Is XTB Safe for UK Traders in 2025? Regulation, Security & Trust

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Who Regulates XTB and How Does This Protect UK Traders?

XTB operates under FCA supervision in the UK and holds licences from multiple global regulators, ensuring high compliance standards. FCA oversight mandates fund segregation, negative balance protection, and transparent practices, giving UK traders confidence in the broker’s trustworthiness and operational integrity.

Why is regulation important for UK investors?

Regulation protects UK traders by ensuring brokers meet strict capital, conduct, and transparency rules. It safeguards client funds through segregation, enforces fair dealing, and reduces fraud risk, giving investors a reliable framework for secure online trading in a highly regulated environment.

| Region | Regulator | Key Responsibilities |

|---|---|---|

| United Kingdom | Financial Conduct Authority (FCA) | Segregates client funds, mandates audits, and enforces transparency. |

| European Union | Cyprus Securities and Exchange Commission (CySEC) | Enforces EU directives (MiFID II), promotes fair trading, and protects investor interests. |

| United Arab Emirates | Dubai Financial Services Authority (DFSA) | Regulates against money laundering and ensures client fund security. |

| Global | Financial Services Commission of Belize (FSC) | Oversees general compliance and transparency for clients outside the UK, EU, and UAE. |

How Does XTB Protect Client Funds and Accounts?

XTB safeguards client money through FCA-mandated segregation, meaning funds are kept separate from company assets. Advanced encryption protects account access, while secure payment processing and risk management protocols help prevent fraud, ensuring UK traders’ capital and personal data remain secure at all times.

Does XTB use segregated accounts?

Yes. XTB maintains segregated client accounts with top-tier banks, keeping trader funds separate from company operating capital. This protects money in the event of insolvency and ensures compliance with FCA rules, giving UK clients greater financial security and peace of mind.

| Safety Feature | Description |

|---|---|

| Segregated Accounts | Client funds are kept separate from company funds, protecting them from operational risks. |

| Encryption & Data Security | All transactions are encrypted, ensuring secure processing of deposits and withdrawals. |

Is negative balance protection included for UK clients?

Yes. XTB provides negative balance protection for UK traders under FCA rules. This means account losses cannot exceed deposited funds, protecting clients from debt due to extreme market volatility or sudden price gaps, an essential safeguard for leveraged trading environments.

What Investor Protection Schemes Apply to UK Traders at XTB?

UK traders at XTB benefit from the Financial Services Compensation Scheme (FSCS), covering eligible clients up to £85,000 in case of broker failure. EU clients may be covered under local schemes, ensuring region-specific protection alongside strict regulatory oversight and compliance.

What are the compensation limits for UK and EU clients?

| Region | Investor Protection Programme | Coverage Amount |

|---|---|---|

| United Kingdom | Financial Services Compensation Scheme (FSCS) | Up to £85,000 per client |

| European Union | CySEC Investor Compensation Fund | Up to €20,000 per client |

| Other Regions | No specific investor protection scheme | Not available |

How Strong is XTB’s Track Record and Transparency?

With over 20 years in operation, XTB maintains a solid financial track record and transparent reporting. Serving clients in 190+ countries, it is known for reliability, regulatory compliance, and open communication, reinforcing its reputation as a trustworthy global brokerage.

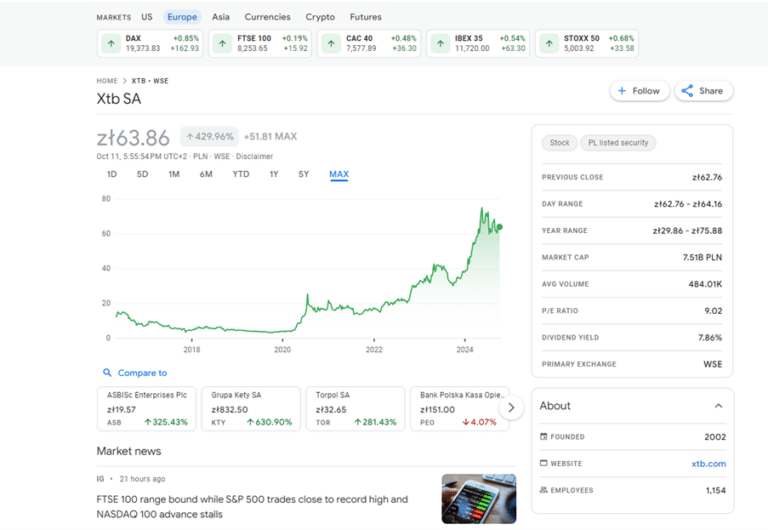

Is XTB publicly listed and financially stable?

Yes. XTB is listed on the Warsaw Stock Exchange, publishing audited financial statements annually. Its public status requires stringent disclosure and governance standards, demonstrating strong financial health and offering traders clear insight into the company’s stability and performance.

What do industry reviews and awards say about XTB?

