How to Short a Stock on Trading 212 (2026 Guide)

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Shorting a stock can seem intimidating, but with the right platform and a solid understanding of the basics, it’s a powerful strategy to have in your trading toolkit. In this guide, I’ll walk you through exactly how to short a stock using Trading 212, one of the most beginner-friendly platforms available today.

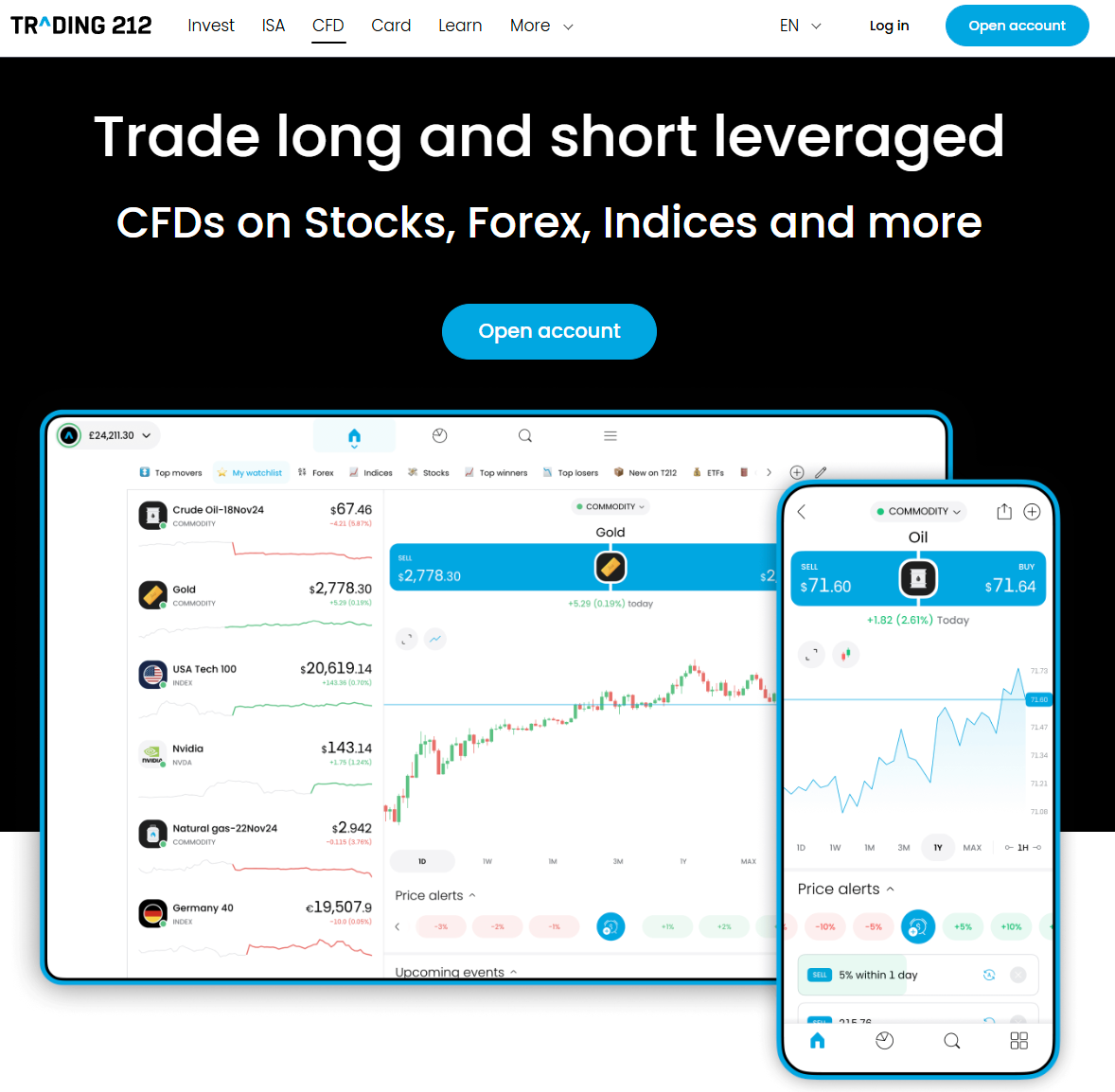

Trading 212 Overview

Use code ‘TIC’ to get a free fractional share worth up to £100

- Minimum Deposit: £1 (via bank transfer or card)

- Invest in stocks, ETFs, and forex with zero commission*

- FCA regulated and trusted by over 2 million users

- Intuitive mobile and web platforms with real-time data

- Interest on cash, ISA Account available

*Other fees may apply. See terms and fees.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

What does it mean to Short a Stock?

