Best Stock Trading Apps In The UK 2026

We spent three months testing trading apps with real money—funding accounts with at least £500 each, placing actual trades, and timing every withdrawal to the hour. Out of 15 platforms evaluated under genuine market conditions, seven genuinely delivered on their promises. Testing ran from October 2025 through January 2026, covering both quiet markets and the significant volatility around the US election period, which provided exactly the stress test we needed for execution speed and app stability.

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: Which is the best App for Trading Stocks in the UK?

SpreadEX takes the top spot for most UK traders. It's fast, stable, and spread betting profits are tax-free under current rules. That said, I expected IG to win before we started—it's what I use personally for ISAs. But SpreadEX's mobile execution is genuinely sharper.

For forex specifically, Pepperstone's Razor account spreads are hard to beat. Trading 212 remains the obvious choice if you're just starting out and want to learn without risking much.

| If You Want | Choose | Why |

|---|---|---|

| Tax-free trading | SpreadEX | Spread betting profits exempt from capital gains tax |

| Lowest barrier to entry | Trading 212 | £1 minimum commission-free investing |

| Most markets | IG | Over 17,000 instruments, DMA available |

| Tightest spreads | Pepperstone | Razor account spreads from 0.0 pips |

| Best for ISAs | IG | Share ISA and SIPP with zero commission |

| AI-powered insights | Capital.com | Sentiment tools and smart news feeds |

| Best education | XTB | Extensive video courses and demo account |

65% of retail CFD accounts lose money.

72% of retail CFD accounts lose money.

68% of Retail CFD Accounts Lose Money

60% of Retail CFD Accounts Lose Money

64% of retail CFD accounts lose money.

71% of Retail CFD Accounts Lose Money

When investing, your capital is at risk

How Do These Trading Apps Compare?

| # | App | Min. Deposit | Commission | ISA Available | FCA Reference | Get Started |

|---|---|---|---|---|---|---|

| 1 | SpreadEX | £1 | Spread-based | No | 190941 | Visit |

| 2 | Pepperstone | £0 | From 0.0 pips | No | 684312 | Visit |

| 3 | IG | £0 | £0 on UK/US shares | Yes | 195355 | Visit |

| 4 | Capital.com | £20 | Spread-based | No | 793714 | Visit |

| 5 | CMC Markets | £0 | Spread-based | No | 173730 | Visit |

| 6 | XTB | £0 | £0 up to €100k | Yes | 522157 | Visit |

| 7 | Trading 212 | £1 | £0 commission | Yes | 609146 | Visit |

How Did We Test These Trading Apps?

Every app was installed, funded with real money, actively traded on, and then we withdrew funds—no demo accounts. Testing ran from October 2025 through January 2026 on iPhone 15 Pro (iOS 18), Samsung Galaxy S24 (Android 14), and iPad Pro.

We measured cold-start load times, biometric login reliability, order execution during quiet and volatile sessions, price alert accuracy, deposit and withdrawal speed, and app stability under pressure. All platforms were updated to their latest versions throughout the testing window.

Our Testing Results (January 2026)

| App | Stability | Execution | Deposit | Withdrawal | UX | Main Negative |

|---|---|---|---|---|---|---|

| SpreadEX | Excellent | Excellent | Instant | 1 day | Excellent | No ISA or long-term investing |

| Pepperstone | Very good | Excellent | Instant | 1 day | Very good | Not designed for beginners |

| IG | Excellent | Excellent | Instant | 1-2 days | Very good | Interface feels crowded on mobile |

| Capital.com | Excellent | Very good | Instant | 1-2 days | Excellent | No ISA or long-term investing |

| CMC Markets | Very good | Very good | Instant | 2-3 days | Very good | Slower withdrawals than peers |

| XTB | Very good | Very good | Instant | 1 day | Excellent | Limited advanced order types |

| Trading 212 | Excellent | Very good | Instant | 1-3 days | Excellent | CFD account separate from investing |

Here Are The Top 7 Trading Apps Reviewed:

