Is the Trading 212 Cash ISA Safe in 2026?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is the Trading 212 Cash ISA Safe?

Yes, Trading 212 is a safe, regulated platform offering FSCS-protected Cash ISAs with coverage up to £85,000 per eligible depositor. Funds are held in segregated accounts with a UK-authorised bank, and user feedback remains overwhelmingly positive across 4.5 million funded accounts.

While fintech platforms may carry perceived risks, Trading 212 follows strict FCA standards and daily safeguarding rules. It's a trustworthy, convenient choice for tax-free savings in 2026.

Top Rated

Top Rated

Platform Overview

Regulated social trading with 30M+ users. Trade stocks, crypto, and ETFs in one sleek interface.

61% of retail CFD accounts lose money when trading CFDs with this provider.

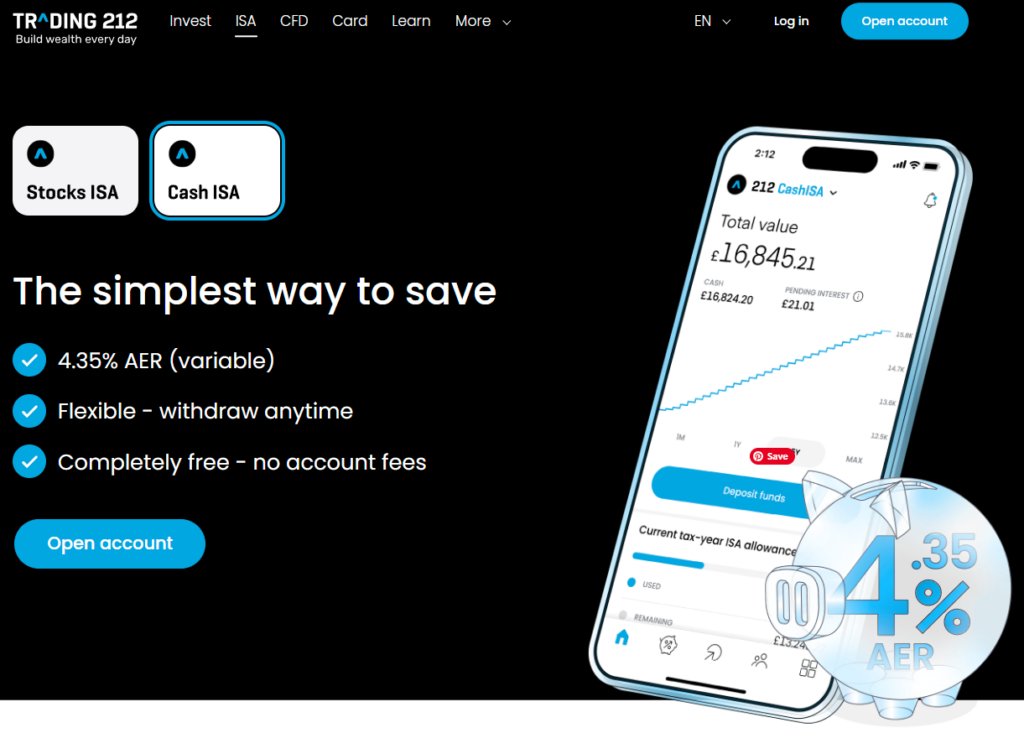

What Is the Trading 212 Cash ISA and How Does It Work?

How does a Cash ISA differ from other savings accounts?

A Cash ISA offers tax-free interest, meaning you keep 100% of what you earn. Unlike regular savings accounts, you don't pay income tax on the interest, though annual contributions are capped — currently £20,000 per tax year.

What makes Trading 212's Cash ISA different from traditional ISAs?

Trading 212's Cash ISA is managed via app, offering digital convenience, a competitive rate, and instant access. Unlike high street ISAs, it operates through a fintech platform and uses a partner bank to hold your funds securely.

How Safe Is Trading 212 as a Financial Provider?

Is Trading 212 regulated by the FCA in 2026?

