eToro vs IG | Which Broker Is Best for UK Investors in 2026?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Should You Choose eToro or IG?

Both eToro and IG are strong FCA-regulated brokers heading into 2026, but they suit different traders. eToro works best for beginners and casual investors thanks to its commission-free stocks and copy trading. IG is better for active traders needing advanced tools, tighter spreads, and deep market access.

Authors Comments:

From my experience, eToro suits everyday UK investors who value simplicity and community trading. IG is technically superb but can feel overwhelming for new traders. Both are trustworthy, FCA-regulated choices — the right pick depends entirely on your trading goals and experience level. – Thomas Drury

Quick Summary Table

| Category | eToro | IG | Winner |

|---|---|---|---|

| Ease of Use | Very beginner-friendly | More complex | eToro |

| Fees | Spread-based, 0% stocks | Tight spreads, some commissions | IG |

| Regulation | FCA-regulated | FCA-regulated | Tie |

| Features | Copy trading, crypto | Advanced tools, pro analytics | Split |

| Best For | Casual investors | Professionals | Depends on user |

Top Rated

Top Rated

Regulated social trading with 30M+ users. Trade stocks, crypto, and ETFs commission-free*.

Welcome bonus for new UK clients — deposit & receive free shares. Stocks only, 90-day hold applies.

- Deposit £500 – £999Get £40

- Deposit £1k – £4,999Get £100

- Deposit £5k – £9,999Get £300

- Deposit £10,000+Get £500

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Top Rated

Top Rated

A globally recognised industry leader. Access over 17,000 markets worldwide with spread betting, CFDs, and share dealing all from one account. IG has also recently launched a dedicated crypto offering, expanding its already extensive range of tradeable assets.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

How Do eToro and IG Compare at a Glance?

Both brokers are safe and well-regulated, but their strengths diverge. eToro focuses on accessibility and social features, while IG appeals to professionals with powerful platforms. Fees also differ, with eToro charging spreads and IG offering competitive commissions for high-volume trading. For a deeper look at IG on its own merits, see my full IG review.

| Feature | eToro | IG | Best For |

|---|---|---|---|

| Regulation | FCA-regulated in the UK | FCA-regulated in the UK | Both safe |

| Fees | 0% commission on stocks, wider spreads | Competitive spreads, commissions for some products | IG cheaper for active traders |

| Platforms | Web + mobile, copy trading focus | Advanced web, mobile, and desktop platforms | eToro easier, IG more advanced |

| Assets | 3,000+ (stocks, ETFs, crypto, CFDs) | 17,000+ (stocks, indices, forex, commodities) | IG broader choice |

| Best For | Beginners, casual traders, social investors | Professionals, active traders, institutions | Split: casuals → eToro, pros → IG |

What Should UK Investors Consider When Choosing Between eToro and IG?

When weighing eToro against IG, UK investors should focus on cost, regulation, and available products. eToro is better for those wanting simplicity and commission-free stocks, while IG caters to serious traders who need broader market access, professional research, and advanced account structures.

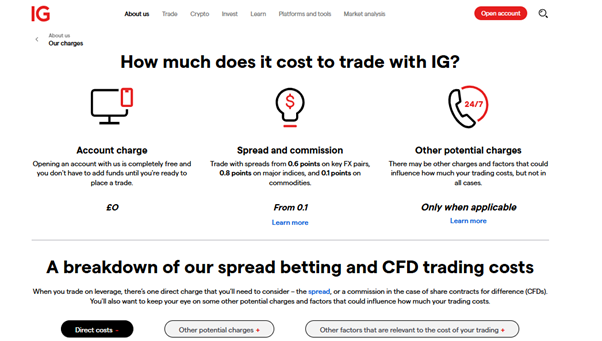

Are the Fees and Account Types Competitive?

eToro offers commission-free stock and ETF trading, but charges through spreads, which can be wider. IG uses tighter spreads and transparent commissions, which favour active traders. Both offer different account types, but IG provides more flexibility for professionals seeking complex trading strategies.

How Safe and Regulated Are These Brokers?

Both brokers are FCA-regulated, protecting client money in segregated accounts. eToro combines UK regulation with additional licences worldwide, while IG has a longer domestic track record. Both are safe, but IG’s heritage may appeal more to traditional UK investors seeking stability. I cover IG’s safety credentials in full in a separate review.