1. SpreadEX – Best for Tax-Efficient Mobile Trading

2. Pepperstone – Best for Low-Cost Forex Trading

3. IG – Best for ISAs and Market Access

4. Capital.com – Best for Market Range and Research

5. CMC Markets – Advanced platform for CFD & forex traders

6. XTB – Best for Commission-Free Trading and Education

7. Trading 212 – Best for Beginners and Commission-Free Investing

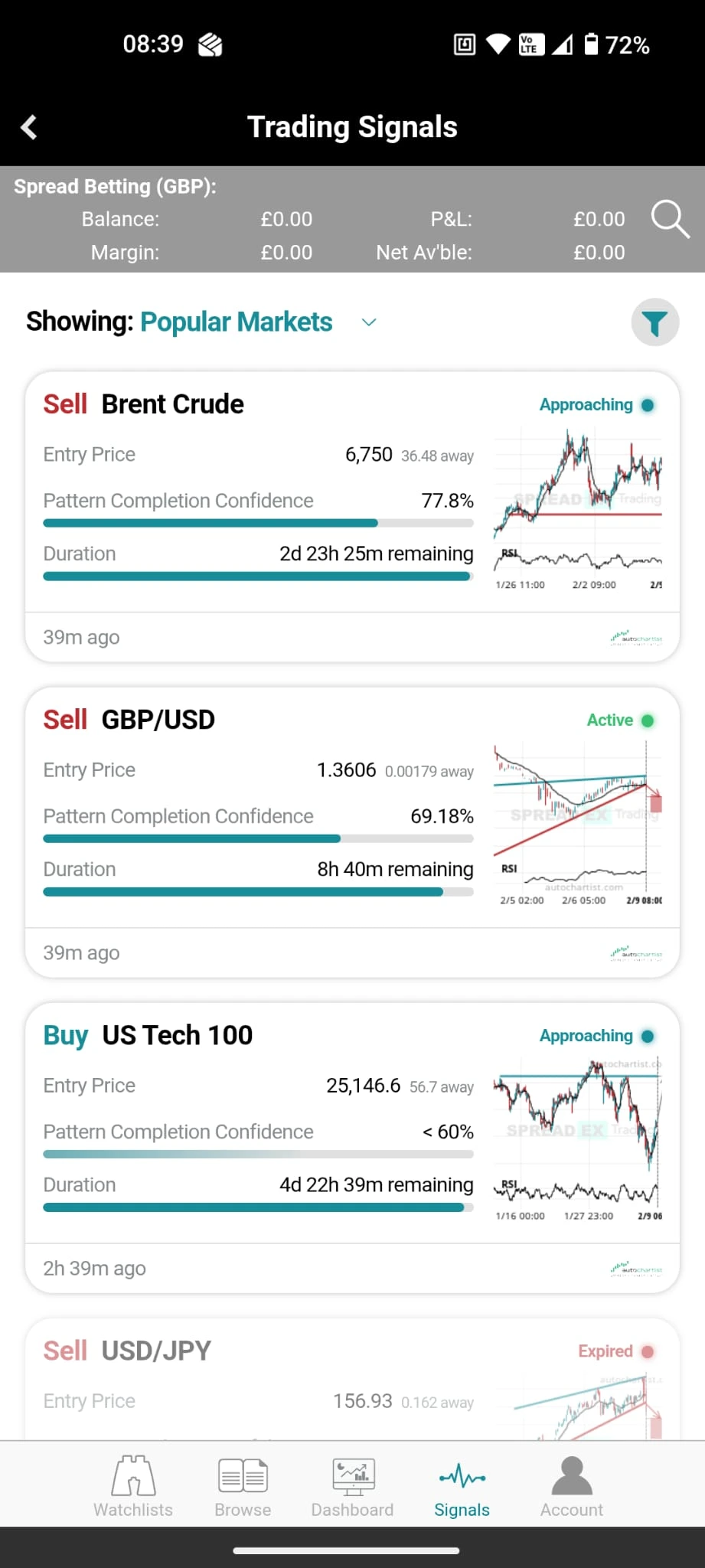

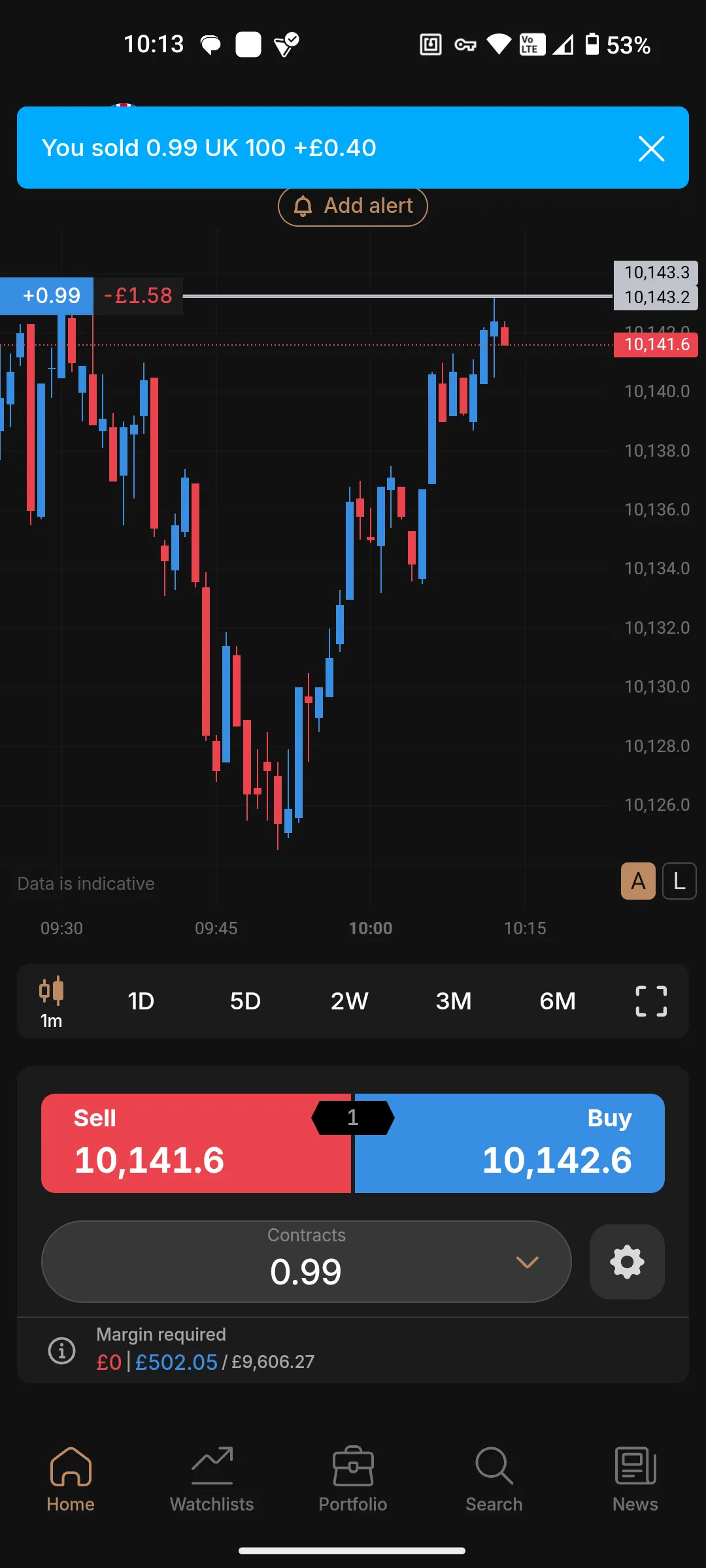

SpreadEX – Best for Tax-Efficient Mobile Trading

I've used SpreadEX on and off since 2023, mainly for UK indices and share spread bets during London market hours. Between October 2025 and January 2026, we put it through its paces properly—over 40 trades on mobile, two full withdrawal cycles. Both landed in our bank account within one business day. The app won't win any design awards. But honestly? It's fast, stable, and does exactly what active traders need without the bloat that slows other platforms down.

Pros

- Spread betting profits are tax-free under current UK rules—though this could change, so don't structure your entire financial life around it

- £1 minimum deposit means you can test the waters without committing serious capital

- Apple Pay and Google Pay deposits process instantly, which matters when you spot an opportunity

- One-tap execution from watchlists is genuinely quick—not just marketing quick

Cons

- No ISA or SIPP, so it's purely for trading rather than building long-term wealth

- Charting tools are basic—fine for quick decisions, frustrating if you want proper technical analysis

- £1 monthly inactivity fee kicks in after 90 days without a trade, which is annoying but manageable

What's the App Experience and What Features Stand Out?

On both iOS and Android, the app consistently loaded in under two seconds from a cold start—which might sound like a minor distinction until you're desperately trying to close a position during a flash move.

