Is Trading 212 FSCS Protected? – 2026 Guide to Client Safety

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

FSCS protection matters — especially when you’re trusting a platform with your money. Here’s what UK investors need to know about Trading 212’s coverage in 2026.

Quick Answer: Is Trading 212 FSCS Protected?

Yes — Trading 212 is covered by the FSCS for up to £120,000, protecting client cash held in segregated accounts if the firm fails. However, FSCS does not cover investment losses, so always understand market risks and Trading 212’s custody structure.

Trading 212 Overview

Use code ‘TIC’ to get a free fractional share worth up to £100

- Minimum Deposit: £1 (via bank transfer or card)

- Invest in stocks, ETFs, and forex with zero commission*

- FCA regulated and trusted by over 2 million users

- Intuitive mobile and web platforms with real-time data

- Interest on cash, ISA Account available

*Other fees may apply. See terms and fees.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

What is the FSCS & How Does It Protect You?

The FSCS is the UK’s financial safety net, compensating eligible customers if authorised firms like brokers or banks fail. It’s designed to protect your cash deposits and certain investments up to £120,000, providing critical peace of mind for UK investors.

What is the Financial Services Compensation Scheme (FSCS)?

The FSCS is an independent UK scheme that protects consumers when financial firms collapse. If Trading 212 were to fail, the FSCS can cover up to £120,000 of eligible client money, helping safeguard your cash from insolvency-related losses.

How Does FSCS Compare to Other Protection Schemes?

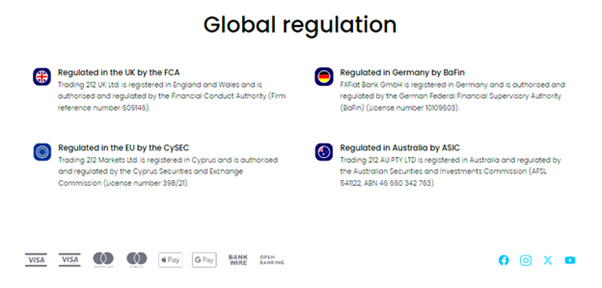

Unlike private insurance, the FSCS is a government-backed statutory scheme. It differs from investor protection rules in the EU or US SIPC by focusing on UK consumers and offering fixed cash limits, making it crucial to know exactly what’s covered.

Who Regulates Trading Platforms Like Trading 212?

Trading 212 is regulated by the UK’s Financial Conduct Authority (FCA), which enforces strict rules on client fund segregation, reporting, and conduct. This oversight ensures platforms meet high standards, reducing the risk of fraud or mismanagement that triggers FSCS claims.

Is My Trading 212 Account Covered by FSCS?

Trading 212 clients benefit from FSCS protection on cash balances up to £120,000 if the firm collapses. However, coverage varies by account type, and investment losses due to market moves are never insured. Knowing which accounts qualify helps secure your capital.

Which Trading 212 Accounts Qualify for FSCS Protection?

FSCS protection applies to Trading 212’s ISA and Invest accounts for cash held in client money accounts. CFD positions generally don’t qualify under FSCS, as losses there stem from trading performance, not broker insolvency. Always check exact terms in Trading 212 disclosures.

What Happens If Trading 212 Goes Bust?

If Trading 212 fails financially, the FSCS may compensate you for eligible cash up to £120,000. Meanwhile, your stocks are typically held by custodians, separate from Trading 212’s own funds, helping protect your assets during insolvency proceedings beyond the FSCS limit.

Are Client Funds Safe with Trading 212?

Trading 212 uses strict measures to protect client money. Funds are held in segregated bank accounts, kept separate from the company’s own finances. Combined with FCA oversight, this greatly reduces the risk of your cash being misused if Trading 212 encounters problems.

How Does Trading 212 Safeguard Client Money?