What Investment Options Do They Offer?

eToro covers over 3,000 instruments, including stocks, ETFs, crypto, and CFDs, making it versatile for everyday investors. IG offers a far broader selection — more than 17,000 markets, including forex, commodities, indices, and options. It's the go-to choice for advanced traders needing market depth.

Which Broker Offers the Best Platform Experience?

Platform quality depends on user needs. eToro is streamlined and mobile-first, ideal for new traders who value accessibility. IG's platforms are feature-rich, with advanced execution, analytics, and desktop tools. The “best” experience depends on whether simplicity or professional-grade functionality is more important.

Is eToro or IG Easier to Use on Mobile and Desktop?

eToro’s interface is highly intuitive, with a mobile app designed for beginners. IG’s mobile and desktop platforms are more complex but extremely powerful. Ease of use clearly favours eToro, while IG delivers depth and flexibility for advanced, experienced investors. That said, IG is still manageable for newer traders — I look at how well IG works for beginners separately.

Which Has Better Research and Educational Resources?

IG outshines in research, offering daily analysis, news feeds, and economic tools. Its educational materials cater to traders at every level. eToro relies more on its community insights, which are useful but less data-driven. Professionals will prefer IG, while beginners may enjoy eToro's community.

How Good Is Customer Support on Each Platform?

Both offer live chat and help centres. IG generally responds faster and provides more detailed assistance. eToro's support has improved but may be slower during busy periods. IG is the stronger choice for traders who need consistent, prompt customer service.

Does eToro's Copy Trading Give It an Edge?

Yes. eToro's copy trading is unique, letting users mirror top investors' strategies automatically. It's particularly valuable for beginners who lack time or expertise. IG doesn't offer this, focusing instead on advanced execution and research tools. Copy trading is a genuine advantage for eToro.

How Do Their Fees and Investment Options Compare?

eToro and IG both provide strong offerings, but in different ways. eToro attracts beginners with commission-free stocks and crypto access, while IG delivers professional-grade access to over 17,000 instruments. Fees differ: eToro relies on spreads, whereas IG charges tighter spreads plus some commissions.

The key difference is eToro’s accessibility versus IG’s depth. eToro keeps things simple with stocks, ETFs, and crypto, while IG’s massive product list appeals to advanced traders. IG also offers tax-free spread betting — something eToro doesn’t provide. Fee structures vary, making IG more cost-effective for high-volume day trading and eToro cheaper for casual users.

| Category | eToro | IG |

|---|---|---|

| Asset Classes | 3,000+ (stocks, ETFs, crypto, CFDs) | 17,000+ (stocks, forex, indices, commodities, options) |

| Spreads/Commissions | Commission-free stocks, wider spreads | Competitive spreads, commissions on some trades |

| Inactivity Fee | $10/month after 12 months | £12/month after 24 months |

| Withdrawal Fee | £3.85 flat fee | Free (bank transfers, some methods may vary) |

| Best For | Beginners, long-term casual investors | Professionals, active high-volume traders |

What Are the Key Pros and Cons of Each Broker?

Pros and Cons of Using eToro

Pros

- Commission-free stock and ETF trading keeps costs low for casual investors

- Copy trading lets beginners mirror experienced investors automatically

- Clean, beginner-friendly interface on both mobile and desktop

- Direct crypto trading with a wide range of supported coins

Cons

- Wider spreads on CFDs can make active trading more expensive

- No spread betting available — missing the UK tax-free advantage

- $10 monthly inactivity fee after just 12 months with no trades

- Research and analysis tools are basic compared to professional platforms

Pros and Cons of Using IG

Pros

- Over 17,000 markets with tight spreads suited to high-volume traders

- Tax-free spread betting available alongside CFDs and share dealing

- Advanced platforms with professional-grade charting and research tools

- 50-year track record with strong FCA regulation and FSCS protection

Cons

- Platform complexity creates a steeper learning curve for beginners

- No copy trading or social investing features available

- Commission-based pricing on share dealing adds cost for occasional traders

- Customer support can be slower during peak market hours

Verdict: Who Should Choose eToro and Who Should Choose IG?

Both brokers excel but serve different audiences. eToro is best for those starting out, wanting easy access to stocks, ETFs, and crypto. IG suits professionals seeking market depth, lower spreads, and powerful platforms. The decision depends on trading style and experience.