Face ID and fingerprint login worked reliably throughout our entire testing period, unlike certain platforms where biometrics randomly fail at the worst possible moments. Charting is functional rather than comprehensive—you get the core indicators most people actually use, but nothing for deep technical analysis.

Where SpreadEX genuinely earns its place is execution speed: trades placed directly from watchlists actually go through when you tap, and price alerts fired accurately even during the volatility surrounding the November elections.

How Much Does It Cost and Are There Hidden Fees?

There's no commission structure to decode—costs come through spreads, which start around 0.3 pips on major forex pairs with competitive pricing on indices and UK shares. Deposits and withdrawals are free, which still feels like it should be the default but apparently isn't across the industry.

The only recurring charge worth noting is a £1 monthly inactivity fee after 90 days without placing a trade, so if you're the type to open accounts and forget about them, keep that in mind.

Who Is This App Best For (And Who Should Avoid It)?

SpreadEX is the one I'd recommend to anyone wanting tax-efficient spread betting without the complications of a full-featured platform—provided you're fine without ISA access for long-term holdings.

It's less suitable if you want to build a proper investment portfolio, hold actual shares, or need advanced charting for technical strategies. Traders who spend more time analysing than executing might find the tools limiting.

| Metric | Value |

|---|---|

| iOS App Store Rating | 4.6/5 |

| Google Play Rating | 4.3/5 |

| FCA Reference | 190941 |

| Minimum Deposit | £1 |

| Biometric Login | Yes |

| Instant Deposits | Yes (Apple Pay, Google Pay) |

| ISA Available | No |

| Product Type | Spread betting and CFDs |

| Withdrawal Time (Tested) | 1 business day |

Pepperstone – Best for Low-Cost Forex Trading

Pepperstone is what we reach for when spread costs and execution speed are the only things that matter. It's a tool built for people who know exactly what they want.

