CMC Markets Review 2026: What Are Users Saying?

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Verdict: Is CMC Markets Worth It in 2026?

CMC Markets remains a top-tier choice for UK traders seeking depth, regulation, and precision. Its Next Gen platform is exceptionally stable, spreads start at 0.7 pips, and client funds are fully segregated. Though overnight costs apply on CFDs, transparency and execution speed justify the fees.

Award Winning

Award Winning

Award-winning Next Generation platform with 12,000+ instruments. Spread betting and CFD trading with Reuters news built in.

64% of retail investor accounts lose money when trading CFDs with this provider

How Does CMC Markets Rate Overall?

| Category | Score (/5) | Comment |

|---|---|---|

| Ease of Use | 4.6 | Smooth platform and app design |

| Fees | 4.3 | Low FX spreads but some overnight costs |

| Regulation | 4.9 | FCA ASIC & MAS licensed |

| Markets | 4.8 | 12000+ global instruments |

| Features | 4.6 | Advanced tools & charting |

| Overall | 4.6 | Excellent for regulated multi-asset trading |

Our Expert Says:

“I've traded through CMC for three years and rate its execution and charting among the best. Deposits arrive instantly, withdrawals are reliable, and spreads rarely widen unexpectedly. It's ideal for experienced FX and CFD traders who prioritise trust and regulation over social trading or high leverage.”

What is CMC Markets?

CMC Markets is a London-based broker offering CFDs and spread betting across forex, indices, shares, commodities, and crypto CFDs. Established in 1989, it's known for its advanced Next Gen platform, transparent pricing, and strong global regulation under the FCA, ASIC, and MAS.

Who Is CMC Markets For?

CMC Markets is designed for active and professional traders who value tight spreads, rapid execution, and in-depth market analysis. It's best suited to those seeking institutional-grade tools and regulation rather than beginners or casual investors.

What Makes It Stand Out?

CMC Markets combines scale and reliability. With over 12,000 tradable instruments and new weekend crypto trading introduced in 2026, it offers unmatched flexibility. Its execution speed and 0.004-second median trade latency underline why it continues to dominate the UK CFD and spread betting space.

What Type of Broker Is CMC Markets?

It's a non-dealing-desk (CFD and spread betting) broker, aggregating liquidity from multiple providers to deliver tight spreads and transparent execution. Clients can use either Next Gen or MT4 platforms.

Who Typically Trades with CMC Markets?

Most clients are retail or semi-professional traders who value charting precision, risk management tools, and low latency. CMC reported 290,946 active clients last year, highlighting strong trust among global users.

What Instruments Can You Trade on CMC?

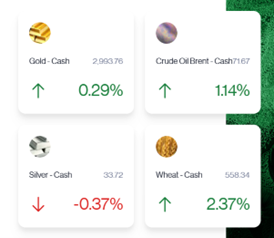

CMC Markets offers access to over 12,000 instruments across forex, indices, shares, commodities, treasuries, and crypto CFDs for eligible clients. Trade long or short with flexible leverage, fractional sizes, and guaranteed stop-loss orders. Market hours span 24/5, with weekend crypto trading launched in 2026. Coverage includes major and niche markets.

| Asset Class | Examples | Availability |

|---|---|---|

| Forex | EUR/USD; GBP/USD; USD/JPY | 24/5 trading |

| Indices | FTSE 100; US 30; Germany 40 | 24/5 trading |

| Shares | Apple; BP; Tesla | 9000+ global stocks |

| Commodities | Gold; Oil; Natural Gas | 24/5 trading |

| Treasuries | UK Gilts; US 10-Year | Regular market hours |

| Crypto CFDs | BTC/USD; ETH/USD (Pro clients only) | Weekend trading added 2026 |

How Many Markets Are Available?

CMC's range covers more than 12,000 instruments globally, including 300+ FX pairs and 9,000 shares. This depth provides unparalleled flexibility, letting traders diversify or focus narrowly on specific market niches.

Does It Support Crypto Trading?

Yes, but only via CFDs for eligible clients. Retail crypto exposure remains restricted under UK regulations, yet CMC offers weekend trading for professional accounts — a unique advantage for crypto-focused traders needing constant market access.

Are Fractional and Thematic Investments Offered?

