- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

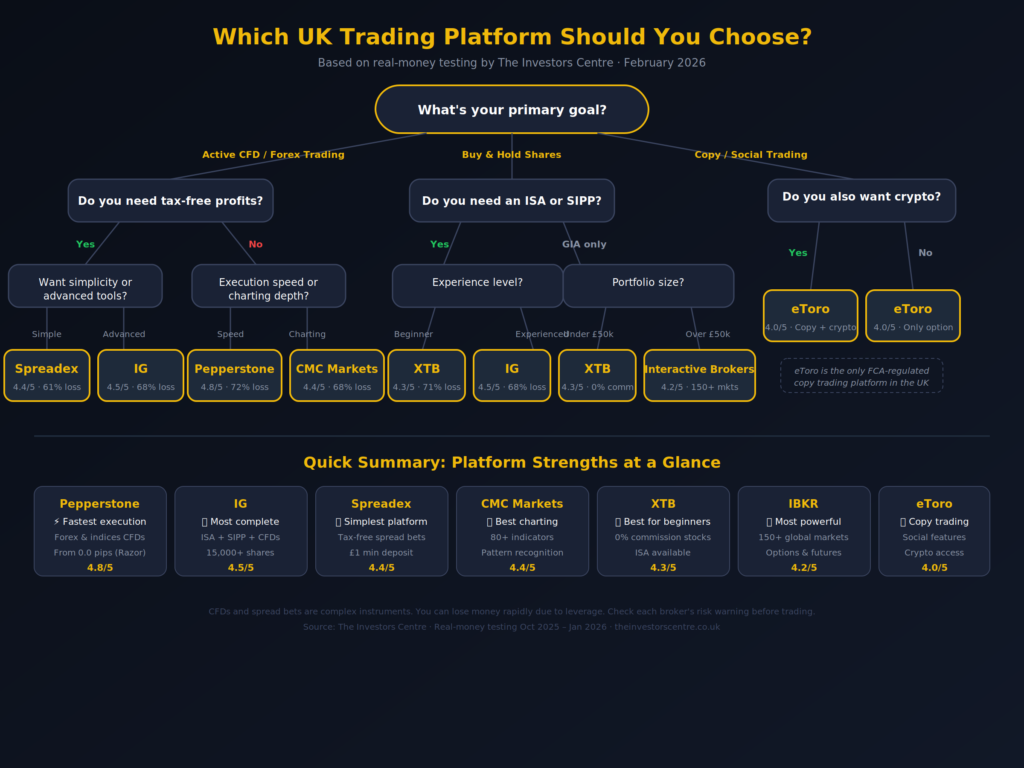

I’ve spent the best part of two years with money sitting in every platform on this list, and the experience is very different from what the marketing pages promise. Pepperstone’s execution is fast — I’ve clocked fills under 40ms during volatile sessions. But IG’s share-dealing ISA, which barely gets mentioned in most “best trading platform” guides, has quietly become where I park most of my long-term money. So: best for what?

Quick Answer: Which is the Best Trading Platform?

If you’re trading CFDs and forex actively, Pepperstone is the platform I’d pick. If you want to buy and actually own shares inside a tax-efficient wrapper, IG is the most complete option on this list. And if you’re opening your first account and want commission-free simplicity, XTB is where I’d point you.

This guide covers platforms where you can trade CFDs and spread bet alongside platforms where you can buy real shares, hold them in an ISA, and build a portfolio over decades — because for most people searching this term, the line between “trading” and “investing” is blurry, and I’m not going to pretend it isn’t. Every opinion here comes from funded accounts, not press releases.

Pepperstone

Stocks Trading Score: 4.8/5

72% of retail CFD accounts lose money.

IG

Stocks Trading Score: 4.5/5

68% of Retail CFD Accounts Lose Money

Spreadex

Stocks Trading Score: 4.4/5

65% of retail CFD accounts lose money.

CMC Markets

Stocks Trading Score: 4.4/5

64% of retail CFD accounts lose money.

How I Tested These Platforms

Every platform on this list has been funded with real money — mine, Adam’s, or both. In Q4 2025, we went back and opened share-dealing accounts on every platform here that offers them. IG, CMC Invest, Interactive Brokers, eToro, XTB — all funded, all tested alongside the CFD and spread betting accounts we’ve been running since 2024.

