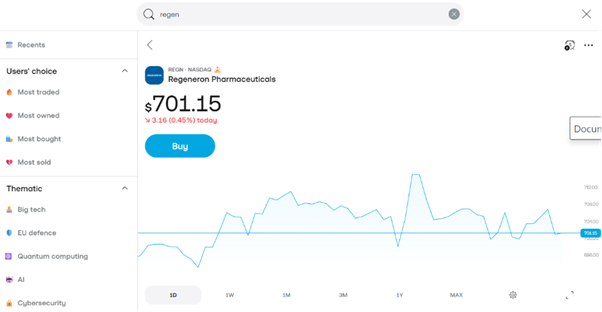

Which Broker Offers More Tradeable Assets?

Capital.com offers thousands of CFDs and spread bets (spread bets only available for UK clients). Trading 212 offers CFDs plus real stocks and ETFs.

Can Both Platforms Trade Crypto, Stocks, and Indices?

Both offer index CFDs. Capital.com offers cryptocurrency CFDs, but only for professional clients in the UK.

Education, Tools, and Extra Features

Which Broker Supports Beginners Better?

Capital.com offers structured learning courses, a learning app, a demo account, and behavioural alerts. Trading 212 offers basic explainers and community forums.

Deposit Minimums and Funding Options Compared

Which Broker Is Cheaper to Start With?

Capital.com allows deposits from 20 base currency units. Trading 212 has no formal minimum.

Whose Deposit and Withdrawal System Is Faster?

Both support instant card funding. Capital.com reports almost all withdrawals processed within 24 hours.

Pros and Cons Side-by-Side

Capital.com Pros and Cons

Pros:

- Spread-only CFD pricing with 0 commission (other fees apply)

- TradingView and MT4 support

- Behavioural training and structured education

- Fast withdrawals and 24/7 customer support in selected regions

Cons:

- No real share ownership

- FX conversion higher than Trading 212 Invest accounts

- Not a single-app solution for long-term investing

Trading 212 Pros and Cons

Pros:

- Zero commission real stock and ETF investing

- ISA accounts with no custody fee

- Large Trustpilot footprint

- One app for investing and CFD trading

Cons:

- No TradingView or MT4 support

- CFD FX conversion can accumulate

- Limited education tools

Full Feature Comparison Table

| Feature | Capital.com | Trading 212 |

|---|---|---|

| Primary model | CFDs and spread betting only | CFD plus real stock and ETF investing |

| Platform support | Web, Mobile, TradingView, MT4 | Proprietary only |

| CFD costs | Spread-only, no ticket cost | Spread-only, no ticket cost |

| Investing costs | Not provided | Zero commission plus 0.15% FX |

| FX conversion | 0.7% on cash adjustments | 0.5% CFD / 0.15% Invest |

| Education | Built-in courses, learning app, behavioural alerts | Basic help docs, community discussions |

| Best for | Retail CFD day traders | CFD plus long-term investor hybrids |

Table summarising differences in platform support, cost models, education tools, and target trader type.

Final Verdict – Which Broker Should You Choose?

If you want a single app to buy stocks and ETFs, Trading 212 is a strong choice. Capital.com is the stronger choice for anyone prioritising CFD trading performance.

FAQs

Is Trading 212 Cheaper Than Capital.com?

Trading 212 is cheaper for long-term investing. Capital.com is often more cost-efficient for frequent CFD traders.

Which Broker Has Better Spreads?

Both offer zero-commission CFD trading, but spreads vary.

Can I Use TradingView With Either Broker?

Only Capital.com supports TradingView.

Which Broker Is Better for Beginners?

Trading 212 is easier for passive investors; Capital.com is better for structured learning.

Which Broker Is Safer?

Both are regulated and segregate client funds.