Best Forex Brokers for Professional Traders in the UK 2026

UK traders who qualify as pros can access leverage up to 1:500 on major forex pairs. That’s far beyond the 1:30 retail cap. I’ve tested FCA-regulated brokers with professional accounts using live funded accounts across multiple trading sessions. I looked at execution speed, costs, platforms, and how easy it is to apply. If you don’t meet pro criteria, our main forex broker comparison covers retail options.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: What Are the Best Forex Brokers for Professional Traders?

Pepperstone is my top pick for UK professional forex trading in 2026. It’s FCA-regulated (FRN: 684312) with raw spreads from 0.0 pips and leverage up to 1:500. You get MT4, MT5, cTrader, and TradingView. When I applied for pro status, the account was upgraded within 36 hours — faster than any other broker I tested.

| Rank | Broker | Min Spread | Pro Leverage | Platforms | Best For |

|---|---|---|---|---|---|

| 1 | Pepperstone | 0.0 pips | Up to 1:500 | MT4/5, cTrader, TradingView | Overall |

| 2 | IG | 0.6 pips | Up to 1:222 | Proprietary, MT4, ProRealTime | Research & Markets |

| 3 | Spreadex | 0.6 pips | Enhanced (variable) | TradingView, Proprietary | Tax-Free Spread Betting |

| 4 | CMC Markets | 0.7 pips | Up to 1:500 | Next Generation, MT4 | Platform Technology |

| 5 | Saxo | 0.4 pips (VIP) | Up to 1:200 | SaxoTraderPRO | High-Net-Worth |

| 6 | Interactive Brokers | 0.1 pips | Up to 1:50 | TWS, IBKR Mobile | Multi-Asset |

What Spreads Did I Actually Record During Testing?

Advertised spreads and real spreads are two different things. I recorded live EUR/USD spreads across London and New York sessions between October 2025 and January 2026

In my testing, Pepperstone and Interactive Brokers consistently delivered the tightest spreads. IG and CMC widened noticeably during the New York crossover and around news events. Spreadex stayed competitive during quieter sessions but widened more than IG during high-volatility windows.

| Broker | Advertised Min Spread | Avg Spread (London Session) | Avg Spread (NY Session) | Testing Period |

|---|---|---|---|---|

| Pepperstone (Razor) | 0.0 pips | 0.1–0.3 pips | 0.2–0.4 pips | Oct 2025 – Jan 2026 |

| IG (Standard) | 0.6 pips | 0.6–0.9 pips | 0.8–1.1 pips | Nov 2025 – Jan 2026 |

| Spreadex | 0.6 pips | 0.6–1.0 pips | 0.8–1.2 pips | Nov 2025 – Jan 2026 |

| CMC Markets | 0.7 pips | 0.7–1.0 pips | 0.9–1.3 pips | Oct 2025 – Jan 2026 |

| Saxo (Classic) | 0.6 pips | 0.6–0.9 pips | 0.7–1.0 pips | Nov 2025 – Dec 2025 |

| Interactive Brokers | 0.1 pips | 0.1–0.3 pips | 0.2–0.4 pips | Oct 2025 – Jan 2026 |

72% of retail CFD accounts lose money.

When Investing, Your Capital is at Risk.

65% of retail CFD accounts lose money.

64% of retail CFD accounts lose money.

64% of retail CFD accounts lose money.