Yes, Trading 212 is fully regulated by the UK's Financial Conduct Authority (FCA). This ensures it meets strict standards on customer protection, financial conduct, and transparency, which adds a strong layer of trust for ISA users.

What kind of FSCS protection do I get with a Trading 212 Cash ISA?

Your Trading 212 Cash ISA is covered by the Financial Services Compensation Scheme (FSCS) up to £85,000. This protects your money if the partner bank holding your funds fails, provided it is an FSCS-participating institution.

Does FSCS cover my money if Trading 212 or its partner bank collapses?

Yes, FSCS will protect your funds if the bank holding your ISA fails. If Trading 212 itself collapses but your money is held with the bank, the FSCS still applies as long as proper segregation and eligibility conditions are met.

Where Is My Money Held and How Is It Protected Daily?

What are segregated accounts and why do they matter?

Segregated accounts are separate from a company's own funds. This means your ISA money is not mixed with Trading 212's operational funds, helping protect it if the company faces financial trouble or goes into administration.

How does Trading 212 separate client funds from company funds?

Trading 212 holds client money in designated client accounts with a UK-authorised bank. These accounts are ring-fenced, meaning Trading 212 cannot use your ISA funds for its business activities, adding a layer of financial security.

What are the ongoing protections in place for my ISA?

Daily safeguarding measures include FCA compliance, use of segregated accounts, and oversight by partner banks. Regular audits and regulatory reporting ensure continued protection of your funds while held within the Trading 212 Cash ISA.

| Feature | FCA-Authorised (e.g. Trading 212) | Non-Authorised Provider |

|---|---|---|

| FCA Regulated | Yes – Strict rules for consumer protection | No – No official oversight |

| FSCS Protection | Yes – Up to £85,000 per eligible depositor | No – No guaranteed compensation |

| Client Funds Separated | Yes – Held in ring-fenced accounts | Not guaranteed – Funds may be at risk |

| Dispute Resolution (FOS) | Yes – Free via Ombudsman | No – Not required to resolve disputes fairly |

| Listed in FCA Register | Yes – Fully trackable and licensed | No – Difficult to verify or check history |

Are There Risks in Using a Cash ISA Through a Fintech Platform?

How do banks and apps differ for ISA safety?

Traditional banks offer physical branches and long-standing reputations, while fintech apps like Trading 212 rely on digital infrastructure. Both can be safe if FCA-regulated, but fintech platforms may carry higher perceived risk due to their newer status.

What risks are unique to fintech platforms like Trading 212?

Risks include reliance on app functionality, potential outages, and partner bank dependency. While rare, digital platforms may also face more cybersecurity threats, though strong regulation and encryption help mitigate these risks.

Can inflation reduce the real value of my interest rate?

Yes, if your Cash ISA interest rate is lower than inflation, the real value of your money decreases over time. Even with tax-free growth, inflation can erode purchasing power if rates don't keep pace.

What Is It Like to Use the Trading 212 Cash ISA App?

How do I deposit, track, and manage my ISA within the app?

Depositing is simple: link your bank or use debit/credit card, then choose "Cash ISA" within the app. You can track daily interest in real time, view monthly payouts, and transfer existing ISAs seamlessly. The interface is intuitive, with clear graphs and easy navigation.

What are real users saying about their experience in 2026?