Yes. CMC allows fractional share trading and access to themed share baskets, enabling low-cost diversification. This approach gives smaller traders exposure to sectors like tech or green energy without committing to full share units.

What Do Users Like About CMC Markets?

CMC Markets has a Trust Pilot rating of 4.0 out of 5 based on over 2,00 unique user reviews, proving they have a reputation for strong user satisfaction.

How Easy Is It to Get Started with CMC Markets?

Sign-up takes under 10 minutes. Verification usually completes within a day via photo ID and address proof. Deposits are free by bank, card or PayPal, and withdrawals clear within 1–2 business days. No minimum deposit applies for UK accounts.

With over 1.6 million unique logins in the last financial year, CMC's platform clearly appeals to an active user base — proof of reliability and ease of access for both retail and professional traders.

How Fast Is Account Opening and Verification?

Registration involves standard KYC checks and is handled online. UK users can trade within a day, while international accounts may take slightly longer. The process feels efficient and transparent, with immediate email confirmation once approved.

What Are the Deposit and Withdrawal Options?

CMC supports major payment methods including debit cards, bank transfers, and PayPal. Deposits are instant, and withdrawals usually clear within 24–48 hours. The broker doesn't charge deposit or withdrawal fees, which adds appeal for active traders.

Is There a Minimum Deposit Requirement?

CMC has no mandatory minimum deposit for UK clients, allowing traders to start small. This accessibility makes it easier to test strategies or explore new markets without financial pressure.

| Step | Details | Time |

|---|---|---|

| Registration | Online KYC form | 5–10 min |

| Verification | ID & address proof | <24 hrs |

| Deposit Methods | Bank transfer / Card / PayPal | Free |

| Withdrawal | Same method | 1–2 days |

| Limit | £40000 per 24h to card | Standard policy |

Who Is CMC Markets Best For?

CMC suits intermediate to advanced traders who value regulation, execution speed, and analytical depth. Its education tools support growth, but casual users may find the platform's sophistication unnecessary. It's a top fit for long-term, strategy-driven investors.

Is It Good for Beginners?

Beginners benefit from the CMC Learn Hub and demo account but may face a learning curve due to complex tools. Still, the broker's educational support and structured platform make it a solid choice for committed newcomers ready to progress.

Why Do Professional Traders Use CMC?

Professional traders use CMC for its institutional-grade execution, deep liquidity, and analytical precision. Its margin policies, advanced charting, and guaranteed stop-loss features offer robust control, making it a consistent choice among regulated brokers for active traders and financial professionals.

Who Might Want to Look Elsewhere?

Casual investors seeking social trading or direct crypto ownership may prefer alternatives like eToro or Uphold. CMC's professional tone, leverage rules, and CFD-only crypto access can feel limiting for users looking for a simpler or more speculative platform.

What's It Like Trading on CMC Markets?

CMC delivers a smooth, stable trading experience. The Next Gen platform combines precision with speed, averaging 0.004-second execution. Customisable layouts, 80+ indicators, and fast order management make it ideal for both day traders and long-term strategists. If short-term strategies are your priority, read our assessment of whether CMC Markets is good for day trading.

How Reliable and Fast Is Trade Execution?

Execution is impressively consistent, even during volatile periods. Orders fill with minimal slippage, supported by robust liquidity infrastructure. Traders can rely on quick response times, helping maintain control and confidence during high-volume market sessions.

How Intuitive Is the Platform to Use?

Next Gen's design balances professional depth with user-friendly navigation. Menus are clear, chart windows responsive, and order controls easily configurable. While the features take time to master, the interface feels logical and well-built for daily use.