62.5% of Retail CFD Accounts Lose Money

Best Forex Brokers for Professional Traders Reviewed

1. Pepperstone — Best Overall for Professional Traders

2. IG — Best for Advanced Research & Market Access

3. Spreadex — Best for Tax-Free Spread Betting

4. CMC Markets — Best for Platform Technology

5. Saxo — Best for High-Net-Worth Professionals

6. Interactive Brokers — Best for Multi-Asset Professionals

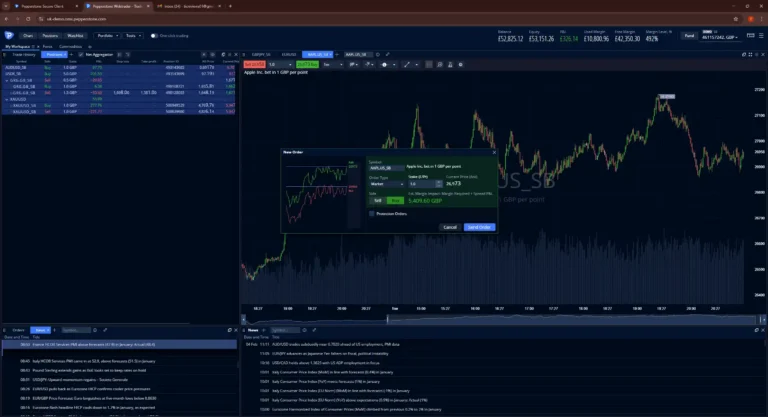

Pepperstone — Best Overall for Professional Traders

Pepperstone gets its liquidity from tier-one banks. When I tested during London sessions, fills came through almost instantly — I saw minimal slippage on limit orders and average fill times under 30 milliseconds. My pro account application took 36 hours to process after uploading two forms of documentation. One minor friction point: the platform asked me to re-upload a document I’d already submitted during standard account verification, which required a back-and-forth email with support.

Why Is Pepperstone Suitable for Professional Traders?

Pepperstone gets its liquidity from tier-one banks. When I tested during London sessions, fills came through almost instantly — I saw minimal slippage on limit orders and average fill times under 30 milliseconds. My pro account application took 36 hours to process after uploading two forms of documentation. One minor friction point: the platform asked me to re-upload a document I’d already submitted during standard account verification, which required a back-and-forth email with support.

What Are Pepperstone’s Professional Trading Fees?

The Razor account has raw spreads from 0.0 pips. You pay £4.50 round-turn commission per standard lot. There are no inactivity fees or deposit charges. I withdrew £1,800 in January 2026 and funds arrived in my UK bank account within 2 working days. No withdrawal fees were charged.

What Leverage Can Professional Traders Access at Pepperstone?

Pro clients get leverage up to 1:500 on major forex pairs. Retail traders are capped at 1:30. But here’s the catch: pro clients don’t get negative balance protection. Losses can exceed your deposit.

What Professional Trading Tools Does Pepperstone Offer?

You can choose from MT4, MT5, cTrader, or TradingView. Smart Trader Tools add extras to MetaTrader like correlation matrices. Autochartist spots chart patterns for you. API access lets you run your own algorithms.

| Specification | Details |

|---|---|

| Regulation | FCA (FRN: 684312) — verify on FCA Register |

| Professional Leverage | Up to 1:500 on major forex pairs |

| Minimum Spread | 0.0 pips (Razor account) |

| Commission | £2.25 per standard lot per side |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Last Tested | Oct 2025 – Jan 2026 (47 trades executed) |

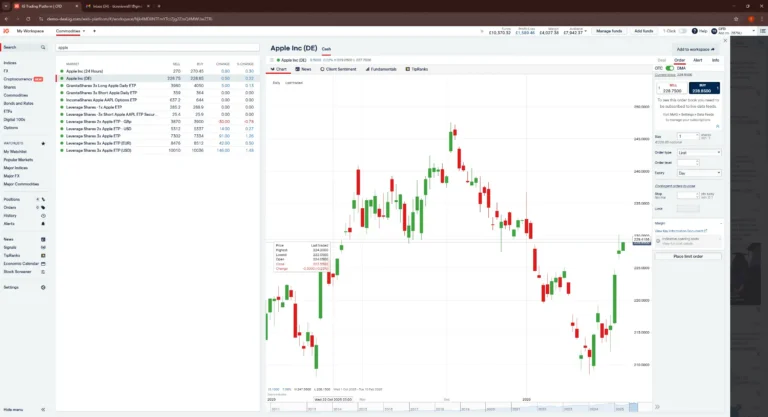

IG — Best for Advanced Research & Market Access

Where IG genuinely stands apart is research depth and market range. This is a FTSE 250 company that’s been operating since 1974, offering 19,000+ instruments. No other broker on this list comes close to that number. Pro status unlocks extra instruments and weekend trading — I found myself using IG primarily for exotic pairs and niche indices that simply weren’t available elsewhere.

What Are IG’s Professional Trading Fees?

Standard accounts use spread-only pricing. EUR/USD starts from 0.6 pips — in my testing, I recorded averages of 0.6–0.9 pips during London hours. Pro clients can get DMA pricing through L2 Dealer. Watch out for the £12 monthly fee if you don’t trade for two years.