Spreads were captured at 10am on weekday mornings between October 2025 and January 2026, when London liquidity is deepest. Withdrawals were tested with real bank-to-bank transfers, timed from request to cleared funds. I called each broker’s UK support line, timed the wait, and asked a specific technical question about transferring an ISA. Adam assessed mobile app usability over two-week daily-use periods on both iOS and Android.

What I didn’t test: Any platforms that are not FCA regulated. We won’t recommend them.

Scoring weights: Fees (25%) · Platform & tools (20%) · Asset range (15%) · Mobile (15%) · Research & education (10%) · Support (10%) · Regulation (pass/fail gate). Full methodology in our How We Test guide.

Which Platform Ranks Best? My Verdict at a Glance

I use three of these platforms simultaneously and I don’t think that’s unusual — no single platform does everything well. The table below is the starting point. The “Can You Own Shares?” column matters more than anything else on this page if you want to build a long-term portfolio rather than trade short-term.

| Platform | Best For | Own Real Shares? | ISA / SIPP? | Min Deposit | Our Rating |

|---|---|---|---|---|---|

| Pepperstone | Speed & CFD trading | No — CFDs only | Neither | £0 | 4.8/5 |

| IG | Share dealing + trading | Yes — 15,000+ shares | ISA + SIPP | £0 | 4.5/5 |

| Spreadex | Simple UK spread betting | No — spread bets & CFDs only | Neither | £1 | 4.4/5 |

| CMC Markets | Technical analysis | Yes — via CMC Invest | ISA | £0 | 4.4/5 |

| XTB | Beginners | Yes — real stocks & ETFs | ISA | £0 | 4.3/5 |

| Interactive Brokers | Professional / global | Yes — 150+ markets | ISA + SIPP | £0 | 4.2/5 |

| eToro | Copy & social trading | Yes — real stocks | ISA (eToro Money) | $50 | 4.0/5 |

Data as of January 2026

Which Are the 7 Best Trading Platforms in the UK?

Each platform below has been tested with a funded account.

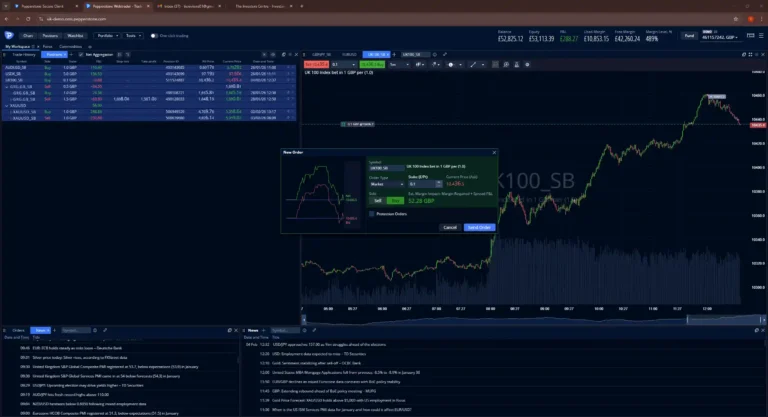

1. Pepperstone — Fastest Platform for Execution

On 14 November 2025, during the US CPI release, I placed a market order on EUR/USD through the Razor account. Filled in 32 milliseconds. The spread widened to about 1.2 pips for a few seconds and was back under 0.2 within fifteen. That kind of execution isn’t theoretical — I watched it happen in real time, and it’s why Pepperstone has been my primary CFD broker since 2024. If you’re trading forex or indices and you care about where your order gets filled, this is the platform I’d pick without hesitation. It also tops our best day trading platforms list for the same reasons.

| Detail | Value |

|---|---|

| Spreads | From 0.0 pips (Razor) / ~1.0 pip (Standard) |

| Commission | Razor: £2.25/side/lot · Standard: £0 |

| Platforms | MT4, MT5, cTrader, TradingView |

| Assets | 1,200+ CFDs — forex, indices, commodities, shares, crypto |

| Own real shares? | No — CFD only |

| ISA / SIPP | Not available |

| FCA FRN | 684312 |

- Ultra-fast trade execution

- Competitive spreads on Razor account

- Strong platform integrations (MT4, MT5, TradingView)

- No minimum deposit

- CFD-only trading (no real shares)

- Not ideal for long-term investors

- No ISA or SIPP accounts

What Does It Cost to Trade on Pepperstone?