Who Is eToro Best For?

eToro suits beginners, casual investors, and those interested in social or copy trading. It's also appealing for users who want to combine traditional assets with crypto exposure. Its commission-free stock trading makes it ideal for long-term retail investors building diversified portfolios.

Who Is IG Best For?

IG is the choice for experienced traders, professionals, or institutions needing access to thousands of markets, including forex and derivatives. Its advanced tools, competitive spreads, and in-depth research make it the superior option for high-volume traders or those following complex strategies. IG has also expanded into direct cryptocurrency trading, closing the gap with eToro on that front.

| User Type | Best Platform | Reason |

|---|---|---|

| Beginners | eToro | Simple UI and copy trading |

| Long-Term Investors | eToro | Free stocks and ETFs |

| Active Traders | IG | Lower spreads and pro tools |

| Forex Traders | IG | Deeper market access |

| Crypto Users | eToro | Supports major coins |

Best for Beginners & Social Trading: Get Started With eToro

Best for Advanced & Active Trading: Get Started With IG

Conclusion: Which Platform Fits Your Trading Style?

eToro and IG are both excellent choices for UK investors in 2026, but the right pick depends on your goals. Choose eToro for simplicity, commission-free stocks, and social trading features. Choose IG for broader market access, professional-grade platforms, and tighter spreads. For alternatives, consider brokers like Interactive Brokers or Pepperstone.

Final Results

| Category | eToro | IG |

|---|---|---|

| Ease of Use | 4.7/5 | 4.1/5 |

| Fees | 4.4/5 | 4.6/5 |

| Safety | 4.8/5 | 4.8/5 |

| Features | 4.5/5 | 4.7/5 |

| Overall | 4.6/5 | 4.5/5 |

FAQs

Is eToro or IG cheaper for UK investors?

eToro offers commission-free stocks but charges through spreads, which can be wider. IG uses tighter spreads and low commissions, which benefit high-volume or professional traders. For casual investors, eToro is usually cheaper, while IG is more cost-effective for frequent, active trading.

Is eToro safer than IG?

Both are FCA-regulated, protecting client funds in segregated accounts. IG has a longer UK history and strong institutional trust, while eToro is globally licensed and popular with retail traders. Safety is strong with both, though IG’s legacy reassures more conservative investors.

Does IG offer copy trading like eToro?

No. Copy trading is unique to eToro, allowing beginners to automatically mirror professional traders’ strategies. IG focuses on advanced platforms, research, and execution, rather than social features. If you want community-driven investing, eToro is better; for self-directed trading, IG excels.

Can I trade crypto on IG and eToro?

Yes. Both platforms now offer direct cryptocurrency trading. eToro supports a wider range of coins and has offered crypto for longer, while IG’s crypto service covers 55+ coins with competitive fees. For variety and familiarity, eToro edges ahead; IG is catching up fast.

Which platform is better for beginners in 2026?

eToro is generally easier for beginners thanks to its simple interface, mobile-first design, and copy trading. IG requires more learning but rewards users with advanced research tools and broader markets. Beginners start smoother with eToro, while experienced traders may prefer IG.

Does IG offer spread betting while eToro doesn’t?

Yes. IG offers tax-free spread betting across over 17,000 markets, which is a significant advantage for UK traders. eToro does not offer spread betting at all, so if tax-free leveraged trading is important to you, IG is the clear choice.

Can I use both eToro and IG at the same time?

Yes. Many UK traders use both platforms for different purposes — eToro for commission-free stocks and copy trading, and IG for spread betting and advanced analysis. There’s no rule against holding accounts with multiple brokers.

Which broker has better customer support?

IG generally offers faster and more detailed customer support, with phone, email, and live chat options. eToro’s support has improved but can be slower during busy periods. For traders who value responsive service, IG has the edge.

Do eToro and IG both offer ISAs?

IG offers a Stocks and Shares ISA with £3 dealing fees and a capped custody charge. eToro does not currently offer an ISA. If tax-free share investing is a priority, IG is the better option for that specific product.

Which platform has more markets available?

IG offers over 17,000 markets including forex, indices, shares, commodities, and options. eToro covers around 3,000 instruments focused on stocks, ETFs, crypto, and CFDs. For sheer market breadth, IG is significantly ahead.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

50% of retail CFD accounts lose money when trading CFDs with this provider.

50% of retail CFD accounts lose money when trading CFDs with this provider.