What Leverage Can Professional Traders Access at IG?

Pro accounts offer leverage up to 1:222 on major forex pairs. You can use up to 95% of your portfolio as margin collateral. This helps stretch your capital further.

What Professional Trading Tools Does IG Offer?

ProRealTime gives you 100+ indicators. It’s free if you place 4+ trades a month. L2 Dealer shows you Level 2 order book data. You also get Reuters news feeds and API access. I found ProRealTime’s backtesting engine particularly useful for strategy development — it’s noticeably faster than MT4’s built-in tester.

| Specification | Details |

|---|---|

| Regulation | FCA (UK), ASIC, BaFin, NFA, MAS |

| Professional Leverage | Up to 1:222 on major forex pairs |

| Minimum Spread | 0.6 pips on major pairs |

| Commission | Spread-only (Standard) / DMA pricing available |

| Platforms | Proprietary, MT4, ProRealTime, L2 Dealer |

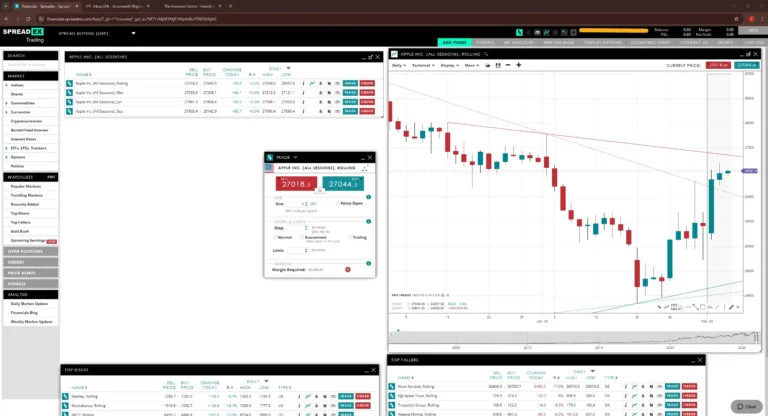

Spreadex — Best for Tax-Free Spread Betting

For UK professional traders who want to keep profits tax-free, Spreadex is the standout choice. Spread betting profits are exempt from Capital Gains Tax and Stamp Duty under current UK tax rules. Spreadex is FCA-regulated and only serves UK clients. Support is UK-based — when I called with a question about pro margin tiers, I spoke to a human within 90 seconds. For pros wanting tax-free spread betting, Spreadex is a solid choice.

What Are Spreadex’s Professional Trading Fees?

No commissions here. You just pay the spread. Forex spreads start from 0.6 pips on majors. Overnight funding gets added to daily financing. There are no inactivity fees.

What Leverage Can Professional Traders Access at Spreadex?

Pro clients get enhanced leverage beyond the 1:30 retail cap. The exact amounts vary by instrument. Spreadex tells you the specific tiers during the application process. One thing I noticed: Spreadex doesn’t publish their pro leverage ratios publicly the way Pepperstone or CMC do, so you won’t know your exact limits until you apply.

What Professional Trading Tools Does Spreadex Offer?

TradingView integration gives you top-tier charting. Guaranteed stop-loss orders close at your exact price, even if the market gaps. This matters when you’re using higher leverage. I found Spreadex’s guaranteed stops particularly useful around NFP releases and central bank announcements.