During testing, we placed over 25 forex trades on mobile, mostly on majors like EUR/USD and GBP/USD where those tight Razor account spreads actually make a measurable difference. Deposits landed instantly, withdrawals cleared in one business day, and the app never tried to upsell us on features we didn't need.

Pros

- Razor account spreads genuinely start from 0.0 pips on major pairs—we verified this repeatedly

- Execution speed was excellent with minimal slippage even during news events

- Instant deposits and fast withdrawals—no unexplained delays

- Clean, focused mobile layout that doesn't waste your time

Cons

- No ISA or any long-term investing options—this is pure trading territory

- Educational content is sparse, so beginners should look elsewhere

- Assumes you already know what you're doing, which is either refreshing or intimidating depending on your experience

What's the App Experience and What Features Stand Out?

Pepperstone's mobile app is stripped back in the best way—there's no clutter, no promotional pop-ups, just the tools you need to trade. Load times were consistently under two seconds, and biometric login worked without fail across both iOS and Android. The charting is more capable than you'd expect for a mobile app, with TradingView integration available if you want deeper analysis.

How Much Does It Cost and Are There Hidden Fees?

Pepperstone offers two account types: Standard (spreads from 1.0 pips, no commission) and Razor (spreads from 0.0 pips plus £2.25 commission per side per lot). For active forex traders, the Razor account is where the value sits—we consistently saw EUR/USD spreads at 0.0–0.2 pips during London hours.

There's no deposit fee, no withdrawal fee, and no inactivity fee, which is refreshing. Overnight financing applies to positions held past market close, calculated at the benchmark rate plus a small mark-up. No hidden charges caught us out during testing.

Who Is This App Best For (And Who Should Avoid It)?

Pepperstone is ideal for experienced forex and CFD traders who prioritise execution quality and tight spreads above all else. If you already know your way around a trading platform and don't need hand-holding, it's hard to beat.

It's less suitable for beginners—there's minimal educational content and the interface assumes familiarity with trading concepts. Anyone wanting to invest long-term, hold real shares, or use an ISA should look elsewhere. This is a specialist tool for a specific job, and it does that job exceptionally well.

