Is Pepperstone Good for Beginners? 2026 Guide

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Is Pepperstone Any Good for Beginners?

Pepperstone Overview

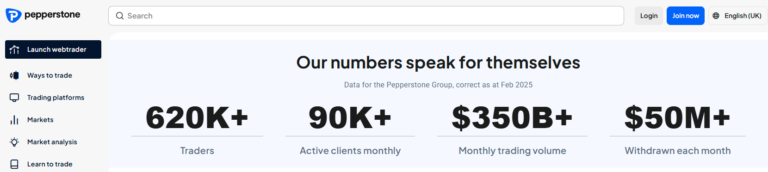

A prominent player in the financial industry, offering innovative trading solutions to individuals and institutions worldwide. With its commitment to transparency, competitive pricing, and cutting-edge technology, Pepperstone has gained a reputation as a trusted broker.

- Minimum Deposit £0

- FCA regulated

- Use of TradingView

- Use of Meta Trader 4 + 5

- Acess to 25 major stock indices, 900+ shares CFDs, 62 forex, 17 commodities and 100+ ETF all in CFD form

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Who is Pepperstone and how are they regulated?

Pepperstone is an Australian-founded broker regulated by top-tier authorities, including the UK’s FCA and Australia’s ASIC. This means strict client fund segregation, transparent operations, and a strong track record since 2010, giving beginners confidence they’re trading with a trustworthy, well-supervised provider.

Why do beginners choose Pepperstone over other brokers?

Beginners pick Pepperstone for its competitive spreads, intuitive platform options, and no-nonsense account setup. The broker combines professional execution with simple onboarding, free demo accounts, and strong educational resources, making it appealing for first-time traders who want low costs and a trusted name.

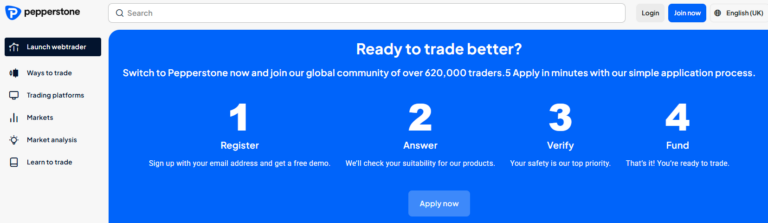

How easy is it to open a Pepperstone account?

Opening a Pepperstone account is quick and fully digital, typically taking less than 24 hours. Beginners just provide ID, proof of address, and basic trading knowledge information. Funding is simple with no minimum deposit, so traders can start small and scale gradually.

What educational resources does Pepperstone provide?

Pepperstone offers webinars, trading guides, market analysis, and platform tutorials tailored for all skill levels. Beginners benefit from structured learning paths, free access to market experts, and practical trading tips, helping them develop strategies and understand risk management before committing real funds.

Can beginners practise with a demo account at Pepperstone?

Yes. Pepperstone’s demo account lets beginners trade in real market conditions using virtual funds. It’s ideal for testing strategies, learning platform tools, and building confidence without risking capital, making it a key stepping stone before transitioning to live trading.

What common mistakes do new traders make on Pepperstone?

Common mistakes include over-leveraging, neglecting stop-loss orders, and chasing high-volatility trades without proper analysis. Beginners also sometimes switch strategies too quickly. Pepperstone’s educational tools aim to reduce these errors, emphasising discipline, gradual risk-taking, and structured learning from the start.

Which trading platform is easiest for Pepperstone beginners?

For most beginners, MetaTrader 4 (MT4) is the easiest platform at Pepperstone. It’s lightweight, intuitive, and widely supported with plenty of tutorials. It balances essential charting tools with simplicity, making it less intimidating than advanced alternatives like cTrader or MetaTrader 5.

Is Pepperstone’s mobile app beginner-friendly?

Yes. Pepperstone’s mobile app is streamlined for quick trade placement, market monitoring, and account management. Beginners appreciate its simple navigation, customisable alerts, and secure login. While advanced charting is limited compared to desktop, it’s excellent for managing trades on the go.

How low are Pepperstone’s fees and spreads for beginners?

Pepperstone offers highly competitive spreads starting from 0.0 pips on its Razor account and no commission on the Standard account. Beginners benefit from transparent pricing, low-cost forex trades, and minimal trading expenses, making it accessible for small accounts while maintaining high execution quality.

Does Pepperstone charge inactivity or withdrawal fees?

No. Pepperstone does not charge inactivity or withdrawal fees, which is ideal for beginners who may trade less frequently. This cost-friendly structure allows new traders to learn and experiment without the pressure of hidden charges eating into their trading balance.

How does Pepperstone help beginners manage trading risk?

Pepperstone supports beginners with negative balance protection, risk management guides, and platform tools like stop-loss and take-profit orders. They also offer micro lot trading, enabling new traders to limit exposure and practise effective risk control while learning market behaviour in real time.

What is Pepperstone’s customer support like for new traders?

Pepperstone provides 24/5 multilingual customer support via live chat, phone, and email. Beginners appreciate the quick, clear responses and guidance on account setup, platform use, and trading basics, making the learning curve smoother and reducing frustration during the early stages.

Final verdict – is Pepperstone a good choice for beginners?

What Is New With Pepperstone in 2026

In 2026, Pepperstone has enhanced its offering with tighter spreads on key markets, faster trade execution, and deeper integration with advanced tools like MetaTrader and TradingView. Platform updates also include improved risk management features, more educational content tailored to UK traders, and continued focus on reliable performance, making it even more competitive for both new and experienced users.

Seamless Trading Across Platforms

- Low Spreads and Fast Execution

- Multiple Account Types

- Advanced Trading Platforms

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Is Pepperstone safe for beginner traders?

Yes, Pepperstone is very safe. It’s regulated by top financial authorities like the FCA (UK) and ASIC (Australia), meaning your funds are protected under strict rules. Plus, they offer negative balance protection to stop you from losing more than your deposit.

Does Pepperstone offer a demo account for beginners?

Absolutely! Pepperstone provides a free demo account with $50,000 in virtual funds. It’s the perfect way to practice trading in real market conditions without risking your own money — and I highly recommend beginners spend time on it before going live.

What is the best Pepperstone account type for new traders?

For most beginners, the Standard account is the best choice. It has no commission fees, wider but still competitive spreads, and a simple cost structure that’s easy to understand when you’re learning how trading works.

Which trading platform should beginners use at Pepperstone?

I personally recommend starting with MetaTrader 4 (MT4) or cTrader. Both are beginner-friendly and come with loads of free tutorials online. MT4 is the most popular choice, but cTrader’s modern design might feel a little easier for some new users.

Are there any downsides for beginners using Pepperstone?

The main challenge is that Pepperstone offers professional-grade platforms like MT4, MT5, and cTrader, which can feel overwhelming at first. But with a bit of practice — especially using the demo account — most beginners adjust quickly and benefit from learning on real trading tools.

References

- Pepperstone – Learn to Trade

- Pepperstone – Trading Platforms Overview