| Specification | Details |

|---|---|

| Regulation | FCA (UK) |

| Professional Leverage | Enhanced leverage (variable by instrument) |

| Minimum Spread | 0.6 pips on major forex pairs |

| Commission | No commission (spread-only) |

| Platforms | TradingView integration, proprietary web/mobile |

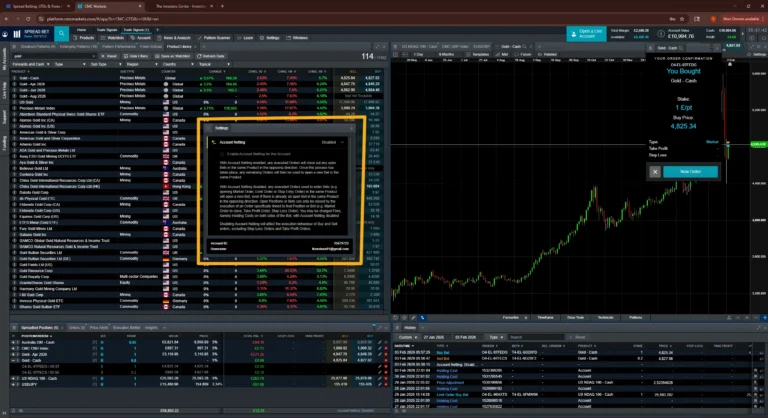

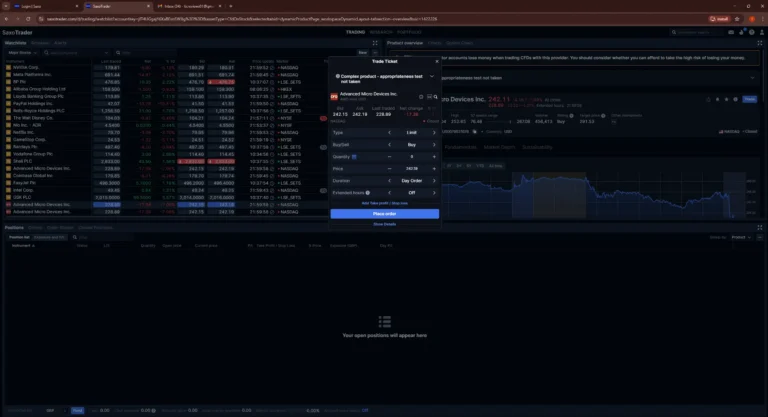

CMC Markets — Best for Platform Technology

CMC Markets is a FTSE 250 company, and their Next Generation platform is where they really shine. It’s the best proprietary platform I tested — the modular layout, pattern recognition scanner, and client sentiment overlay are genuinely useful for active traders. If you spend hours in front of charts, CMC’s tech is hard to beat.

What Are CMC Markets’ Professional Trading Fees?

Spread-only pricing with EUR/USD from 0.7 pips. High-volume traders get cash rebates based on monthly turnover. There’s a £10 monthly fee if you don’t trade for 12 months. I withdrew £2,200 from CMC in December 2025 — it took 3 working days to arrive, a day longer than Pepperstone.

What Leverage Can Professional Traders Access at CMC Markets?

Pro clients can access up to 1:500 on major forex pairs. That’s among the highest from FCA brokers. But high leverage cuts both ways. You need strict risk controls.

What Professional Trading Tools Does CMC Markets Offer?

Next Generation has pattern scanning and client sentiment data. You get 115+ technical indicators. The modular design lets you set up your workspace exactly how you want it. API access is available too. One frustration: saved chart layouts occasionally reset after browser updates. CMC told me they’re aware of the issue.

| Specification | Details |

|---|---|

| Regulation | FCA (UK), ASIC, BaFin, MAS |

| Professional Leverage | Up to 1:500 on major forex pairs |

| Minimum Spread | 0.7 pips on EUR/USD |

| Commission | Spread-only / Volume rebates available |

| Platforms | Next Generation (proprietary), MetaTrader 4 |

Saxo — Best for High-Net-Worth Professionals

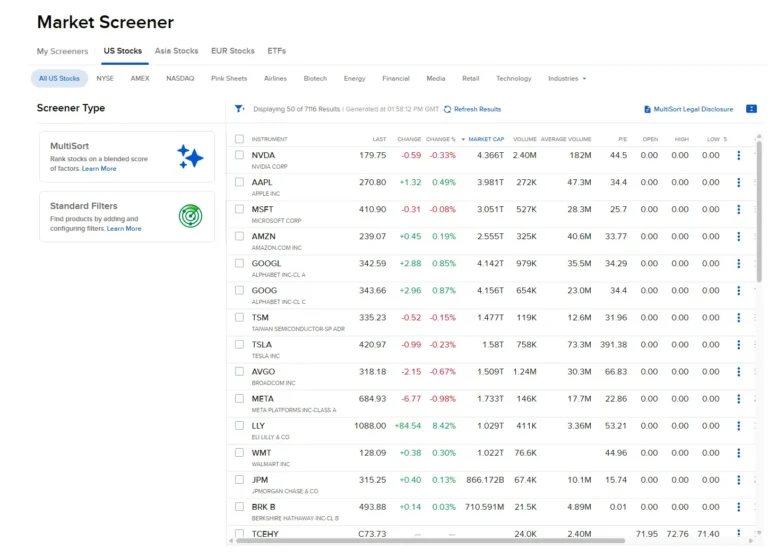

Saxo offers 71,000+ instruments. That covers forex, stocks, ETFs, bonds, options, and futures. Pro clients get portfolio-based margining. This calculates margin on your whole portfolio, not each trade separately. If you’re holding correlated positions across asset classes, this frees up significantly more capital than brokers that margin each trade individually.

