Is Trading 212 Halal? (2026 Guide)

Looking to invest without breaking Islamic principles? Here’s what UK Muslim investors need to know about Trading 212 and Shariah compliance in 2026.

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is Trading 212 Halal?

Trading 212 can be used in a halal manner with caution — avoiding CFDs, leverage, and interest while carefully screening stocks. However, without official Shariah certification, it's not inherently halal. For certainty, dedicated Islamic accounts from certified brokers are the safer choice.

Top Rated

Top Rated

Commission-free* investing made accessible. Build automated portfolios with fractional shares and earn high interest on uninvested cash. *Other fees may apply.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

What Does “Halal” Mean in Trading?

In Islamic finance, “halal” trading involves only permissible industries, avoiding interest, speculation, and excessive uncertainty. It emphasizes ethical investment, transparency, and fairness. Compliance is determined by both the nature of the business and financial ratios set by Shariah standards.

What Are the Key Shariah Principles for Investing?

Shariah principles require avoiding riba (interest), gharar (uncertainty), and haram industries. Investments should be asset-backed, ethically sound, and financially healthy. Ratio screens typically limit debt levels, interest income, and non-permissible revenue to maintain religious and economic integrity in portfolios.

Which Trading Practices Are Considered Haram?

Haram trading includes short-selling, high leverage, speculation, gambling-like activity, and investing in prohibited sectors. Such practices often involve debt, uncertainty, or unethical products, violating Shariah's emphasis on fairness, transparency, and shared risk between the investor and the investment.

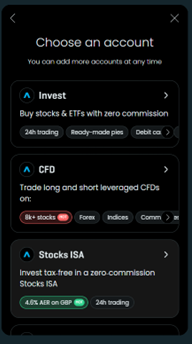

Does Trading 212 Offer a Halal Account?

Trading 212 does not provide a dedicated Islamic account. However, investors can adjust settings, disable interest on cash, and avoid non-compliant instruments to create a more halal-friendly setup, though this remains user-managed and not certified by a Shariah board.

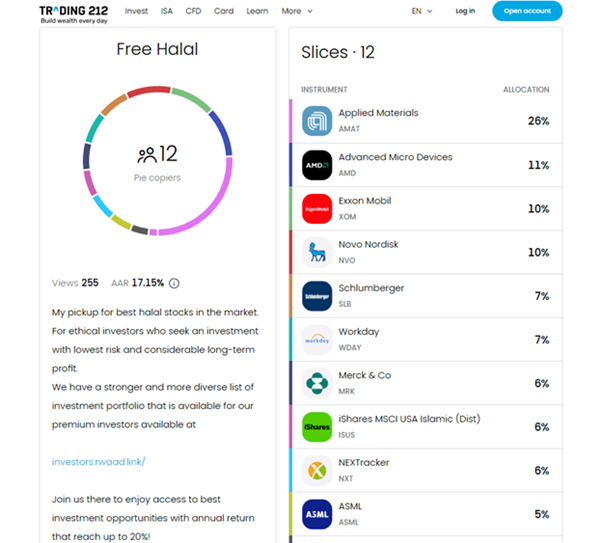

Can I Buy Halal Stocks on Trading 212?

Yes. Trading 212 provides access to many stocks that may be Shariah-compliant. Investors must manually research or use halal screening tools to ensure companies meet both industry and financial ratio requirements set by Islamic investment guidelines before purchasing shares.

How Do I Check if a Stock Is Shariah-Compliant?

You can use external Shariah screening services, Islamic finance apps, or consult fatwa-based guidelines. The process involves reviewing the company's revenue sources, debt levels, and interest income, ensuring it meets industry and financial criteria for permissible (halal) investments under Islamic law.

How Do I Disable Interest on Cash in Trading 212?

Within account settings, locate the “Interest on Uninvested Cash” option and turn it off. This prevents earning riba, which is prohibited in Islam. Disabling it is essential for maintaining Shariah compliance when holding uninvested funds in your Trading 212 account.

Are CFDs and Leverage on Trading 212 Haram?

Yes, CFDs and leverage are considered haram because they involve speculation, borrowing with interest, and trading without full asset ownership. These practices introduce excessive risk and uncertainty, conflicting with Islamic finance principles that require real asset backing and fair risk-sharing.

What Are My Options If Trading 212 Isn't Fully Halal?

If Trading 212 cannot meet your Shariah requirements, you can choose brokers offering certified Islamic accounts. These accounts are designed to avoid interest and prohibited instruments, providing a more straightforward path to compliance without manual settings or stock-by-stock screening.

Which Brokers Offer Certified Islamic Accounts?

Popular options include Interactive Brokers (Islamic account via partners), ADSS, Amana Capital, and AvaTrade's Islamic account. These platforms remove overnight interest (swap-free), avoid haram products, and often have Shariah board oversight, simplifying compliance for Muslim investors seeking fully halal trading.

What Are the Pros and Cons Compared to Trading 212?

Pros include built-in Shariah compliance, no interest charges, and fewer prohibited instruments. Cons can include higher fees, smaller product selection, and less intuitive interfaces compared to Trading 212. Choosing depends on whether convenience or guaranteed compliance is your top priority.

What’s Changed in 2026?

No major changes. Trading 212 still doesn't offer an Islamic account or swap-free option. Interest on cash remains opt-out. CFDs and leverage are still available (and still haram). Use the Invest account, disable interest, and screen stocks manually using tools like Zoya or Islamicly.

Final Verdict: Is Trading 212 Halal or Haram?

Trading 212 can be used in a halal manner with caution — avoiding CFDs, leverage, and interest while carefully screening stocks. However, without official Shariah certification, it's not inherently halal. For certainty, dedicated Islamic accounts from certified brokers are the safer choice.

FAQs

Is Trading 212 a halal trading platform?

Trading 212 is not fully halal because it offers CFDs, leverage, and forex trading, which involve riba (interest) and speculation. However, if you only invest in Sharia-compliant stocks and avoid haram features, you can use it in a halal way.

Does Trading 212 have an Islamic (swap-free) account?

No, Trading 212 does not offer an Islamic (swap-free) account. Many brokers provide these accounts to remove interest-based transactions, but Trading 212 has overnight fees (swap fees) on CFDs, which involve riba.

Can I invest in halal stocks on Trading 212?

Yes, you can invest in halal stocks, but you need to screen them manually. The platform does not provide a built-in halal stock filter, so you'll have to check if the company avoids haram industries (alcohol, gambling, pork, etc.), has low interest-bearing debt (less than 33% of assets), and meets other Shariah screening criteria.

How do I check if a stock on Trading 212 is halal?

You can use third-party halal stock screeners like Zoya, Islamicly, or Wahed Invest. Alternatively, check the company's financial reports or use sites like Yahoo Finance to analyse debt levels.

Are CFDs on Trading 212 halal?

No, CFDs (Contracts for Difference) are haram because they involve leverage which includes riba (interest), they allow short-selling which is not permitted in Islam, and they are highly speculative, falling under gharar (excessive uncertainty). If you want halal investing, you should avoid CFDs altogether.

References

- AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) – Shariah Standards for Islamic Finance

- Trading 212 Official Website & Terms of Service – Review of Their CFD and Investment Accounts

- Financial Conduct Authority (FCA) – Regulations on CFDs and Retail Trading

- Halal Investing Guide – How to Invest Islamically

- ✓ 0% Commission* on stocks & ETFs · *Other fees may apply

- ✓ Fractional shares from £1

- ✓ Stocks & Shares ISA available

Use promo code TIC for free fractional shares

CFDs are complex financial instruments. Ensure you understand the risks before trading.