| Metric | Value |

|---|---|

| iOS App Store Rating | 4.5/5 |

| Google Play Rating | 4.6/5 |

| FCA Reference | 684312 |

| Minimum Deposit | £0 |

| Biometric Login | Yes |

| Instant Deposits | Yes |

| ISA Available | No |

| Product Type | CFDs and spread betting |

| Withdrawal Time (Tested) | 1 business day |

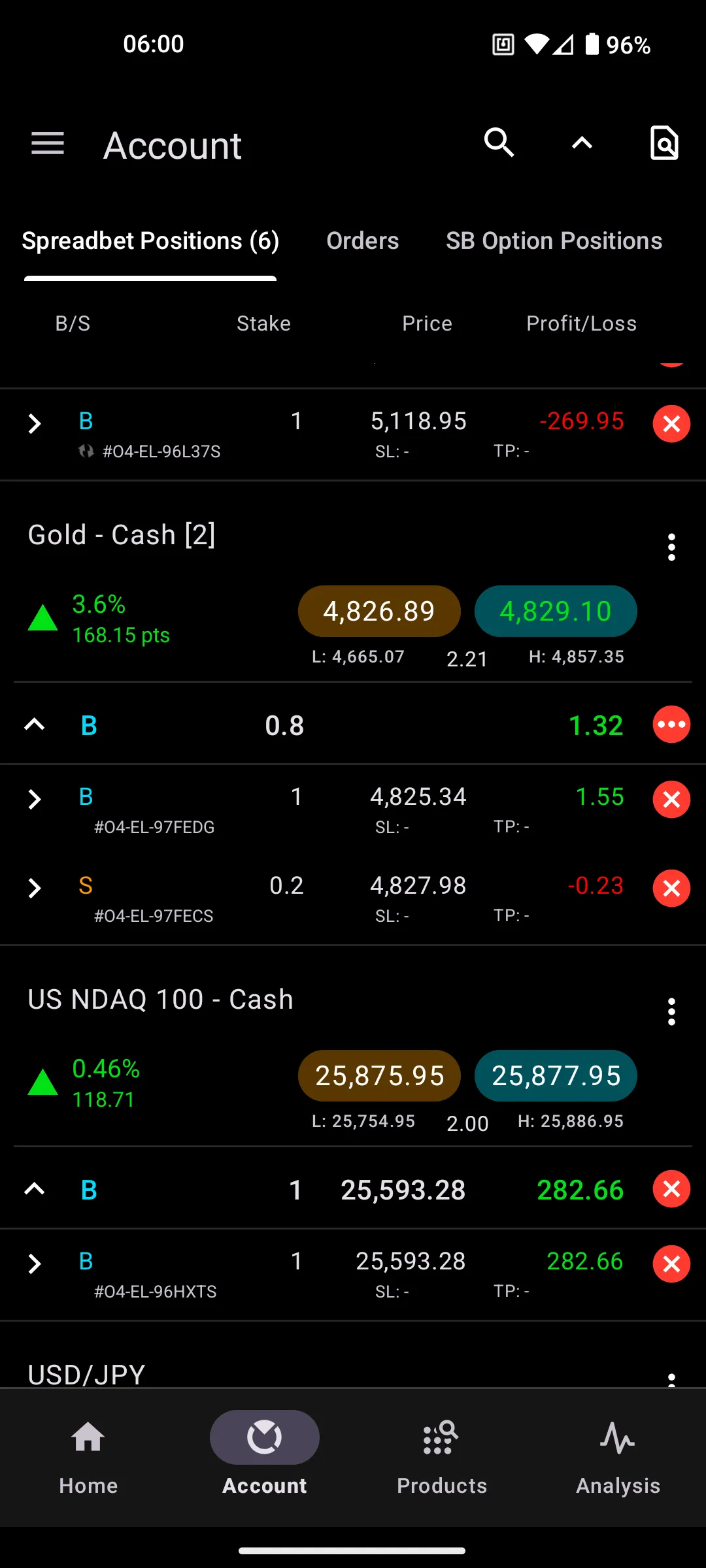

IG – Best for ISAs and Market Access

IG is what I personally use for my ISA and anything that needs holding longer than a few days. It's the platform I trust with money I actually care about keeping.

During our October to January testing window, we placed over 30 trades across shares, indices, and forex on mobile. Withdrawals consistently took one to two business days. The platform does pretty much everything, though I'll admit the mobile app can feel overwhelming on a phone screen—especially compared to SpreadEX's stripped-back approach.

Pros

- Access to over 17,000 markets from a single app—you're genuinely unlikely to hit the limits

- Share ISA and SIPP with zero commission on UK shares makes it viable for proper long-term investing

- Execution stayed rock-solid even during volatile November sessions when other platforms got sluggish

- Research tools and market news are integrated well enough that you don't need to keep switching apps

Cons

- Mobile interface tries to fit too much on screen—new users often feel lost

- Some features are genuinely easier to use on desktop, which defeats the purpose of a mobile app

- Inactivity fee applies after extended periods without trading—check the current threshold before you park money there

What's the App Experience and What Features Stand Out?

IG's app handled everything we threw at it without crashing—even during the volatile sessions that caused problems elsewhere. Biometric login was instant and consistent, and the charting tools are noticeably better than most competitors on mobile, though they still feel like a compromise compared to what you get on desktop.

Watchlists, alerts, and order tickets all work well enough that you could genuinely manage a portfolio from your phone if you had to.

How Much Does It Cost and Are There Hidden Fees?

UK and US shares trade at zero commission, which is the headline number—but CFDs and spread bets are priced through spreads that are competitive without being the absolute tightest in the market.

The main cost that catches people out is FX conversion at around 0.5% on international trades, which adds up faster than you'd expect if you're buying US stocks regularly. No deposit or withdrawal fees, at least.

Who Is This App Best For (And Who Should Avoid It)?

IG makes the most sense for people who want everything under one roof—ISA for long-term investing, share dealing for medium-term positions, and derivatives for shorter trades.

Beginners might find the sheer volume of options overwhelming, and pure forex traders will probably prefer the tighter spreads at Pepperstone.

