TradingView Review: Still the Best Charting Platform for Traders?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: Is TradingView Any Good?

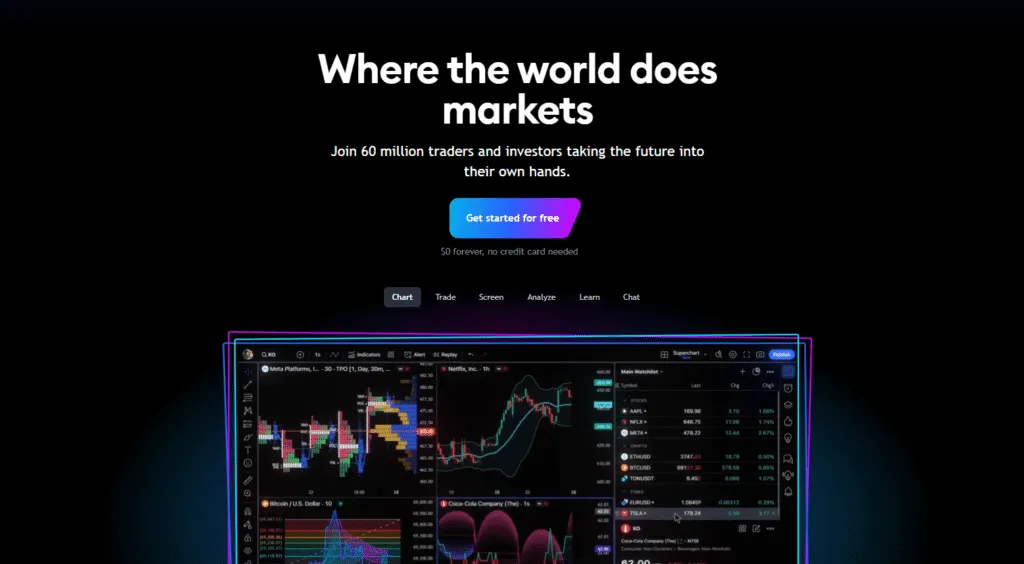

TradingView remains one of the best charting platforms in 2026, offering powerful technical analysis tools, strategy testing, and real-time market data. With flexible pricing and seamless cross-device access, it suits both beginners and experienced traders looking for a professional, web-based charting solution.

Authors Comments

After using TradingView daily across web and mobile, I still consider it the most complete charting tool for traders in 2026. Its mix of custom scripting, community ideas, and multi-market coverage makes it hard to beat for serious analysis, although real-time data subscriptions can increase overall costs. – Thomas Drury

Quick Verdict

| Category | Rating | Verdict |

|---|---|---|

| Ease of Use | 4.8/5 | Exceptionally clean and intuitive interface |

| Features | 4.9/5 | Outstanding charting, scripting, and social tools |

| Performance | 4.7/5 | Fast, stable, and highly responsive across devices |

| Value for Money | 4.4/5 | Free plan solid; paid tiers worth it for pros |

| Security | 4.8/5 | Secure login, GDPR-compliant, and stable uptime |

| Overall | 4.7/5 | Still the best all-round charting platform for traders |

Who Should Use TradingView?

TradingView is ideal for traders who rely on technical analysis, multiple indicators, and chart customisation. It’s built for anyone serious about charting — from beginners learning market structure to professionals running complex strategies. Its flexibility, real-time alerts, and backtesting tools make it suitable for both short- and long-term trading styles.

How Easy Is TradingView to Use?

I found TradingView incredibly intuitive right from the start — it didn’t overwhelm me like some traditional trading platforms do. The layout is clean and responsive, with a customisable workspace that lets me drag and drop charts, indicators, and watchlists exactly where I want them. I didn’t need a user manual to figure out how things worked — it just made sense.

Is the Interface Beginner-Friendly?

Absolutely. When I first started using TradingView, I was impressed by how polished everything felt. The toolbar is simple but powerful, the watchlist sits neatly on the side, and I could pull up new charts in just a click. Zooming in, layering indicators, or switching between assets takes seconds. It’s great for visual traders, and not too cluttered for everyone else — perfect for building confidence early on.

What Learning Tools Does It Offer?

TradingView makes onboarding painless. I leaned on the built-in tutorials and the help centre when I wanted to learn more advanced features, but honestly, I picked up most things just by exploring. What helped even more were the thousands of community-shared scripts and strategies — I could copy, tweak, and learn from them directly on the chart.