I use the Razor account because at the volumes I trade, the £2.25 per side commission with near-zero spreads works out considerably cheaper than the Standard’s commission-free structure with its ~1 pip markup. The crossover point is roughly £50,000 in notional position size — below that, Standard is simpler and slightly cheaper. Above it, Razor saves you money on every single trade. For a full breakdown, I’ve written a dedicated Razor vs Standard comparison.

No platform fee. No inactivity fee. No deposit or withdrawal charges. That fee structure is clean — one of the simplest in the industry.

Where Does Pepperstone Fall Short?

You can’t buy shares. You can’t open an ISA. There’s no investment portfolio feature, no fractional shares, no dividend income. If you’re building long-term wealth, Pepperstone isn’t the tool for that — it’s a trading engine, not an investment platform. I pair it with IG for the investing side. If your search brought you here because you want to buy and hold shares, skip to the IG or XTB sections below.

How Did Pepperstone Handle My Withdrawal?

I withdrew £1,500 to my Barclays account on 6 December 2025. The money arrived in two working days. Pepperstone sent a confirmation email within 15 minutes. No fees deducted. The process was straightforward — but I’d note that first withdrawals take longer because of additional verification checks required under FCA anti-money-laundering rules.

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

If you’ve searched “best stock trading platform” because you actually want to buy shares and own them — not speculate on price movements through CFDs — IG is probably what you’re looking for. It’s one of the only platforms on this list where I can buy FTSE 100 stocks inside an ISA, trade forex CFDs with ProRealTime charts, and manage a SIPP all under one login. That breadth creates trade-offs — the interface tries to serve five different types of investor and doesn’t always get the balance right. But the pricing is competitive, the ISA is fee-free, and the share-dealing commission of £0 with three or more trades a month is hard to argue with.

| Detail | Value |

|---|---|

| Share dealing | £0 commission (3+ trades/mo), otherwise £8 UK / $10 US |

| Platform fee | £0 |

| Platforms | IG proprietary, ProRealTime, MT4, L2 Dealer |

| Assets | 15,000+ shares, ETFs, funds, investment trusts + 17,000 CFD markets |

| Own real shares? | Yes |

| ISA / SIPP | Both available |

| FCA FRN | 195355 |

- Extensive market access across global equities, indices, and forex

- Strong research tools and analysis

- Trusted and long-established UK brand

- FCA regulated with robust investor protections

- Higher fees for infrequent traders

- Steeper learning curve for new investors

Can I Build a Long-Term Portfolio on IG?

Yes. I hold 14 UK and US equities in my IG ISA, including a couple of S&P 500 trackers (we’ve written a full guide on how to invest in the S&P 500 from the UK if that’s your focus). Dividends are paid tax-free, there’s no platform fee eating into returns, and the share-dealing fee drops to zero if I make three trades in a month. For a buy-and-hold ISA investor making a handful of trades per quarter, the annual cost on a £20,000 portfolio is essentially zero. That puts IG ahead of Hargreaves Lansdown, AJ Bell, and most of the platforms that dominate the best investment platforms rankings — on cost alone.

How Complex Is IG for Someone Who’s Never Traded?

It’s not simple. When Adam first opened his IG account, it took him three days to find where the ISA settings were buried in the app. The onboarding funnels you toward CFDs by default — you have to specifically navigate to “share dealing” to buy real equities. If you’re primarily using your phone to invest, it’s worth comparing IG against the options on our best investment apps list. IG Academy has decent educational content, but the platform itself assumes you already know what you’re doing.

What Was My Experience With IG’s Customer Support?

I called IG’s UK line at 2:14pm on 17 January 2026. Connected in 3 minutes 40 seconds. I asked about transferring a SIPP from another provider. The agent was knowledgeable, didn’t rush the call, and followed up by email within the hour. That’s the best support experience I’ve had from any platform on this list.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