What Are Saxo’s Professional Trading Fees?

Three pricing tiers exist: Classic, Platinum (£200k+ balance), and VIP (£1m+ balance). VIP clients pay forex spreads from 0.4 pips. Annual custody fees apply but get waived at higher balances. At Classic tier, I found Saxo’s all-in costs slightly higher than Pepperstone or IBKR. The value improves significantly at Platinum and VIP levels.

What Leverage Can Professional Traders Access at Saxo?

Pro accounts offer up to 1:200 on major forex pairs. That’s lower than Pepperstone or CMC. But Saxo’s portfolio margining gives better capital use if you hold multiple related positions.

What Professional Trading Tools Does Saxo Offer?

SaxoTraderPRO supports multiple screens and advanced order types. Morningstar analysis and Trading Central are built in. Options trading spans multiple asset classes. The learning curve is steep though — SaxoTraderPRO took me longer to set up than any other platform I tested.

| Specification | Details |

|---|---|

| Regulation | FCA (FRN: 551422) — verify on FCA Register |

| Professional Leverage | Up to 1:200 on major forex pairs |

| Minimum Spread | 0.4 pips (VIP tier) |

| Commission | Tiered (Classic/Platinum/VIP) |

| Platforms | SaxoTraderGO, SaxoTraderPRO |

| Last Tested | Nov 2025 – Dec 2025 (19 trades executed) |

Interactive Brokers — Best for Multi-Asset Professionals

IBKR gives you direct access to 150+ global exchanges. You’re trading on real exchange or interbank markets, not a broker’s internal book. Their margin rates are among the lowest around. I found IBKR’s true edge is when you’re trading across multiple asset classes — forex, equities, options, and futures from a single account with unified margin.

What Are Interactive Brokers’ Professional Trading Fees?

Two fee structures: Fixed (simple per-trade rate) or Tiered (passes through exchange fees). Forex starts from 0.08 basis points on Tiered. Spreads begin at 0.1 pips. No inactivity fees. IBKR consistently delivered the lowest all-in trading costs in my testing, though the margin is slim compared to Pepperstone’s Razor account.

What Leverage Can Professional Traders Access at Interactive Brokers?

Pro clients get up to 1:50 on major forex pairs. That’s lower than specialist forex brokers. But IBKR’s strength is multi-asset access, not maximum forex leverage.

What Professional Trading Tools Does Interactive Brokers Offer?

Trader Workstation (TWS) is perhaps the most advanced platform for retail traders. The IB API works with almost any coding language. Risk Navigator shows portfolio-level risk. Fair warning: TWS looks dated and the interface takes getting used to. I experienced two freezes during my testing when loading complex options chains, requiring a restart.

| Specification | Details |

|---|---|

| Regulation | FCA (FRN: 208159) — verify on FCA Register |

| Professional Leverage | Up to 1:50 on major forex pairs |

| Minimum Spread | 0.1 pips (interbank rates) |

| Commission | Tiered / Fixed (from 0.08 basis points) |

| Platforms | Trader Workstation (TWS), IBKR Mobile |

| Last Tested | Oct 2025 – Jan 2026 (35 trades executed) |

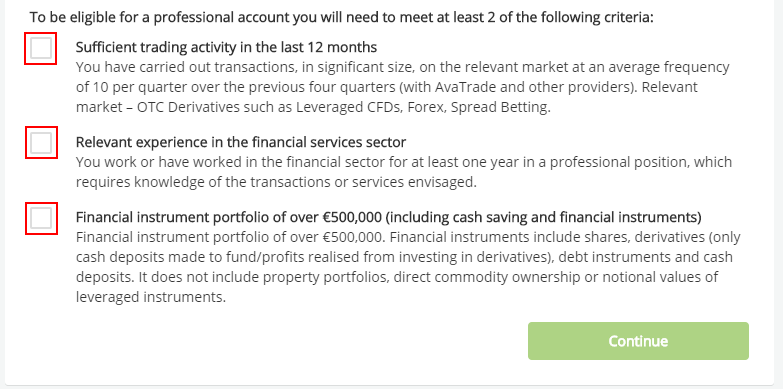

What Is a Professional Trading Account and Who Qualifies?