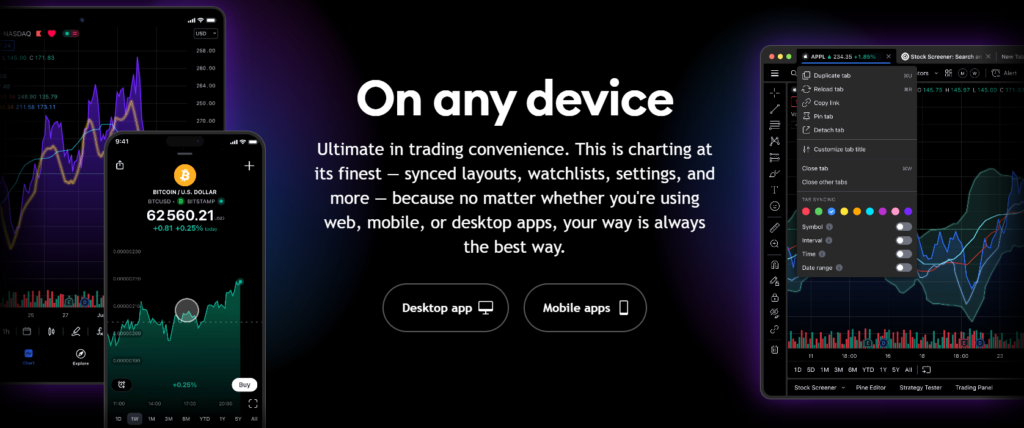

How reliable Is the Mobile App?

The mobile app is one of the best I’ve used. It mirrors the desktop functionality really well, and I often check charts or set alerts on my phone when I’m away from my setup. On both tablets and smartphones, everything runs smooth, there’s no lag, or shortcomings in the usability.

What Are the Standout Features of TradingView in 2025?

What keeps me coming back to TradingView is its remarkable power and flexibility. It’s not just a charting tool — it’s a full suite for technical analysis, strategy testing, and market tracking. Every feature feels thoughtfully built, whether I’m drawing trendlines or coding my own indicators.

TradingView’s charts are some of the best I’ve used. I can draw anything from simple support and resistance lines to detailed Fibonacci retracements, and all updates are in real-time. The multi-timeframe overlays are especially helpful; I often layer a 1-hour chart over a daily chart to spot alignment. Plus, the ability to save and switch between multiple layouts helps me stay organised whether I’m trading stocks or crypto.

What Kind of Indicators and Scripts Are Available?

This is where TradingView really shines. It comes with over 100 built-in indicators, but what I really love is the community library. There are more than 100,000 custom scripts — everything from moving average crossovers to complex volume analysis tools. And thanks to Pine Script 5.0, I’ve even built a few of my own. You can backtest them right on the chart, which is a massive time-saver.

Can You Set Custom Alerts and Notifications?

Yes, and they’re incredibly versatile. I set price alerts, indicator-based triggers, and even multi-condition alerts — like when RSI is below 30 and price hits a key level. TradingView lets me receive them via push, email, or SMS, so I never miss a setup, even when I’m away from my desk.

What Other Tools Are Included?

Beyond charts, I get access to real-time economic calendars, embedded financial news, heatmaps, bar replay (which I use for practice), and a social feed full of trade ideas. It’s all integrated, so I don’t have to bounce between platforms to stay informed.

How Much Does TradingView Cost in 2025?

TradingView has a plan for every type of trader, including a solid free version, which is how I got started. I later upgraded to Pro+ for the extra chart layouts and alerts, and it’s been well worth it for the tools I use every day.

What Are the Pricing Plans?

There are four main plans: Free, Pro, Pro+, and Premium. You can pay monthly or save a bit by going annual — I personally chose the annual Pro+ plan to lock in the discount. If you’re on the fence, there’s also a 30-day trial so you can test-drive the paid features without risk.

Here’s a quick breakdown of what you get with each:

| Plan | Price (Monthly) | Charts/Layout | Indicators | Alerts | Ideal For |

|---|---|---|---|---|---|

| Free | $0 | 1 | 3 | 1 | Beginners |

| Pro | $14.95 | 2 | 5 | 10 | Casual traders |

| Pro+ | $29.95 | 4 | 10 | 30 | Daily traders |

| Premium | $59.95 | 8 | 25 | 400 | Advanced, quant users |

I use Pro+ because it provides me with the flexibility to run multiple strategies simultaneously. Although it should be noted that real-time data for some exchanges (like NYSE or LSE) comes with an extra monthly fee. It’s optional, but I’ve added a few of them to track live prices with accuracy.

Can You Trade Directly on TradingView?

Yes — and I do it regularly. TradingView lets you place real trades through integrated brokers right from the chart interface, which means you can go from analysis to execution without switching platforms. It’s incredibly efficient once everything is set up.

How Reliable Is the Trade Execution?

Order execution has been smooth in my experience. You can place market, limit, stop, or trailing orders directly from the chart — just right-click or tap a button on mobile. It’s intuitive and fast, especially for day trading. That said, TradingView doesn’t handle your funds, it is not a broker itself. All transactions go through your connected broker, and execution speed ultimately depends on them.