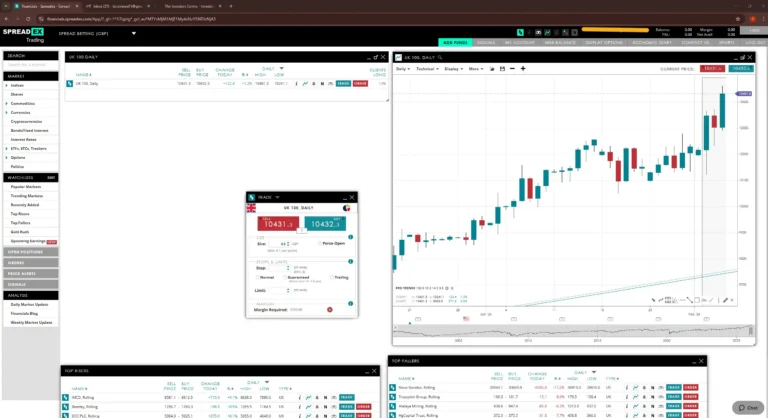

3. Spreadex — The Simplest Platform on This List

Spreadex won’t impress anyone looking for institutional-grade tools. It isn’t trying to. What it does is offer spread betting and CFDs with zero commission, no inactivity fees, and a minimum deposit of £1 — in an interface that’s cleaner and less cluttered than anything else I’ve tested. I recommended it to a family member who’d never traded before, and she was placing a bet on the FTSE within twenty minutes of downloading the app. That’s not something I could say about IG or CMC.

| Detail | Value |

|---|---|

| Spreads | All costs included in the spread |

| Commission | £0 |

| Platforms | Spreadex proprietary (web + app) |

| Assets | Spread betting & CFDs on indices, forex, shares, commodities |

| Own real shares? | No — spread bets & CFDs only |

| ISA / SIPP | Not available |

| FCA FRN | 190941 |

- Simple, user-friendly interface

- Low minimum deposit (£1)

- No inactivity or platform fees

- Good UK-based customer service

- Limited access to global markets

- Basic toolset may not suit advanced traders

Is Spread Betting Actually Tax-Free?

Under current HMRC rules, spread betting profits are exempt from both Capital Gains Tax and Stamp Duty. That’s a real advantage for active traders — but it only applies if HMRC considers you a speculator, not someone deriving their primary income from trading. If you’re trading full-time and spread betting represents your main earnings, take professional tax advice on this. The exemption isn’t as unconditional as most broker websites imply. We cover the full picture in our best spread betting platforms guide.

What Can’t I Do on Spreadex?

You can’t buy shares. You can’t open an ISA. Global market access is limited — if you want to trade Japanese equities or emerging market forex pairs, this isn’t the platform. The charting tools are basic. There’s no TradingView integration, no algorithmic trading, no API access. If any of those matter to you, look at Pepperstone or CMC instead. Spreadex is a focused tool for a specific job, and it does that job well.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

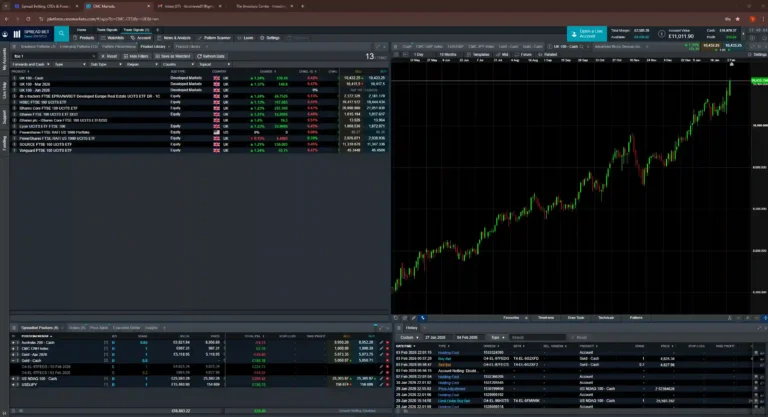

4. CMC Markets — Best Charting I've Used on a Retail Platform

I need to be specific about what I mean when I say CMC has the best charting. Their Next Generation platform has over 80 technical indicators and 12 chart types — that’s comparable to TradingView in depth, and the pattern recognition scanner has flagged setups I’d have missed manually. It also flags plenty of noise, so I treat it as a starting point rather than a signal.

What makes it stand out from Pepperstone’s TradingView integration is the customisability — I can save multiple layouts per instrument and switch between them in a click. For anyone whose trading strategy is built around technical analysis — particularly across CFDs and commodities — CMC’s platform is the one I’d point to first.

| Detail | Value |

|---|---|

| CFD spreads | From 0.7 pips (EUR/USD) |

| Commission | £0 on CFDs · share dealing via CMC Invest |

| Platforms | Next Generation (proprietary), MT4, TradingView |

| Assets | 12000+ CFD instruments + shares via CMC Invest |

| Own real shares? | Yes — through CMC Invest (separate product) |

| ISA / SIPP | ISA via CMC Invest · No SIPP |

| FCA FRN | 173730 |

- Advanced charting and analysis tools

- Highly customisable trading platform

- No minimum deposit requirement

- Strong reputation with FCA regulation

- Interface can be overwhelming for beginners

- Limited support for long-term investing accounts like ISAs/SIPPs

What’s the Difference Between CMC Markets and CMC Invest?

