How to Day Trade on eToro - 2025 Guide & Walkthrough

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: How Do You Day Trade on eToro?

Open and fund your eToro account, build watchlists, then buy and sell assets within the same day aiming to profit from small moves. Use stop losses and take profits to manage risk. Always start small — day trading is high risk and needs discipline.

Key Takeaways

Day trading on eToro is possible for UK and EU users through CFD and stock trading. The platform offers real-time charts, quick order execution, and stop-loss tools. While simple for beginners, spreads and leverage limits mean active traders must manage costs carefully.

eToro Overview

- Minimum Deposit: $50 (via UK bank transfer)

- Copy top-performing traders across a wide range of assets

- FCA regulated and compliant with UK crypto marketing rules

- User-friendly platform with social trading and mobile app support

- Perfect for beginners and casual investors looking to follow expert strategies with ease

61% of retail CFD accounts lose money when trading CFDs with this provider.

UK New Clients

UK New Clients

Day Trading Snapshot

Day trading on eToro offers speed and leverage — but that also means higher risks. It’s easy to overtrade or let small losses snowball. Know the main pitfalls so you can protect your account and keep emotions from wrecking your trades.

eToro is amongst the best trading platform in the UK. For more on this see our eToro review.

| Feature | Detail |

|---|---|

| Account Type | CFD or Invest |

| Minimum Deposit | £50 |

| Execution Speed | Instant on major assets |

| Leverage | Up to 1:30 (retail) |

| Platform | Web & Mobile App |

| Markets | Stocks Forex Crypto Indices |

Quick Fact: Over 34% of eToro’s UK users execute trades lasting under 24 hours, showing high retail interest in short-term trading. (Source: eToro Trading Report 2024)

Your Step-by-Step Guide to Day Trading on eToro

Here’s exactly how to start day trading on eToro, from sign-up to your first trade. Each step ensures you build a safe, structured approach — critical for avoiding common beginner mistakes.

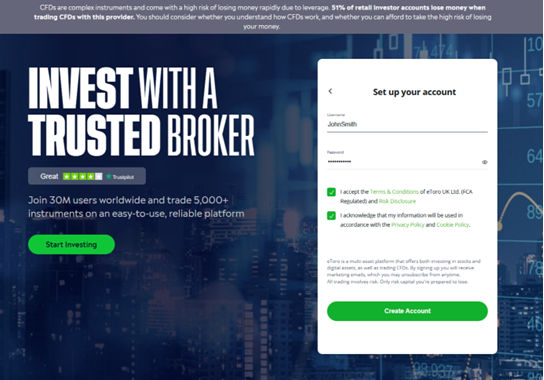

Step 1: Open and Verify Your eToro Account

Go to eToro’s site or app and click “Join Now.” Complete your details, set security questions, and accept T&Cs. Verification is required by law before you can trade or withdraw funds.

What Documents Will You Need?

You’ll upload a passport or driver’s license, plus a recent utility bill or bank statement to prove your address. Make sure documents are clear and in date to avoid delays.

How Long Does Verification Take?

Most UK users get verified in under 24 hours. Occasionally, eToro asks for extra ID checks, which can stretch to 48 hours. You’ll get an email once fully approved.

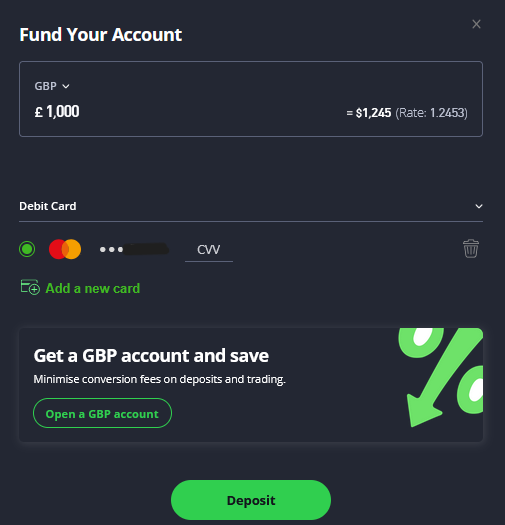

Step 2: Fund Your Account Safely

Once verified, click “Deposit Funds.” eToro accepts cards, bank transfers, PayPal, and more. Always double-check your deposit details and start small — never add money you can’t afford to lose.