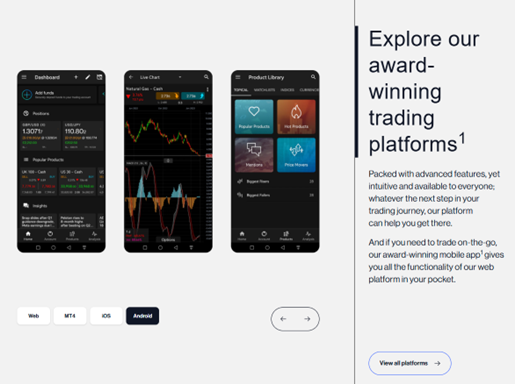

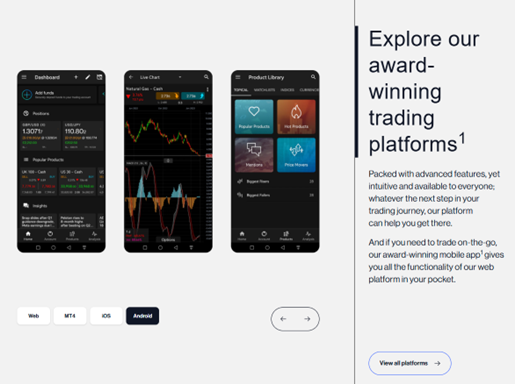

How Good Is the CMC Markets Mobile App?

The mobile app mirrors desktop functionality, including advanced charting and full order management. Performance is stable even during news-driven spikes, making it a strong companion for traders needing access on the move.

Desktop vs Mobile Trading on CMC

CMC's desktop platform offers the full professional toolkit — multi-chart layouts, 80+ indicators, and advanced order management. The mobile app mirrors nearly all these functions, maintaining speed and reliability. While the desktop suits deep analysis, the app excels for responsive, on-the-go trading control.

CMC Markets vs CMC Invest

CMC Markets focuses on CFD and spread betting, designed for active traders who speculate on short-term price movements with leverage. CMC Invest, by contrast, targets long-term investors with access to real shares, ETFs, and ISAs — offering zero-commission investing without leverage or overnight financing costs. If fund security matters to you, we also answer the question is CMC Invest safe.

What Are CMC Markets' Fees and Spreads Like?

CMC's pricing is transparent and competitive in 2026. FX spreads start from 0.7 pips, share CFDs cost 0.10% (minimum £9), and there are no deposit or withdrawal fees. Overnight and inactivity charges apply, but all costs are clearly displayed before confirming trades.

What Are Typical Trading Costs?

Major forex pairs trade from 0.7 pips, with indices and commodities remaining equally cost-efficient. Share CFDs incur a 0.10% commission per side, subject to a £9 minimum. Pricing is stable, making CMC suitable for both frequent and high-volume traders.

Are There Any Hidden or Extra Fees?

No hidden charges exist. All fees are shown in advance. Overnight financing and inactivity costs are the only extras — standard across regulated brokers. CMC's fee structure remains simple and transparent, ensuring traders know their exact exposure at every stage.

How Do Its Fees Compare to Competitors?

CMC's spreads are slightly higher than IG's headline rates but lower than eToro's on most pairs. It ranks among the most cost-effective FCA-regulated brokers in 2026, balancing low trading costs with strong platform quality and execution speed.

| Fee Type | Typical Cost / Spread | Notes |

|---|---|---|

| FX Spread (Major pairs) | From 0.7 pips | Applies to EUR/USD and other majors |

| Share CFD Commission | 0.10% per side (min £9) | UK market rate |

| Overnight Holding Charge | Variable | Applied daily to open CFD positions |

| Inactivity Fee | £10 per month | After 12 months of no trading |

| Deposit Fee | Free | No charge for card or bank transfer |

| Withdrawal Fee | Free | No standard withdrawal cost |

| Minimum Deposit | None | Start trading with any balance |

Is CMC Markets Safe and Regulated?

CMC is fully licensed by the FCA (UK), ASIC (Australia), and MAS (Singapore). Client funds are segregated, and UK customers benefit from FSCS protection up to £85,000. The broker undergoes regular audits and maintains real-time financial transparency. For more on this, see our page Is CMC Markets Safe?

What Licences and Protections Does It Have?

CMC holds multiple tier-one regulatory licences, ensuring client fund segregation and operational oversight. Its UK operations are monitored under FCA registration 173730. Similar safeguards apply in Australia and Singapore.

How Secure Are Client Funds?

Funds are stored in segregated accounts at tier-one banks. CMC uses encryption, two-factor authentication, and strict compliance monitoring to protect client balances and personal data.

Does It Offer Negative Balance Protection?

Yes. Retail traders receive negative balance protection, ensuring they can't lose more than their deposit. This aligns with European investor safety standards under ESMA rules.

What Educational Tools and Research Does CMC Offer?

CMC excels in education, with webinars, videos, and live sessions. The Learn Hub simplifies complex topics, while the demo account allows unlimited practice. Its integrated news feed and market analysis tools help users apply lessons directly to real-time trades.