This catches people out. CMC Markets is the trading platform — CFDs and spread bets. CMC Invest is the share-dealing and ISA platform. They’re technically separate products under the same brand, with different fee structures and different account logins. If you want to buy actual shares in an ISA, you need CMC Invest specifically. The CFD account won’t let you do that. I’ve spoken to three people who opened a CMC Markets account thinking they could buy shares in an ISA, only to discover they’d signed up for the wrong product. CMC doesn’t make this distinction clear enough on their homepage.

Why Wouldn’t I Just Use TradingView Instead?

Fair question. TradingView is superb — and you can use it with Pepperstone. The difference is that CMC’s charting is natively integrated with their execution engine. There’s no latency between what the chart shows and what the broker fills. On TradingView via a third-party broker, I’ve occasionally noticed a slight delay between the charted price and the execution price. On CMC’s native platform, I haven’t. If charting and execution sitting in the same environment matters to your strategy, CMC has the edge.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

5. XTB — Where I'd Tell a Beginner to Start

If someone asked me where to open their first trading account tomorrow morning, I’d say XTB — it’s the top pick on our best platforms for beginners list for the same reasons. Not because it’s the most powerful platform on this list — it isn’t — but because it’s the one least likely to cost a beginner money through confusion. The xStation 5 interface is clean.

The education library is useful — not marketing dressed up as tutorials. And the 0% commission on real stocks and ETFs up to €100,000 per month removes the single biggest psychological barrier for someone investing their first £500. I’ve watched Adam’s partner open an account and buy her first ETF in under ten minutes.

| Detail | Value |

|---|---|

| Stock/ETF commission | 0% up to €100k/month · 0.2% above |

| CFD spreads | From 0.1 pips (EUR/USD) |

| Platforms | xStation 5 (web + mobile) |

| Assets | 8,500+ real stocks & ETFs + 2,500+ CFDs (11,100+ total instruments) |

| Own real shares? | Yes |

| ISA / SIPP | Stocks & Shares ISA available · No SIPP |

| FCA FRN | 522157 |

- Commission-free trading up to monthly limits

- Regulated by the FCA

- Excellent educational content for beginners

- Clean, user-friendly trading platform

- No ISA or SIPP options

- Limited advanced order types for professional traders

What Does “0% Commission” Actually Mean on XTB?

Commission-free means no dealing charge on buying or selling real stocks and ETFs, up to €100,000 in monthly turnover. Above that, a 0.2% fee applies. But commission isn’t the only cost: there’s a currency conversion charge if you’re buying non-EUR instruments, and a £10 inactivity fee if you don’t log in for 365 days (though notably, XTB doesn’t charge inactivity fees on ISA accounts). The “0%” headline is accurate but not the whole picture — we break down the real costs across all commission-free platforms separately. Some brokers also offer free shares as sign-up incentives, but I’d rather people chose a platform on its merits than because of a welcome bonus.

How Does XTB Compare to eToro for a First-Time Investor?

Both offer commission-free stock trading. XTB has tighter CFD spreads and a significantly better education platform. eToro has copy trading, which XTB doesn’t. eToro charges a $5 withdrawal fee and 0.5% FX on deposit; XTB has no withdrawal fee but charges for currency conversion on non-EUR instruments. XTB now offers a Stocks & Shares ISA directly in-app, while eToro’s ISA requires the separate eToro Money app. If you want to learn by doing, XTB. If you want to learn by copying someone who knows more than you, eToro. For most first-time UK investors buying straightforward equities, XTB’s fee structure is cleaner.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