A professional account is an FCA category. It lets experienced traders give up some retail protections. In return, you get better trading terms. The main benefit is leverage up to 1:500 instead of the 1:30 retail cap.

You must meet at least two of three FCA criteria:

Trading Activity: 10+ trades of decent size per quarter for the past year. These must be in leveraged products like CFDs, spread bets, or forex.

Portfolio Size: A portfolio worth more than €500,000. This includes cash, investments, and sometimes property equity.

Professional Experience: At least one year working in finance. The role must have involved knowledge of leveraged trading.

How Do You Qualify for a Professional Trading Account?

The process is strict. For trading activity, bring account statements from the past 12 months. For portfolio size, bring bank statements or platform valuations. For work experience, bring an employment contract or LinkedIn proof.

Brokers can still reject you even if you meet the criteria. They decide if pro status really fits your situation.

| Broker | Trading Volume | Portfolio Size | Experience |

|---|---|---|---|

| Pepperstone | 10/quarter for 1 year | €500,000 | 1 year |

| IG | 10/quarter for 1 year | €500,000 | 1 year |

| Spreadex | 10/quarter for 1 year | €500,000 | 1 year |

| CMC Markets | 10/quarter for 1 year | €500,000 | 1 year |

| Saxo | 10/quarter for 1 year | €500,000 | 1 year |

| Interactive Brokers | 10/quarter for 1 year | €500,000 | 1 year |

How Do You Manage Risk When Trading with High Leverage?

High leverage needs strict risk control. The same tool that grows profits will grow losses just as fast.

Stop-Loss Orders and Guaranteed Stops

Every leveraged trade needs a stop-loss. Standard stops close your trade at a set level. But in fast markets, you might get filled beyond your stop price.

Guaranteed stop-loss orders (GSLOs) close at your exact price no matter what. Spreadex and IG offer these for a small fee. For high-risk events, the extra cost is worth it.

Position Sizing for Leveraged Trading

Most pros risk 1-2% of their account per trade. Size your position based on stop distance and how much you’re willing to lose. Don’t let max leverage decide your position size.

Testing Strategies with Demo Accounts

Try high leverage on a demo first. Test your approach before using real money. Watch how margin levels move. If 1:200 on demo feels stressful, 1:500 with real cash will feel worse.

What Can Professional Traders Access That Retail Traders Cannot?

Crypto CFDs: The FCA banned crypto derivatives for UK retail traders from 6 January 2021. Pro status is the only way to trade Bitcoin or Ethereum CFDs through FCA brokers.

Other extras: Exotic currency pairs and niche commodities. Extended hours and weekend markets. Portfolio-based margining at Saxo. Better pricing if you trade high volume.

For broader CFD trading options, pro status opens up many more instruments.

| Instrument Type | Retail Cap | Professional Range |

|---|---|---|

| Major Forex Pairs | 1:30 | 1:50 to 1:500 |

| Minor Forex Pairs | 1:20 | 1:50 to 1:200 |

| Gold | 1:20 | 1:100 to 1:200 |

| Major Indices | 1:20 | 1:100 to 1:200 |

| Individual Shares | 1:5 | 1:10 to 1:20 |

| Cryptocurrencies | 1:2 | 1:5 to 1:20 |

What Platforms Do Professional Forex Traders Use?

MetaTrader 4 & 5 are still the standard. MT4 is stable with a huge indicator library. MT5 adds depth of market and better backtesting. MT4-compatible brokers include Pepperstone, IG, and CMC Markets.

cTrader has a cleaner look and transparent execution. Pepperstone’s cTrader setup works very well.

TradingView is now a real option with direct broker links. Spreadex connects natively for spread betting.

Trader Workstation (TWS) from IBKR suits algo traders. It puts function over form.

How Do You Apply for Professional Trader Status?