What Learning Resources Are Available?

Weekly webinars, on-demand videos, and tutorials cover both basic and advanced trading. CMC's materials are practical and scenario-driven, improving user confidence in risk management and execution.

How Helpful Is the Demo Account?

The demo account mirrors live conditions with real-time data and virtual funds. It's unlimited, allowing traders to test strategies risk-free for as long as they wish.

Where Does CMC Markets Excel and Where Could It Improve?

CMC stands out for its regulation, execution speed, and platform quality. Areas for improvement include expanding crypto access and offering 24/7 customer support. Still, its consistency and transparency outweigh these minor drawbacks for most users.

What Are the Main Strengths?

CMC's major strengths are reliability, FCA regulation, low spreads, and the sophistication of its Next Gen platform. Its research suite and risk controls set it apart from less-regulated brokers.

What Are the Common Weaknesses Reported by Users?

Some users mention the learning curve for advanced tools and limited weekend support. Others note the lack of direct crypto ownership. Despite these, satisfaction ratings remain high due to platform stability and fair pricing.

What Are the Main Pros and Cons?

Pros

- Tight spreads from 0.7 pips

- Highly regulated globally (FCA, ASIC, MAS)

- Fast and reliable execution speed

- Excellent in-house research and analysis tools

- Free deposits and withdrawals

Cons

- Overnight holding fees apply on CFD positions

- No crypto ownership for UK retail clients (CFDs only)

- Interface may feel complex for beginners

- £10 inactivity fee after 12 months

- Customer support not available 24/7

How Does CMC Compare to Other Brokers?

CMC's depth, transparency, and execution outperform many competitors. IG slightly edges it on asset range, while eToro offers social features CMC lacks. However, for regulated, professional-grade trading, CMC remains one of the UK's most balanced options.

What Makes It Unique Among UK Brokers?

Its scale, regulation, and speed create an unmatched blend of safety and performance. Few brokers offer 12,000+ assets with this level of transparency and technology.

Where Do Other Platforms Perform Better?

Rivals like IG (See our IG Review) offer broader research, and eToro (see our eToro review) provides community trading. Yet, few match CMC's consistency in execution and liquidity depth, especially for serious FX and CFD traders.

Final Verdict: Should You Try CMC Markets

CMC Markets is a top-tier, fully regulated broker with exceptional execution and education. It's perfect for disciplined traders seeking reliability and depth. While beginners may need time to adapt, the platform rewards commitment with precision and trustworthiness.

Who Will Get the Most Value from It?

Active traders, professionals, and investors who prioritise regulated environments and analytical depth will gain most. It's ideal for those trading multiple markets under one robust platform.

What Are the Key Takeaways?

MC's regulated structure, fast execution, and transparency justify its position as a leading global broker. It's a dependable choice for traders who value control, data, and fair costs.

What's the Overall Recommendation?

Highly recommended for serious traders seeking a long-term, FCA-regulated partner. Few brokers combine breadth, reliability, and support as effectively as CMC Markets in 2026.

FAQs

Is CMC Markets a reliable trading platform?

Yes, CMC Markets is a highly regulated broker, overseen by top financial authorities like the FCA (UK) and ASIC (Australia). It offers fast trade execution, advanced charting tools, and tight spreads, making it a solid choice for active traders.

Does CMC Markets charge high fees?

CMC Markets offers low forex spreads and zero withdrawal fees, but stock CFD commissions can be higher than some competitors. Inactivity fees apply after 12 months of no trading.

Can beginners trade on CMC Markets?

Yes! While the Next Generation platform has a learning curve, CMC Markets provides educational webinars, guides, and a demo account, making it beginner-friendly.

Is CMC Markets good for long-term investors?

No, CMC Markets only offers CFDs, meaning you cannot buy and own stocks or earn dividends. It's better suited for short-term trading.

Does CMC Markets have a mobile app?

Yes, CMC Markets has a mobile app for trading on the go, but some users find it less intuitive for charting and analysis compared to desktop.

References

- CMC Markets Official Website – CMC Markets – Enabling Traders | Your Gateway to Global Markets

- Financial Conduct Authority (FCA) Register – Financial Conduct Authority | FCA

- Trustpilot – CMC Markets User Reviews