Client deposits are placed in segregated accounts at reputable banks, meaning Trading 212 cannot use these funds for its own operations. This structure ensures your money is legally ring-fenced and returned to you if the broker becomes insolvent.

What Other Security Measures Does It Use?

Trading 212 also performs daily reconciliation of client balances, complies with strict FCA reporting, and uses multi-layered IT security to protect accounts. While these don’t prevent market losses, they help safeguard your capital from broker mismanagement or fraud.

What Does FSCS Not Cover on Trading 212?

The FSCS does not protect you from losing money due to poor trades or market downturns. It also generally doesn’t cover CFD losses, since these result from leverage and volatility, not broker failure. Understanding these gaps is key to managing your risk.

Are CFD or Share Trading Accounts Protected?

FSCS only steps in if Trading 212 fails as a firm, not if your investments lose value. For CFDs, losses from price swings or leverage aren’t insured. Shareholdings may be held with custodians, adding a separate layer of safety beyond FSCS coverage.

What Risks Remain Even With FSCS?

FSCS only covers eligible cash up to £85,000. If your balance exceeds that, or if your investments drop due to market volatility, you bear those risks. This makes it vital to diversify and consider additional security steps like stop-losses.

How Can You Check If FSCS Covers Your Trading 212 Account?

It’s smart to confirm your FSCS eligibility before problems ever arise. This ensures you know exactly how much protection applies to your funds if Trading 212 fails, and what additional safeguards or diversification steps you might need to take.

Simple Steps to Verify Your Protection

Check Trading 212’s FCA registration on the Financial Services Register. Review your account type — ISA and Invest cash are typically protected under FSCS rules. Look for statements in Trading 212’s client agreements outlining how segregated funds qualify for compensation.

What To Do If You’re Not Covered

If you hold large balances or accounts outside FSCS scope, diversify by using multiple brokers or moving funds to a UK bank account. Consider additional safeguards like using limit orders or non-custodial investments that don’t rely on broker solvency.

Pros & Cons of FSCS Protection with Trading 212

- FSCS covers cash up to £120,000 if Trading 212 fails

- Funds held in segregated accounts with top-tier banks

- Overseen by the FCA, adding trust

- Doesn’t protect investment losses from markets or leverage

- Coverage limit may not fully cover large accounts

- Some complex instruments (like CFDs) generally excluded

Final Thoughts: Is Trading 212 Safe for Your Money?

Trading 212 is regulated by the FCA, keeps client money segregated, and offers FSCS protection on eligible cash. While that safeguards you from broker failure, market losses remain your risk. Combine Trading 212’s protections with smart security practices and diversification to trade confidently.

What’s Changed in 2026?

The FSCS compensation limit has increased to £120,000 per eligible person, per firm. An increase from years prior. Trading 212 continues to operate under full FCA authorisation, with client funds held in segregated accounts at major UK banks. There haven’t been any major changes to how FSCS protection works or which Trading 212 accounts qualify. The platform’s user base has grown significantly, but its regulatory structure and client money protections remain consistent. As always, FSCS doesn’t cover market losses — only firm insolvency.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Is my Trading 212 cash FSCS protected?

Yes. Client money in Trading 212’s Invest or ISA accounts is covered by FSCS up to £85,000 if the broker collapses, provided funds are held in eligible segregated accounts.

Does FSCS cover CFD losses on Trading 212?

No. The FSCS only steps in if Trading 212 itself fails. Losses on CFDs or share prices dropping due to market moves aren’t protected by compensation schemes.

Can Trading 212 freeze my account?

Yes. Like all regulated brokers, Trading 212 can freeze or restrict accounts for regulatory checks, suspicious activity, or incomplete verification. Keeping ID documents updated reduces the chance of disruptions.

Is Trading 212 safer than unregulated brokers?

Absolutely. Trading 212’s FCA licence means strict client fund rules, regular audits, and FSCS fallback if the firm goes under. Unregulated brokers lack these protections, putting your money at far higher risk.