Industry reviews frequently praise XTB for low costs, platform usability, and customer service. Awards from reputable financial publications highlight its innovation and reliability. Consistent recognition across markets strengthens its standing as a trusted broker for both new and experienced traders.

Are There Any Risks or Drawbacks to Using XTB?

While XTB is FCA-regulated and reputable, risks remain. Spreads may widen during volatility, certain advanced tools are platform-specific, and inactive accounts incur fees. Traders must also remain cautious of impersonators, as fraudsters often exploit trusted brand names in phishing schemes.

What issues have traders experienced?

Some traders report occasional platform downtime, slower withdrawals during high-demand periods, and higher overnight financing costs compared to competitors. These issues are not unique to XTB but highlight the importance of understanding broker terms and trading conditions before committing capital.

How can traders avoid XTB scams and impersonators?

Always open accounts via XTB’s official UK website, verify FCA registration, and avoid unsolicited contact claiming to be from XTB. Never send funds to personal bank accounts. Check all communication against verified company channels to prevent fraud and identity theft.

How Does XTB Compare to Other Safe UK Brokers?

| Broker | Regulation | Max Protection | Years in Business | Key Strength |

|---|---|---|---|---|

| XTB | FCA | £85,000 (FSCS) | 20+ | Award-winning xStation platform and fast execution |

| IG | FCA | £85,000 (FSCS) | 45+ | Industry leader with advanced trading tools |

| CMC Markets | FCA | £85,000 (FSCS) | 30+ | Strong educational content and charting tools |

| eToro | FCA | £85,000 (FSCS) | 15+ | Social trading and copy-trading features |

| Pepperstone | FCA | £85,000 (FSCS) | 13+ | Tight spreads and high-speed execution |

XTB stands shoulder-to-shoulder with long-established FCA brokers. While IG and CMC Markets boast longer histories, XTB’s innovative xStation platform and focus on transparency make it a modern competitor. It provides the same FSCS protection as peers, ensuring strong safety and trust for UK traders.

What Are the Pros and Cons of Trading with XTB?

| Pros | Cons |

|---|---|

| FCA-regulated with FSCS protection up to £85,000 | Inactivity fees apply after 12 months of no trading |

| 20+ years in business and publicly listed on the Warsaw Stock Exchange | Platform tools can vary slightly depending on your region |

| Competitive spreads, zero deposit fees, and quick withdrawals | Overnight swap rates may be higher on certain CFDs |

| Advanced account security and segregated client funds | No actual crypto ownership (crypto trading via CFDs only) |

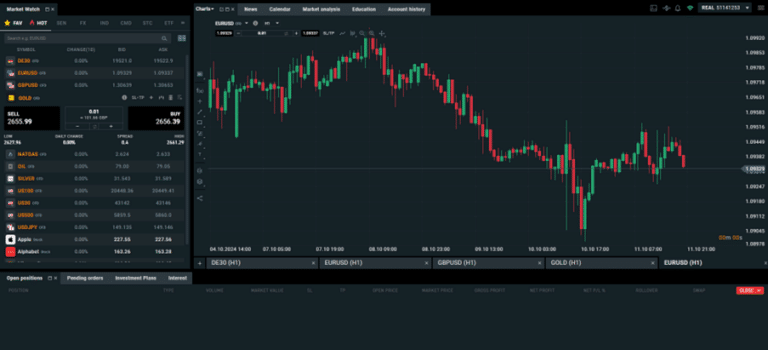

| Award-winning xStation 5 platform with built-in education and analytics | Limited product range compared to multi-asset brokers like IG |

| Responsive UK-based support and transparent pricing | No MetaTrader 4/5 support (xStation exclusive) |

XTB’s pros clearly outweigh its cons for most traders. It offers a secure, FCA-regulated environment with competitive pricing and modern technology. The xStation platform is intuitive and powerful, though traders should note overnight costs and the lack of MT4/MT5 support before committing funds.

Final Verdict – Is XTB a Safe Choice for UK Traders in 2026?

Yes. With FCA regulation, FSCS coverage, a long-standing track record, and strong security measures, XTB is a safe and reliable broker for UK traders. While not risk-free, its transparency and investor protections make it a solid choice for 2026.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

Is XTB regulated by the FCA?

Yes, XTB is regulated by the Financial Conduct Authority in the UK.

Does XTB offer negative balance protection?

Yes, XTB provides negative balance protection to prevent losses beyond your account balance.

Is XTB listed on a stock exchange?

Yes, XTB is listed on the Warsaw Stock Exchange.

What is the minimum deposit for XTB?

XTB typically does not require a minimum deposit to start trading.

References

- ✓ Zero commission on real stocks & ETFs up to €100k/month

- ✓ xStation 5 platform — fast, intuitive & feature-rich

- ✓ CFD trading on forex, indices, commodities & crypto

- ✓ Earn up to 5% interest p.a. on uninvested cash (GBP)

71% of retail investor accounts lose money when trading CFDs with this provider.