The integration works well for managing trades visually, but it’s worth noting that more advanced order types or portfolio tracking features are usually handled outside TradingView on the broker’s side. Still, for most active traders, the setup is more than enough.

How Secure and Reliable Is TradingView?

From what I’ve seen using it daily, TradingView takes security and reliability seriously. I’ve never experienced a data breach or major outage, and the platform feels stable even during high-volatility events.

I always enable two-factor authentication (2FA), and TradingView makes that easy. Login sessions are encrypted, and they follow GDPR guidelines, which is reassuring — especially if you’re trading across global markets. I’ve never had concerns about account safety or personal data being mishandled.

How Stable Is the Platform?

Performance-wise, TradingView is rock-solid. I’ve used it during earnings seasons, FOMC announcements, and major crypto events, and the charts never froze or lagged. Load times are fast whether I’m on desktop or mobile. Uptime has been excellent over the years, and while I’ve heard of brief outages in the past, I’ve never experienced one myself.

Even during fast-moving markets, price updates remain smooth, and alerts fire instantly. That’s something I really value, because if your platform stalls, so does your edge. Overall,I’ve found it to be one of the most dependable tools in my trading stack.

How Does TradingView Compare to Other Tools?

I’ve used most of the major platforms over the years, but TradingView still stands out as the most balanced option when it comes to usability, flexibility, and clean design. It’s not perfect, but for visual traders like me, it ticks nearly every box.

| Feature | TradingView | MetaTrader 5 |

|---|---|---|

| Web-Based | Yes | No |

| Mobile Support | Yes | Yes |

| Script Language | Pine Script | MQL5 |

| Social Tools | Yes | No |

| Trade Execution | Limited | Full |

What Are the Pros and Cons of Using TradingView?

TradingView stands out for its cloud-based design, seamless mobile access, and powerful Pine Script tools for building and backtesting strategies. It’s ideal for traders focused on analysis and visuals, though trade execution is limited and real-time data feeds can be costly. Overall, it’s unmatched for charting versatility.

| Pros | Cons |

|---|---|

| Clean, user-friendly interface | Real-time data feeds cost extra |

| Flexible indicators and Pine Script engine | Premium plan is expensive for beginners |

| Cross-platform with cloud syncing | Limited trade execution with some brokers |

| Huge trader community and shared content | Lacks portfolio tracking and order book depth in some markets |

Overall, the strengths outweigh the drawbacks — especially if your focus is charting and strategy testing rather than full brokerage functionality.

What Do Traders and Experts Think of TradingView?

Most traders rate TradingView highly across Reddit, Trustpilot, and YouTube. Users praise its clean design, fast charts, and flexible layouts. Experienced traders love its customisation, while beginners find it easy to learn. The main drawbacks mentioned are paid real-time data and limited broker integration for direct trade execution.

What Do Industry Experts Recommend?

Trading educators and analysts I follow often highlight TradingView as the best platform for teaching technical analysis and backtesting. I’ve seen hedge fund professionals use it for visual strategy development, and it’s widely adopted in the crypto space, especially by those building and refining algo strategies. It’s well-respected for a reason.

Final Verdict: Should You Use TradingView?

If you’re serious about trading — whether you’re a swing trader, day trader, or even dabbling in algorithmic strategies — I genuinely think TradingView is worth your time. It’s visually sharp, runs smoothly, and supports everything from basic charting to advanced scripting.

For casual traders or beginners, the free plan is surprisingly robust. You can chart, test ideas, and learn at your own pace without spending a penny. But once you start needing more layouts, alerts, or indicators, I’d recommend upgrading to Pro or Pro+ — that’s when the platform really opens up.

In my view, TradingView nails the balance between power and usability. If you’re still unsure, just start with the 30-day trial of a paid plan. That’s exactly how I got hooked and I haven’t looked back since.

FAQs

Is TradingView free to use?

Yes, TradingView offers a free plan with basic charting tools, one chart layout, and limited indicators. It’s a great starting point for anyone interested.

What markets can I analyse on TradingView?

You can chart and analyse stocks, forex, cryptocurrencies, commodities, indices, and bonds.

Can I place trades directly on TradingView?

Yes, TradingView supports direct trading through integrated brokers, though not all assets or order types are supported.

What’s the difference between Pro, Pro+, and Premium plans?

The higher-tier plans unlock more charts per layout, more indicators, and vastly more alerts — ideal for advanced or full-time traders.

Does TradingView work on mobile?

Yes, the mobile app is highly rated and syncs seamlessly with your desktop layouts, making it perfect for trading on the go.

Can I build my own indicators on TradingView?

Yes, with Pine Script you can code, test, and even share custom indicators and trading strategies directly within the platform.