Deposit Methods & Minimums

UK minimum deposits are typically $50–$200 (around £40–£160), depending on funding method. Debit cards and e-wallets are fastest; bank transfers can take a few days to clear.

Any Hidden Fees?

eToro doesn’t charge deposit fees, but withdrawals cost $5, and funds are held in USD, so conversion fees around 0.5% apply. Always factor in these small costs when planning trades.

| Method | Min Deposit | Typical Speed | Withdrawal Fee | FX Fee |

|---|---|---|---|---|

| Debit Card | ~$50 | Instant | $5 | ~0.5% |

| Bank Transfer | ~$200 | 3-5 days | $5 | ~0.5% |

| PayPal | ~$50 | Instant | $5 | ~0.5% |

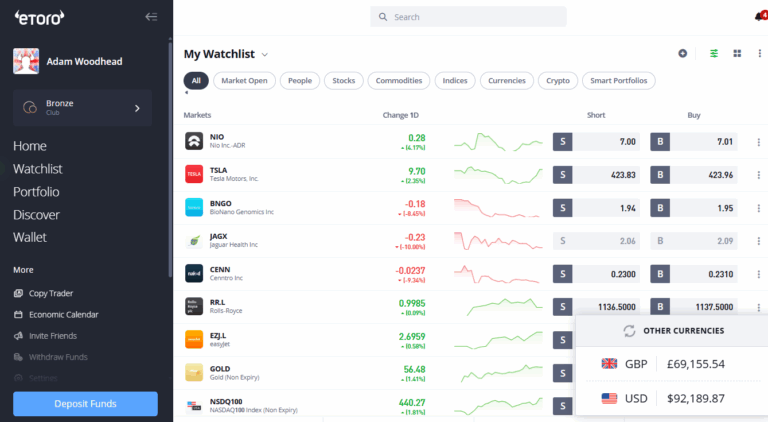

Step 3: Set Up Your Watchlists & Alerts

Before trading, build watchlists of assets that interest you. This keeps your day trading focused and stops random chasing. eToro makes it easy to group stocks, forex pairs, or cryptos, so you’re always tracking the right markets.

How to Build a Focused Watchlist

Click the “Watchlist” tab, then “Create New List.” Add high-volume stocks or currency pairs with strong daily moves. Avoid clutter — stick to a handful of assets you’ll actually monitor each session.

Using Price Alerts to Spot Day Trades

Tap the bell icon on any asset to set alerts. eToro notifies you when prices hit key levels, so you can jump in without staring at charts all day. Alerts help spot breakout trades or reversal zones.

Step 4: Pick the Right Stocks or Markets to Day Trade

Choose assets that move. Day traders rely on volatility and volume. On eToro, look for trending stocks, popular forex pairs, or cryptos with clear momentum. Avoid illiquid shares — wide spreads eat profits fast.

Which Assets Are Best for Day Trading on eToro?

While eToro doesn’t support professional day trading or high-frequency strategies, users can open and close short-term positions on liquid markets such as major stocks, ETFs, and select forex pairs. Crypto day trading isn’t available for UK or EU retail users, as crypto CFDs are restricted under FCA rules. These assets instead suit short-term investing rather than pure day trading.

What Makes a Good Day Trading Stock?

Tight bid-ask spreads, consistent daily swings of at least 2-3%, and high trading volumes. Think Tesla or big banks on earnings days — not sleepy penny stocks that barely budge.

Example: Finding a Volatile Equity on eToro

Go to “Discover,” filter by “Trending Stocks” or use “Most Volatile.” Check the 1-day chart — look for clean up or down moves. Add it to your watchlist for the next session.

What Makes a Good Day Trading Asset?

| Factor | Ideal for Day Trading? | Why It Matters |

|---|---|---|

| Volume | High | Easy entries/exits |

| Volatility | Moderate-High | More opportunities |

| Tight Spreads | Yes | Lower trading costs |

| News Sensitivity | Often | Moves quickly on catalysts |

Step 5: Learn the Basics of Forex & CFD Day Trading

Forex pairs like GBP/USD or EUR/USD move daily, offering leverage for small accounts. eToro also lets you trade stocks via CFDs, meaning you can go long or short — but this increases both profit potential and risks.