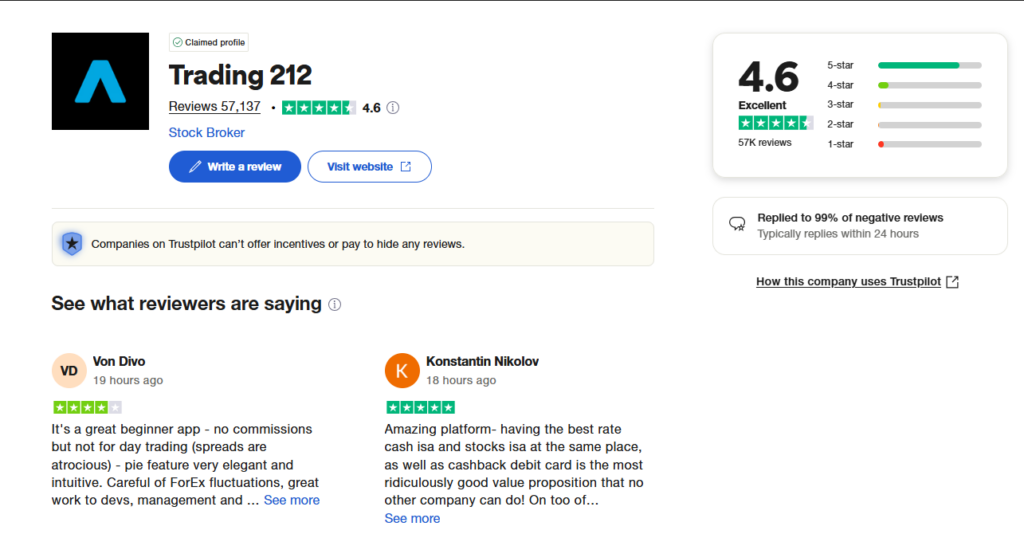

User feedback is overwhelmingly positive. On Trustpilot (4.6/5), one review states:

"Amazing platform– having the best rate cash ISA…and transactions are seamless. Extremely efficient… Highly recommended"

From the team at The Investors Centre (4.6/5):

"Very easy to use and good flexibility… fast notification of interest paid on a daily basis."

How Does Trading 212's Cash ISA Compare to Other Providers?

| Feature | Trading 212 | Traditional Bank ISA | Other Fintech ISAs |

|---|---|---|---|

| Interest Rate (2026) | 3.85% AER standard (BoE tracker); ~4.71% with new customer bonus | Lower & typically monthly/annual | Varies widely |

| FSCS Protection | Yes – Up to £85,000 (via partner bank) | Yes – Up to £85,000 | Often yes |

| Access | Instant via app | Branch/online access | App/web |

| Ease of Use | Highly rated (4.6/5 Trustpilot) | Mixed | Varies |

| Transfer Process | In-app & seamless | Manual & slower | In-app for most |

| Flexible ISA | Yes – withdraw and replace same tax year | Varies by provider | Varies |

Should You Trust Trading 212 With Your Cash ISA in 2026?

Yes, Trading 212 is a safe, regulated platform offering FSCS-protected Cash ISAs with coverage up to £85,000 per eligible depositor. Funds are held in segregated accounts with a UK-authorised bank, and user feedback remains overwhelmingly positive across 4.5 million funded accounts.

While fintech platforms may carry perceived risks, Trading 212 follows strict FCA standards and daily safeguarding rules. It's a trustworthy, convenient choice for tax-free savings in 2026.

FAQs

Can I transfer an existing Cash ISA into Trading 212's Cash ISA?

Yes, Trading 212 allows ISA transfers. You'll need to complete a transfer request within the app. Always use the official process to avoid losing your tax-free ISA status.

Is there a minimum deposit required for the Trading 212 Cash ISA?

No, there's no strict minimum deposit. However, to earn meaningful interest, users typically deposit at least a few hundred pounds.

Can I withdraw money from my Trading 212 Cash ISA at any time?

Yes, it's a flexible ISA. You can withdraw funds at any time without penalty, but you may lose that portion of your annual ISA allowance unless it's a flexible ISA (which Trading 212 may or may not offer).

Does the Trading 212 Cash ISA allow for joint accounts?

No, ISAs are individual savings accounts and cannot be held jointly. Each person must open their own account to benefit from the ISA allowance.

How often is interest paid on the Trading 212 Cash ISA?

Interest is accrued daily and typically paid monthly. Users can view their daily earnings directly in the app for real-time tracking.

References

- ✓ Deposit £500–£999 → Get £40

- ✓ Deposit £1k–£4,999 → Get £100

- ✓ Deposit £5k–£9,999 → Get £300

- ✓ Deposit £10,000+ → Get £500

61% of retail CFD accounts lose money when trading CFDs with this provider.