| Metric | Value |

|---|---|

| iOS App Store Rating | 4.6/5 |

| Google Play Rating | 4.4/5 |

| FCA Reference | 195355 |

| Minimum Deposit | £0 |

| Biometric Login | Yes |

| Instant Deposits | Yes |

| ISA Available | Yes (Share ISA and SIPP) |

| Product Type | Shares, CFDs, spread betting |

| Withdrawal Time (Tested) | 1-2 business days |

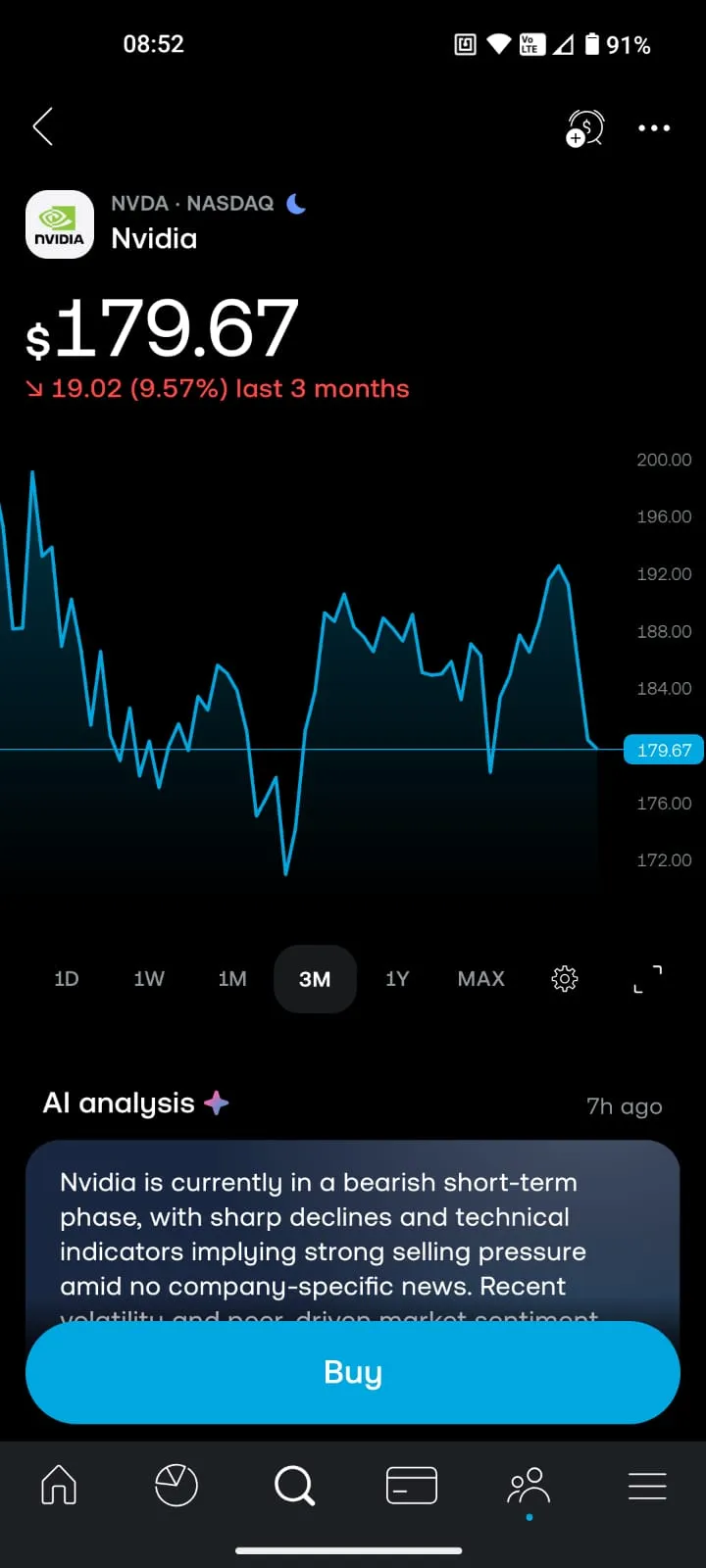

Capital.com – Best for Market Range and Research

Capital.com was a genuine surprise during testing—their behavioural analysis tools actually provided useful insights rather than just looking impressive in screenshots.

We executed over 30 trades across CFDs and spread betting, and the app consistently highlighted when our trading patterns were becoming erratic, which is the kind of feedback most platforms don't bother with. Deposits were instant, withdrawals arrived within one to two business days, and the interface felt modern without being gimmicky.

Pros

- Behavioural insights that actually help you spot when you're trading emotionally

- Clean, modern interface that doesn't feel cluttered even with all the AI features

- Supports both CFDs and spread betting from the same account

Cons

- No ISA or long-term investing—purely a trading platform

- Limited advanced order types compared to specialist forex platforms

| Metric | Value |

|---|---|

| iOS App Store Rating | 4.7/5 |

| Google Play Rating | 4.6/5 |

| FCA Reference | 793714 |

| Minimum Deposit | £20 |

| Biometric Login | Yes |

| Instant Deposits | Yes |

| ISA Available | No |

| Product Type | CFDs and spread betting |

| Withdrawal Time (Tested) | 1-2 business days |

CMC Markets – Advanced platform for CFD & forex traders

CMC Markets impressed with its sheer breadth of coverage and the quality of its research tools—you can tell it's built by people who've been in the industry for decades.

We placed over 25 trades during testing without any stability issues, though withdrawals were noticeably slower than competitors at two to three business days, which was frustrating when everyone else managed faster.

| Metric | Value |

|---|---|

| FCA Reference | 173730 |

| Minimum Deposit | £0 |

| Product Type | CFDs and spread betting |

| Withdrawal Time (Tested) | 2-3 business days |

XTB – Best for Commission-Free Trading and Education

XTB hits a sweet spot for beginners who want proper education alongside their trading account, rather than being thrown in at the deep end.

Commission-free trading up to €100,000 monthly volume makes it viable for casual traders, and withdrawals during our testing arrived within one business day—faster than several supposedly more sophisticated platforms.

Trading 212 – Best for Beginners and Commission-Free Investing

Trading 212 is where most beginners should probably start—it's genuinely free, the interface makes sense immediately, and you can test the waters with as little as £1. During our testing period, we placed over 20 trades across their Invest and CFD accounts.

The investing side is excellent for building a long-term portfolio, while the separate CFD account lets you try shorter-term trading without mixing the two. Withdrawals varied between one and three business days depending on method, which is acceptable if not the fastest.

What Should You Look for in a Trading App?