Why Forex is Popular with Day Traders

Forex runs 24 hours on weekdays, so you can trade before or after UK stock hours. It’s liquid, fast-moving, and often trends cleanly on news — perfect for short-term charts.

CFD Leverage: Boosting (and Risking) Returns

CFDs let you trade with a small margin, amplifying gains. But it cuts both ways. A 5% move against you wipes out a small account fast. Always use stop losses and never max your leverage.

Key Forex & CFD Day Trading Concepts

| Concept | What It Means | Day Trader Impact |

|---|---|---|

| Leverage | Trade with borrowed funds | Magnifies gains & losses |

| Spread | Difference buy vs sell price | Cost of each trade |

| Margin Call | Broker closes positions | If losses too large |

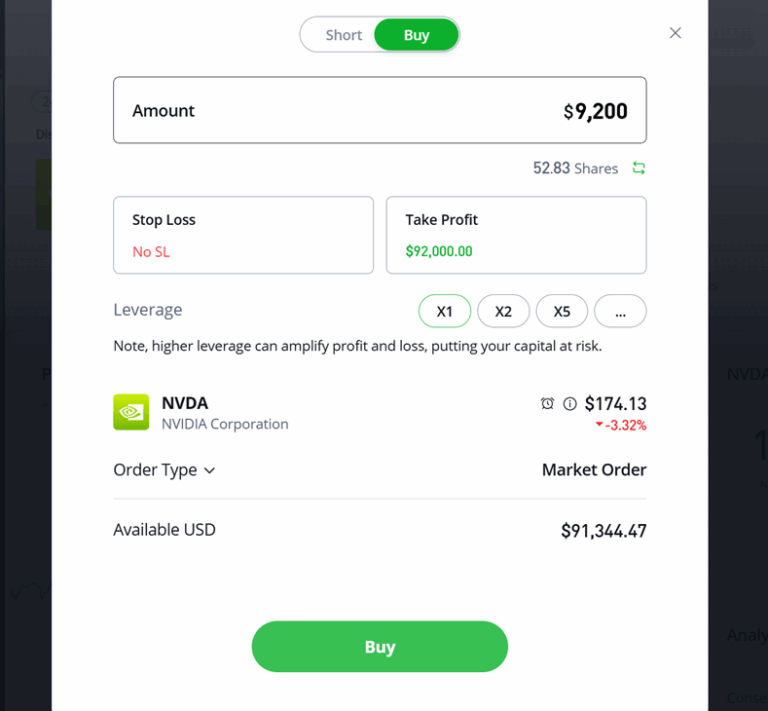

Step 6: Place Your First Day Trade on eToro

Once you’ve found your trade, hit “Trade” on the asset page. Decide how much to risk, set your stops, and confirm. Start small — even a £50 test trade builds experience without heavy losses if things turn fast.

Choosing Order Types (Market vs Limit)

A market order buys instantly at current prices — ideal in fast markets. A limit order sets your own price, useful for breakouts or pullbacks. New day traders often start with markets for speed but switch to limits for control.

Setting Stop Losses and Take Profit Levels

Always set a stop loss to cap downside and a take profit to lock gains. On eToro’s ticket, toggle “Stop Loss” and “Take Profit” — adjust to key chart levels, not just random numbers.

Step 7: Monitor Positions and Manage Risk

After entering, watch price action. Avoid panic if it wobbles — small intraday moves are normal. Stick to your plan. Adjust stops to lock in gains or limit bigger losses as the trade develops.

Adjusting Stops in Real Time

If price moves in your favour, tighten stops to breakeven or small profit. This protects from sudden reversals — crucial in day trading where trends can flip fast.

When to Exit Winning or Losing Trades

For losses, honour your stop. For winners, exit at your planned take profit or when momentum fades. Never hold hoping a losing day trade “comes back.” That’s how small losses become portfolio killers.

What Are the Main Risks of Day Trading on eToro?

Day trading on eToro offers speed and leverage — but that also means higher risks. It’s easy to overtrade or let small losses snowball. Know the main pitfalls so you can protect your account and keep emotions from wrecking your trades.

Why Day Trading is Riskier Than Investing

Unlike investing, where you ride long-term trends, day trading means frequent entries and exits. One bad session wipes out days of gains. Add leverage, and tiny moves can empty your balance fast. Always be ready to cut losers quickly.