Short selling is a trading strategy where you attempt to profit from a stock’s price decline rather than its rise. In simple terms, you borrow shares from a broker, sell them on the market, and then aim to buy them back later at a cheaper price. The difference between what you sell them for and what you buy them back for is your profit.

Learning how to short a stock can be a powerful tool in your investor’s toolkit. However, you ned to understand that it is a high-risk strategy. Theoretically, a stock’s price can rise indefinitely, and your potential losses from short selling aren’t capped.

Why Do Traders Choose to Short-Sell Stocks?

Traders use this method for a few different reasons. Some use it to hedge their existing positions — protecting themselves if another investment goes south. Others use short selling as a way to speculate, betting on the decline of a particular stock or even an entire sector.

However, shorting stock isn’t for the faint-hearted. Since your losses can be unlimited if the stock price keeps rising, it’s absolutely vital to approach it with a well-thought-out plan, a solid understanding of the risks, and strict risk management.

Why Should You Choose Trading 212?

If you’re considering shorting a stock, Trading 212 is one of the most accessible platforms to get started. It offers several key advantages that make it attractive for both beginners and experienced traders.

- Low Fees: One of the biggest draws is Trading 212’s low-cost structure. Unlike some brokers that eat into your profits with hefty commissions, Trading 212 offers commission-free trading*. This can make a real difference to your bottom line over time.

- User-Friendly Interface: Whether you’re new to trading or have a bit of experience, Trading 212’s clean, intuitive layout makes it easy to find stocks and execute short trades.

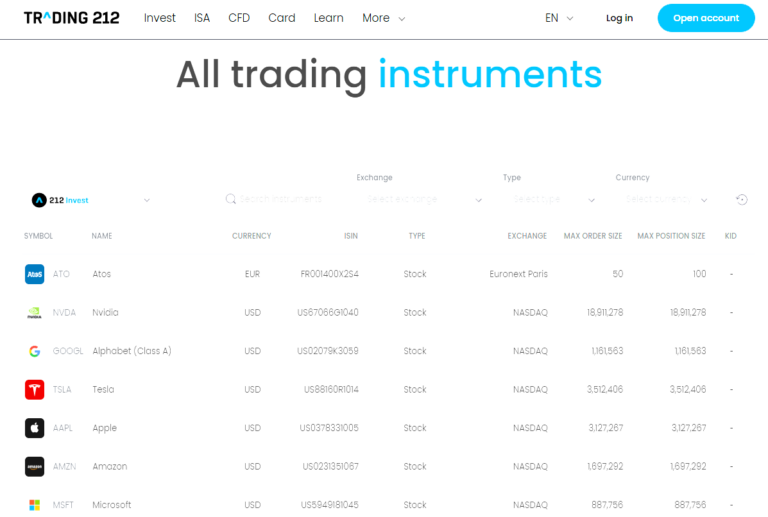

- Wide Range of Stocks: Trading 212 provides access to a broad selection of stocks across multiple global markets. That means you can diversify your short-selling strategies across different industries, regions, and market conditions.

- Advanced Tools and Features: The platform comes equipped with professional-level charting tools, indicators, and analysis features. These can help you spot opportunities, understand market movements, and refine your short-selling strategy.

*Other fees may apply. See terms and fees.

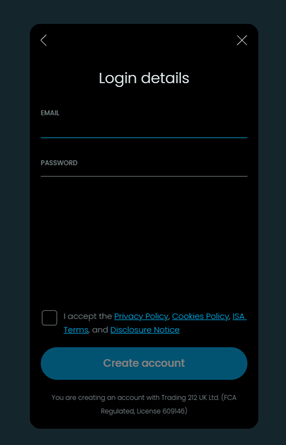

How Do You Set Up a CFD Account on Trading 212?

1. Visit the Trading 212 Website: Head to Trading 212’s homepage and click “Open Account.”

2. Choose the Right Account Type: You’ll see options for an “Invest,” “ISA,” or “CFD” account. Make sure you select CFD.

3. Complete Your Registration: Fill in your personal details, upload identity verification documents if required, and complete any necessary questionnaires about your trading experience.