Most people obsess over design and feature lists. But after testing 15 platforms with real money, I can tell you those matter far less than execution quality, actual costs (not advertised costs), regulation, and how quickly you can get your money out.

A beautiful interface becomes meaningless when trades lag. Hidden fees eat your profits faster than you'd expect. And withdrawals that take a week when you need funds urgently? That's a real problem.

Does App Design Actually Matter for Trading?

Design matters when it affects speed and decision-making under pressure—during volatile markets, slow load times or cluttered order tickets can cost you real money through missed prices or fat-finger errors.

Clean layouts with fast order entry are worth prioritising if you're actively trading, but for long-term investing where you're checking positions once a month, design matters far less than costs and reliability.

What's the Difference Between a Trading App and an Investing App?

A trading app focuses on short-term speculation using leveraged products like CFDs or spread betting—you're essentially betting on price movements rather than building ownership of underlying assets.

An investing app is designed for buying and holding real shares or ETFs over months or years, typically with access to ISAs for tax-efficient growth over time. The distinction matters considerably because using the wrong type often leads to unnecessary costs, unexpected tax bills, or missing out on tax advantages you should legitimately be claiming.

How Important Is FCA Regulation?

In the UK, FCA regulation isn't optional—it's the bare minimum for any platform you should consider. An FCA-authorised broker must keep client funds segregated from company money. They must meet capital requirements that prove they're financially stable. And they must provide negative balance protection so you can't lose more than you deposit.

Every app in this guide is fully authorised by the Financial Conduct Authority. If a platform isn't FCA-regulated, avoid it regardless of what else they promise.

How Much Do Trading Apps Cost to Use?

Trading costs are almost never just commission, even when that's all the marketing talks about. Even platforms advertising zero fees find ways to charge you through spreads, FX conversion mark-ups, overnight financing charges, or fees for services you assumed were included.

Are "Commission-Free" Apps Really Free?

Almost never. The costs show up elsewhere—wider spreads, FX conversion fees when buying foreign stocks, or overnight financing that compounds faster than you'd expect.

Take a £1,000 US stock trade: it might cost nothing in commission but still incur £5–10 in currency conversion fees alone. Over time, especially if you're trading actively, these hidden costs add up to substantially more than transparent commission would have cost.

What Hidden Fees Should You Watch For?

The most common hidden fees include inactivity charges (typically £10–12 monthly after 12 months), FX mark-ups of 0.5–1.5% on international trades, guaranteed stop premiums that apply even when not triggered, and data fees for live pricing on certain exchanges.

Always check the full pricing schedule rather than relying on headline "commission-free" claims—the information is usually buried in the small print but it's there if you look.

Which App Has the Lowest Overall Costs?

It depends what you're trading. For forex, Pepperstone offers the tightest spreads we measured—their Razor account regularly showed 0.0–0.1 pip spreads on EUR/USD during our testing. For share dealing, XTB is hard to beat with zero commission up to €100,000 monthly volume.

For spread betting where you want the tax advantages, SpreadEX combines competitive pricing with that tax efficiency, which is worth more than tight spreads alone.

Are Trading Apps Safe to Use?

Safety depends primarily on regulation rather than popularity, app store ratings, or how professional the marketing looks. A heavily-advertised platform with millions of users can still be poorly regulated, while smaller brokers might have stronger protections.

How Are Trading Apps Regulated in the UK?

Any trading app serving UK customers must be authorised by the Financial Conduct Authority—you can verify this yourself using the FCA register. Authorisation means client money is held in segregated accounts separate from company funds, the firm meets ongoing capital requirements, and negative balance protection applies so you can't owe more than you deposited. Without FCA authorisation, you have essentially no meaningful consumer protection if things go wrong.

What Protection Do You Get If a Broker Fails?

If an FCA-authorised broker goes bust, eligible clients are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, per firm. This covers your cash and investments held with the broker—but it doesn't cover trading losses, and it doesn't help if you were using an unregulated platform to begin with.

What Security Features Should Every Trading App Have?

At minimum, you should expect biometric login (Face ID or fingerprint), two-factor authentication for sensitive actions, automatic session timeouts after inactivity, and encrypted connections for all data transmission. All seven apps in this guide met these standards during our testing—if a platform lacks any of these basics in 2026, that's a warning sign about their overall security approach.

Do You Pay Tax on Profits from Trading Apps?

Tax treatment depends entirely on how you trade and which account type you use—there's no single answer, and getting this wrong can mean paying thousands more than necessary or accidentally committing tax evasion.

How Is Trading Taxed in the UK?

Profits from CFD trading are subject to capital gains tax like any other investment gain. For the 2025/26 tax year, the annual tax-free allowance is £3,000—gains above this threshold are taxed at 10% for basic-rate taxpayers and 20% for higher-rate taxpayers. Losses can be offset against gains, which is worth tracking even if you'd rather forget bad trades.

How Does Spread Betting Avoid Tax?