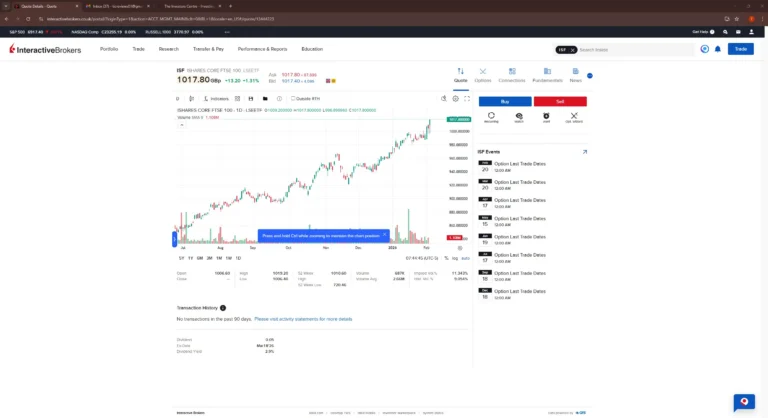

6. Interactive Brokers — The Serious Money Platform

Interactive Brokers is objectively the most capable platform on this list. It’s also the one I’d least recommend to most people reading this page. That’s not a contradiction — IBKR is built for professionals, and using it as a casual retail investor is like buying a commercial kitchen to make toast.

You technically can. You’ll have access to more equipment than you need. And the experience won’t be pleasant until you know exactly what you’re doing. But if you’re managing a six-figure portfolio across multiple currencies and geographies, or you need access to options, futures, and bonds alongside equities — IBKR has no real competitor on this list. It’s the only platform here where I’d say the learning curve is worth the pain.

| Detail | Value |

|---|---|

| Share dealing | Tiered: from £1.00 per order (0.05% of trade value) · Fixed: from £3.00 per order |

| Platform fee | £0 |

| Platforms | Trader Workstation, Client Portal, IBKR Mobile |

| Assets | Stocks, options, futures, bonds, forex — 150+ markets, 33 countries |

| Own real shares? | Yes |

| ISA / SIPP | Both available |

| FCA FRN | 208159 |

- Ultra-low trading fees

- Access to global markets

- Advanced trading tools and order types

- Strong reputation among professional investors

- Complex interface with a steep learning curve

- Overwhelming for casual or beginner traders

At What Portfolio Size Does IBKR Start Making Financial Sense?

I ran the numbers on a £25,000 UK equity portfolio with 12 trades per year. On IBKR’s tiered pricing, your annual cost is roughly £12 in dealing fees (£1 per order at 0.05% of a ~£2,000 trade), zero platform fee. On the fixed plan, that’s £36. On IG with fewer than 3 trades per month, you’d pay £96. On Hargreaves Lansdown, you’d pay £143. The difference is meaningful — and the cost advantage kicks in above £50,000, where the gap widens significantly against percentage-fee platforms.

Why Do I Keep Hearing That IBKR Is Difficult to Use?

Because it is. The Trader Workstation looks like it was last redesigned in the mid-2000s. The Client Portal is better — cleaner, browser-based, functional. But even then, simple tasks like finding your ISA wrapper or changing your base currency require more clicks than they should. Every Reddit thread about IBKR includes someone saying “the learning curve is brutal.” That’s accurate. The question is whether the tool quality on the other side of that curve is worth it. For experienced traders managing larger portfolios, it is — we cover this in more detail in our professional traders guide. For most beginners, it isn’t.

62.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

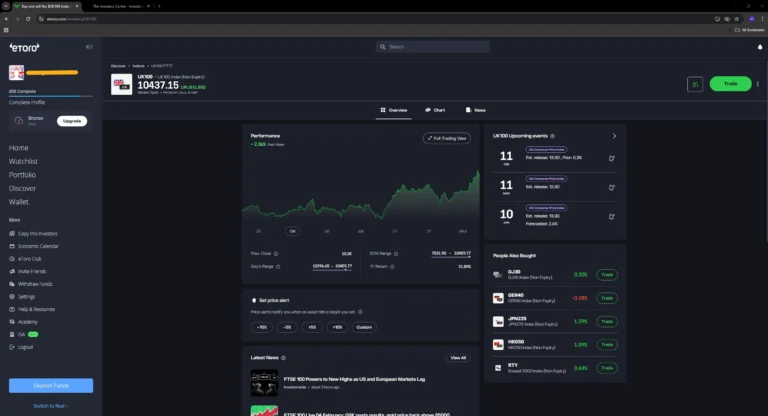

7. eToro — Copy Trading Done Properly, Everything Else Done Adequately

The team genuinely disagrees about eToro. Adam rates the CopyTrader feature highly — he’s used it to mirror three Popular Investors over six months and tracked the performance against doing it manually. I think the spreads are too wide for active trading. Dom uses it for the social feed and crypto access and nothing else. All three positions are defensible — whether you rate eToro depends on what you’re using it for.