How to Use eToro Tools for Safer Trades

eToro’s stop loss and take profit features are your best defence. Use alerts to avoid staring at charts all day, and the “Close at Profit/Loss” toggles to automate exits. Keeping trade sizes small also limits damage on rough days.

| Risk Factor | How I Mitigate It |

|---|---|

| Market Volatility | I avoid trading just before big economic reports and use tight stop-loss orders. |

| Leverage Risks | I never risk more than 1-2% of my trading account per trade and limit leverage. |

| Emotional Trading | I follow a pre-defined trading plan and never let emotions dictate my actions. |

| Regulatory Risks | I stay informed by reading financial news and understanding new regulations. |

| Liquidity Risks | I only trade high-volume stocks and forex pairs to ensure smooth exits. |

Is eToro a Good Platform for Day Trading?

For most, yes. eToro blends simplicity with advanced features, letting you day trade stocks, forex, and CFDs in one place. Its clean app makes executing trades fast — crucial for short-term moves. Just watch fees on frequent crypto or forex trades.

Pros of Using eToro for Day Trades

- Super user-friendly app and web platform

- Hundreds of stocks, major forex pairs, and crypto CFDs

- Built-in stop loss, take profit, and price alerts

- Regulated by the FCA, adding trust for UK traders

Any Drawbacks or Limitations?

- Crypto and forex spreads are higher than specialist brokers

- Limited deep charting tools — pro day traders may want extra software

- $5 withdrawal fee + small FX conversions add up if moving money often

How Does eToro Compare to Other Platforms for Day Trading?

eToro’s low entry costs and user-friendly design beat most retail brokers for accessibility. However, IG and Interactive Brokers offer faster execution and deeper analytical tools, making them better suited for professional intraday traders.

Final Thoughts

Day trading on eToro has been a journey of learning and growth. While it offers great opportunities, I’ve had to be disciplined and strategic. Risk management is key, and taking advantage of eToro’s tools has helped me stay on track. If you’re thinking about starting, I’d suggest using the demo account first, setting realistic goals, and sticking to a strategy. Happy trading!

eToro UK 2026 Updates

In 2026, eToro has fine-tuned its UK platform with clearer fee transparency, enhanced risk management tools, and improved mobile performance. FCA regulation and client protections remain strong. New educational content helps UK traders understand markets better, and periodic promotions continue to lower entry costs on select asset classes. Overall, updates focus on usability and cost clarity rather than major structural changes.

eToro is a multi-asset platform which offers both investing in stocks and

cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money

rapidly due to leverage. 50% of retail investor accounts lose money when

trading CFDs with this provider. You should consider whether you

understand how CFDs work, and whether you can afford to take the high risk

of losing your money.

This communication is intended for information and educational purposes

only and should not be considered investment advice or investment

recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your

investments may go up or down. Your capital is at risk.

Donʼt invest unless youʼre prepared to lose all the money you invest. This is a

high-risk investment and you should not expect to be protected if something

goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and

assumes no liability as to the accuracy or completeness of the content of this

publication, which has been prepared by our partner utilizing publicly

available non-entity specific information about eToro.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Is day trading on eToro good for beginners?

Not really — day trading is high risk. eToro’s simplicity helps, but start with small amounts or demo trades to learn without costly mistakes.

Can you day trade forex on eToro?

Yes, easily. eToro lets you trade all major forex pairs with leverage. Just be extra cautious — forex moves fast and magnifies tiny errors.

What’s the minimum to start day trading on eToro?

Usually around $50–$200 (about £40–£160) to fund your account, depending on payment type. Keep initial day trades tiny to avoid blowing your balance while learning.

What’s the best time to day trade on eToro?

Volatility peaks during the London and New York sessions — ideal for active traders.

References

- eToro Official Website – Trading Platform Features & Fees | Provides official information on trading tools, fees, and platform functionality.

- Financial Times – Stock Market News & Analysis (Subscription may be required) | Up-to-date market trends, stock performance, and expert analysis.

- Bloomberg – Global Financial News | Provides real-time data, insights, and expert opinions on financial markets.

- NerdWallet – eToro Review | An in-depth review of eToro’s features, pros, and cons for traders.

- SEC (U.S. Securities and Exchange Commission) – Trading & Investing Regulations

- TradingView – Real-time Market Charts & Analysis