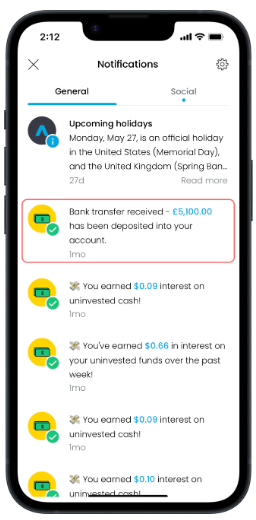

4. Deposit Funds: You’ll need to fund your account before you can start trading. Trading 212 accepts a variety of payment methods, including bank transfer, debit/credit cards, and popular e-wallets.

5. Understand Margin Requirements: Since CFDs are leveraged products, you’ll need to maintain a certain minimum balance (called “margin”) to keep your positions open. Always check the margin requirements carefully to avoid unexpected position closures.

6. Set Up Risk Management Tools: Before placing your first trade, it’s a smart move to set up stop-losses, take-profit orders, and any other risk management settings. These tools can help you control your exposure and protect your account from severe losses.

Once your CFD account is funded and ready, you’ll be able to short stocks easily within the platform.

Always remember: short selling can be advantageous, but it also comes with significant risk. Never risk more than you can afford to lose.

How Do You Navigate the 'Detailed Trade Box' on Trading 212?

Once you’ve set up your CFD account on Trading 212, the next big step is executing your first short sale. This is where the platform’s ‘Detailed Trade Box’ becomes an essential tool. It gives you more control over your trade — allowing you to place complex orders, set risk management levels, and fine-tune your positions.

I’ll walk you through exactly how to use it:

1. Find the Stock You Want to Short:

Use the search bar at the top of the Trading 212 platform to find the stock you’re interested in. Type in the company name or ticker symbol and select it from the results.

2. Open the ‘Detailed Trade Box’:

Once you’ve selected the stock, you’ll see an overview screen. Look for the option to open the ‘Detailed Trade Box’ — this is where you’ll set up the specifics of your trade.

3.Choose ‘Sell’ (Not ‘Buy’):

Inside the detailed trade box, you’ll see two primary options: Buy and Sell. Since you’re shorting the stock, you’ll want to click Sell.

4.Enter the Quantity:

Next, decide how many shares you want to short. Be mindful of your available account balance and margin requirements — shorting uses leverage, so even a small move against you can have a big impact.

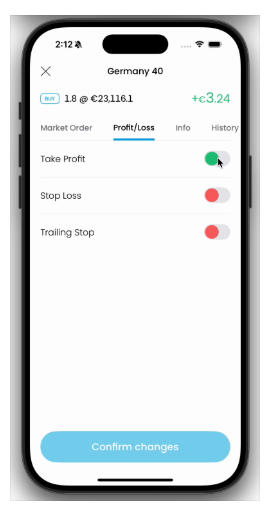

5. Set Your Stop Loss and Take Profit Levels:

This is a crucial step for managing your risk.

- Stop Loss: Set a maximum loss limit. If the stock price rises and hits this point, your position will automatically close to prevent deeper losses.

- Take Profit: Set a level where you’d like to lock in profits automatically if the stock moves in your favour.

6. Review Your Trade:

Before you hit the button, double-check all the details — the quantity, stop loss, take profit, and your margin requirements. Make sure it fits your trading plan.

7.Execute the Short Sale:

Once you’re satisfied, click Sell. Trading 212 will automatically borrow the shares, sell them on the market, and open your short position.

How Can You Manage Risk When Shorting Stocks on Trading 212?

Mastering risk management isn’t just a good idea — it’s absolutely essential. Here are some key tools and strategies to help you protect your account when shorting stocks:

- Stop-Loss Orders:

Setting a stop-loss is one of the simplest and most effective ways to limit potential losses. A stop-loss order will automatically close your short position if the stock price moves against you beyond a certain point. It acts as your safety net, helping prevent small losses from snowballing into larger ones.

- Take-Profit Orders:

Just as setting a stop-loss can lock in gains automatically, using a take-profit order can also do the same. If the stock price falls to your targeted profit level, your position will close out, allowing you to secure your earnings without needing to constantly monitor the market.

- Margin Calls and Maintenance Margins:

When you short sell with CFDs, you’re trading on margin. This means you must maintain a minimum account balance, called the maintenance margin. If your equity falls below this threshold, you could face a margin call — and if you don’t top up your account quickly, Trading 212 may automatically close your positions to limit their risk.