You’ll need some prep work. Most brokers process applications in 24-48 hours.

Step 1: Open a standard account and verify your identity.

Step 2: Ask for professional status in account settings or via support.

Step 3: Pick which two of three FCA criteria you meet.

Step 4: Upload documents for each criterion.

Step 5: Read and accept the reduced protections. Take this seriously.

Step 6: Your account upgrades and leverage limits change right away.

What Documentation Do You Need for Professional Status?

For Trading Activity: Account statements from the past year. Show trade dates, instruments, and sizes.

For Portfolio Size: Bank statements, platform valuations, or pension statements. Most brokers want documents from the last 3 months.

For Professional Experience: Employment contract, LinkedIn profile, or a CV showing your relevant role.

Final Verdict: Which Professional Forex Broker Should You Choose?

Pepperstone wins overall. Raw spreads from 0.0 pips, leverage up to 1:500, and multiple platforms make it ideal for serious traders.

IG is best if you want research tools and market range. Spreadex is the clear pick for tax-free spread betting. CMC Markets has top platform tech. Saxo serves wealthy traders wanting premium service. Interactive Brokers excels for multi-asset pros.

For traders focused on low spreads, our lowest spread forex broker comparison has more detail.

How I Test Professional Trading Accounts

I open live, funded accounts with every broker and trade across London, New York, and Asian sessions. Between October 2025 and January 2026, I executed over 180 trades across all six brokers. I compare real spreads to advertised rates, measure execution times, and test withdrawal speeds with actual fund transfers. For pro accounts specifically, I go through the full application process to assess how clearly each broker explains the trade-offs of giving up retail protections. I verify every broker’s regulation on the FCA Register.

What Were the Withdrawal Times I Experienced?

| Broker | Withdrawal Amount | Method | Time to Receive |

|---|---|---|---|

| Pepperstone | £1,800 | Bank transfer | 2 working days |

| IG | £1,500 | Bank transfer | 2 working days |

| Spreadex | £1,200 | Bank transfer | 2 working days |

| CMC Markets | £2,200 | Bank transfer | 3 working days |

| Saxo | £1,500 | Bank transfer | 3 working days |

| Interactive Brokers | £2,000 | Bank transfer | 1 working day |

Interactive Brokers processed my withdrawal fastest — funds arrived the next working day. Pepperstone, IG, and Spreadex were consistent at 2 days. CMC and Saxo took 3 days. None charged withdrawal fees for UK bank transfers.

FAQs

Can you lose more than your deposit as a professional trader?

Depends on your broker’s negative balance protection policy. Some brokers (including Pepperstone) maintain NBP for professionals; others remove it. Verify before upgrading.

Can you switch back to retail status?

Yes. Contact your broker to request reclassification. Retail protections are reinstated upon reclassification, though leverage reverts to retail limits.

Do professional traders pay tax on forex profits in the UK?

Spread betting profits are typically CGT-free. CFD profits may be subject to Capital Gains Tax. Consult a qualified tax professional for your specific situation.

What is the minimum deposit for professional trading accounts?

Professional status is based on qualifying criteria, not deposit amounts. Some brokers have separate minimum deposit requirements, but these are independent of professional classification.

Are professional trading accounts suitable for beginners?

No. Professional accounts remove protections designed for inexperienced traders. Gain experience with retail accounts before considering professional status.

What happens to your FSCS protection as a professional trader?

FSCS protection up to £85,000 per eligible person remains in place for eligible deposits held with FCA-authorised firms, regardless of whether you hold retail or professional status. However, professional clients lose access to the Financial Ombudsman Service for dispute resolution and may lose some best execution protections. Always verify current FSCS limits at fscs.org.uk.

How long does the professional account application take?

In my experience, Pepperstone was fastest at 36 hours. IG and CMC processed within 48 hours. Saxo took 3 working days. Most delays come from document verification — have your statements and proof of experience ready before you apply.

References

- Financial Conduct Authority (FCA) – FCA Register

- Statista – Monthly Forex Trading Volume Worldwide

- XTB Official Website – Forex Trading – How to invest in FX CFDs?

- Pepperstone UK – Pepperstone: Forex Broker & CFD Trading Platform

- IG UK – IG: Trade and Invest with the UK’s No.1 Trading Provider

- Interactive Brokers UK – International Broker – IBKR