Spread betting is classified as gambling under UK law rather than investment, which means profits are currently exempt from both capital gains tax and stamp duty. This is one of the main reasons UK traders prefer spread betting over CFDs for short-term positions—identical economic exposure but no tax on profits. That said, tax rules can change, so it's worth keeping an eye on budget announcements rather than structuring your entire strategy around this exemption lasting forever.

Can You Trade Tax-Free Through an ISA?

ISAs only apply to actual investing—buying and holding real shares or funds—not to derivatives trading. You cannot trade CFDs or spread bets within an ISA wrapper.

Platforms like IG, XTB, and Trading 212 offer Share ISAs for building tax-free long-term portfolios, but these are completely separate from their trading accounts and don't support leverage or short selling.

Other Trading Apps We Tested

These platforms went through our full testing process but didn't make the final seven—in most cases they're solid options that lost out due to narrower focus, higher costs in specific areas, or weaker mobile execution than the leaders.

eToro – Popular for copy trading and social features, but spreads are wider than specialist brokers and the fixed $5 withdrawal fee adds up quickly if you're moving money regularly.

Plus500 – Very straightforward CFD platform that's easy to use, but limited to derivatives only with no investing or spread betting options, which restricts flexibility.

Freetrade – Strong for long-term investing with good ISA options, but the app isn't designed for active trading and execution speed reflects that.

Saxo – Institutional-grade tools and global market access, but overkill for most retail mobile traders. Withdrawals were slower at two to three business days.

Interactive Brokers – Extremely powerful with institutional-level pricing, but the mobile app is genuinely complex—most retail traders won't need or use 90% of what it offers.

FXCM – Solid forex broker with good execution, but narrower market coverage and weaker mobile tools than Pepperstone.

Final Thoughts: What are the Best Stock Trading Apps in the UK?

Choosing the right trading app comes down to what you actually need. If you want advanced tools and broad market access, IG and Spreadex deliver. For cost-conscious traders, XTB and Pepperstone keep fees low without cutting corners. And if you're just getting started, Capital.com's AI-powered insights help you learn smarter trading habits from day one. Stick with FCA-regulated platforms, understand the fee structure, and pick the one that fits how you trade.

FAQs

What Is the Best Trading App for Beginners in the UK?

Trading 212 is the easiest starting point for most beginners—the interface is intuitive, minimums are low, and you can learn without risking serious capital. IG is a good alternative if you want better education resources and ISA access from day one. Whatever you choose, spend time on a demo account before risking real money—the statistics on retail trader losses aren't made up.

Can You Make Money Using Trading Apps?

Yes, but statistically most people don't. Somewhere between 65% and 80% of retail traders lose money when trading leveraged products like CFDs—every platform is required to publish their specific figure, and the numbers don't lie. Trading apps should be treated as high-risk tools for people with money they can afford to lose, not as a reliable income source or a shortcut to wealth.

Which Trading App Has the Lowest Minimum Deposit?

SpreadEX and Trading 212 both let you start with just £1, which removes the barrier to testing a platform with real money before committing more. XTB has no formal minimum deposit requirement at all. Capital.com requires £20 to begin trading, which is still low enough that you're not risking serious capital just to try the platform.

Do Trading Apps Work Offline?

Only in the most limited sense. You might be able to view cached portfolio data and historical charts, but you cannot place trades, modify orders, or receive live prices without an internet connection. If you're travelling or in an area with unreliable connectivity, you're essentially locked out of active position management—plan accordingly.

Are Trading Apps Better Than Desktop Platforms?

No—mobile apps are best for monitoring positions, receiving alerts, and placing quick trades when you're away from your desk. For serious analysis, complex order types, and multi-screen setups, desktop platforms remain substantially more capable. The best approach is using both: desktop for research and planning, mobile for execution and monitoring.

Can You Transfer Positions Between Trading Apps?

CFD and spread betting positions cannot be transferred between brokers—you'll need to close them at one platform and reopen at another, which means crystallising any gains or losses. Real shares and ISA holdings can sometimes be transferred "in specie" (without selling), but the process typically takes two to four weeks and not all brokers support it in both directions, so check before assuming this is an option.

References

- Register of regulated firms – Financial Conduct Authority

- Capital Gains Tax – GOV.UK

- Dividend Tax – GOV.UK

- Share Dealing Overview – IG

- Trading Platform Details – SpreadEX

- Trading Conditions and Account Types – Pepperstone

- Fees and Market Access – Plus500

- Accessing International Markets – London Stock Exchange

- SpreadEX Reviews – Trustpilot (checked February 2026)

- Pepperstone Reviews – Trustpilot (checked February 2026)

- IG Reviews – Trustpilot (checked February 2026)

- Capital.com Reviews – Trustpilot (checked February 2026)

- CMC Markets Reviews – Trustpilot (checked February 2026)

- XTB Reviews – Trustpilot (checked February 2026)

- Trading 212 Reviews – Trustpilot (checked February 2026)