- Risk-to-Reward Ratio:

Before entering any short trade, it’s critical to assess your risk-to-reward ratio. This simply compares the amount you stand to lose with the potential gain. Ideally, you should be aiming for trades where the potential reward outweighs the risk — helping tilt the odds in your favour over the long term.

- Leverage:

Trading 212 offers leverage on CFDs, which means you can control a larger position with a smaller amount of money. While this can amplify profits, it also magnifies losses. Always use leverage cautiously and only take on as much exposure as you are comfortable with.

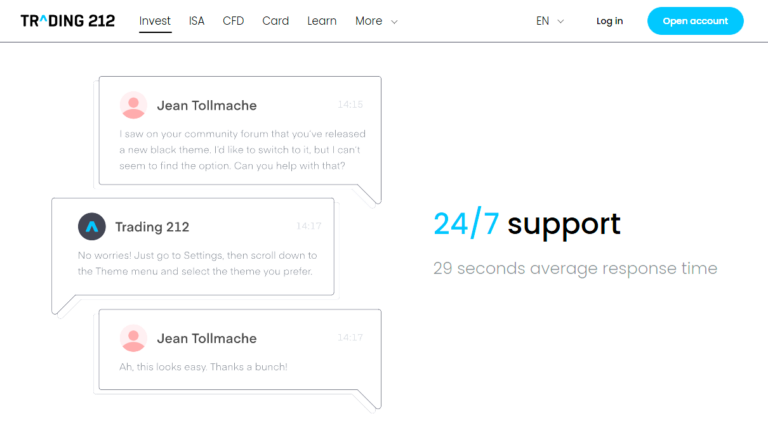

Is Customer Support Available on Trading 212?

Traders can benefit from 24/7 assistance, especially for those operating across different time zones or trading volatile markets outside regular hours. Whether you have questions about your account, need help navigating the platform, or face technical issues, knowing that help is always available provides added peace of mind. Quick access to support can be crucial when every second counts, particularly when managing high-risk trades.

What’s Changed in 2026?

No major changes to Trading 212’s CFD shorting process. The platform remains FCA-regulated with commission-free CFD trading (overnight fees still apply). Interface and risk tools unchanged. Always check margin requirements before opening short positions.

Final Thoughts: Can I short Stock on Trading 212?

Absolutely, thanks to its user-friendly platform, low fees, and wide range of stocks, Trading 212 gives traders a strong foundation to explore shorting opportunities.

However, success doesn’t come from the platform alone. It stems from understanding the fundamentals of short selling, setting up your CFD account correctly, utilising the ‘Detailed Trade Box’ effectively, and — most importantly — managing your risk with discipline and care.

Trading always involves some degree of uncertainty, and shorting a stock, in particular, carries the potential for unlimited losses if you’re not careful. Keep learning, stay disciplined, and always trade with a clear plan in mind.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Can you short stocks directly in a Trading 212 Invest account?

No, to short a stock, you need to open a Trading 212 CFD account.

Is short selling on Trading 212 safe for beginners?

Short selling is inherently riskier than traditional investing. Trading 212 makes the process user-friendly, but beginners should be very cautious, use stop-loss orders, and only risk money they can afford to lose.

What fees should I be aware of when shorting a stock on Trading 212?

While Trading 212 offers commission-free trading*, there are other costs to consider when shorting, such as overnight fees (swap fees) for holding CFD positions open longer than a day.

*Other fees may apply.

What happens if the stock price rises after I short it?

If the stock price rises, you’ll start to incur losses. If the price rises significantly, you could face a margin call or have your position automatically closed if you don’t meet margin requirements. Setting a stop-loss can help protect you from major losses.

Can I short any stock available on Trading 212?

Not every stock listed on Trading 212’s Invest platform is available for shorting through CFDs. However, the CFD platform offers a wide range of popular stocks, indices, and commodities that you can short. Always check availability before planning your trades.

Does Trading 212 Offer Promo Codes?

Yes! To get started, sign here up at Trading 212 using our promo code and make your initial deposit. Trading 212 will then add a free share worth up to £100 into your account.

Use code TIC to get a free share worth up to £100

References

- Trading 212 Official Help Centre – Short Selling Explained

- Trading 212 – Trading 212 – Official Site

- FCA (Financial Conduct Authority) – Understanding CFDs and Risks

- Investopedia – What Is Short Selling?

- NerdWallet – Short Selling: What You Should Know

- Morningstar – The Risks of Short Selling Explained

- Investing.com – Margin Calls and Managing Risk