| Detail | Value |

|---|---|

| Stock commission | £0 on real share purchases |

| Withdrawal fee | $5 |

| FX conversion | 0.5% on GBP deposits (accounts held in USD) |

| Platforms | eToro proprietary (web + mobile) |

| Assets | 6,000+ real stocks, 700+ ETFs, crypto, indices, commodities via CFD |

| Own real shares? | Yes |

| ISA / SIPP | ISA via eToro Money (separate app) · No SIPP |

| FCA FRN | 583263 |

- 0% commission on real stock trading

- Easy-to-use platform for beginners

- Innovative CopyTrader™ feature

- Strong mobile experience

- Currency conversion and withdrawal fees

- Wider spreads on some trades

- Not suited for advanced strategies

How Did CopyTrader Perform Over Six Months?

Adam allocated £3,000 across three Popular Investors between August 2025 and January 2026. Net return after all fees: +4.2%. The feature works as advertised — trades are mirrored automatically with proportional sizing. But the quality of traders you can copy varies enormously. Two of Adam’s three picks were profitable. One lost 8%. The interface makes it easy to start copying; it doesn’t make it easy to pick the right person to copy. Adam’s written a full breakdown in our eToro copy trading guide.

What Are the Hidden Costs Most People Miss on eToro?

The FX trap. Your account is denominated in USD. Every pound you deposit gets converted at a 0.5% fee. That’s not a commission — it’s a currency conversion charge, and it applies every time. On a £5,000 deposit, that’s £25 gone before you’ve placed a trade. Then there’s the $5 per withdrawal and the $10/month inactivity fee after 12 months of not logging in. The “0% commission” headline is technically true for share trading, but total cost of ownership is higher than it first appears.

What’s the Difference Between eToro and eToro Money?

eToro Money is a separate FCA-regulated app and a separate legal entity. The ISA sits inside eToro Money, not the main eToro trading app. You can’t buy shares in the main app and then wrap them in an ISA — you have to use eToro Money specifically. This is poorly explained on eToro’s own site and catches a lot of people out. If ISA access is important to you, make sure you’re downloading the right app. We compare the mobile experience across all platforms in our best trading apps guide.

61% of retail CFD accounts lose money when trading CFDs with this provider.

What About Trading 212, Hargreaves Lansdown, and the Others?

We tested more platforms than made this list. The seven above earned their place through our scoring methodology — the ones below fell short in one or more weighted categories, though several came close.

Trading 212

Adam’s had a funded account since 2024 and it’s a strong product — zero commission, zero platform fee, fractional shares, a solid ISA. Where it lost marks was research and education: the in-app tools are thin compared to IG or CMC, and there’s no equivalent to XTB’s education library. The fee structure is arguably the cleanest of any platform we tested, so if low-cost passive investing is your priority, it’s worth a look. It narrowly missed the seven and could make the next update.

Hargreaves Lansdown

The biggest platform in the UK by client numbers, and the customer service is the best we encountered — better even than IG’s. But the fees pulled it down hard in our scoring: £11.95 per share trade and a 0.45% platform fee on funds is significantly more expensive than IG, IBKR, or XTB for the same job. If you value hand-holding and premium support above all else, HL is worth considering. On cost, it couldn’t compete.

AJ Bell

A solid all-rounder with a good ISA and SIPP at £5 per trade. It scored well on account types and tax wrappers but didn’t differentiate itself enough on platform quality or fees to displace any of the seven. A safe middle-ground pick, but not a standout in any single category.

Freetrade

Commission-free with a clean mobile app, popular with younger investors. It scored well on fees and onboarding simplicity but fell short on market access — the range is limited compared to IG or IBKR — and there’s no desktop platform to speak of. If you only trade on your phone and only want UK and US equities, it works. Beyond that, it runs out of road quickly.

Saxo

Powerful platform with institutional-grade tools and a wide asset range. The issue is pricing — Saxo’s fee structure is built for high-net-worth portfolios, and on a sub-£50,000 account the costs don’t justify the tooling over IBKR, which offers comparable depth at lower fees.

If your needs lean more toward long-term investing than active trading, several of these platforms may suit you better than the CFD-focused brokers in our main list. Our best investment platforms UK guide covers that angle in more detail.

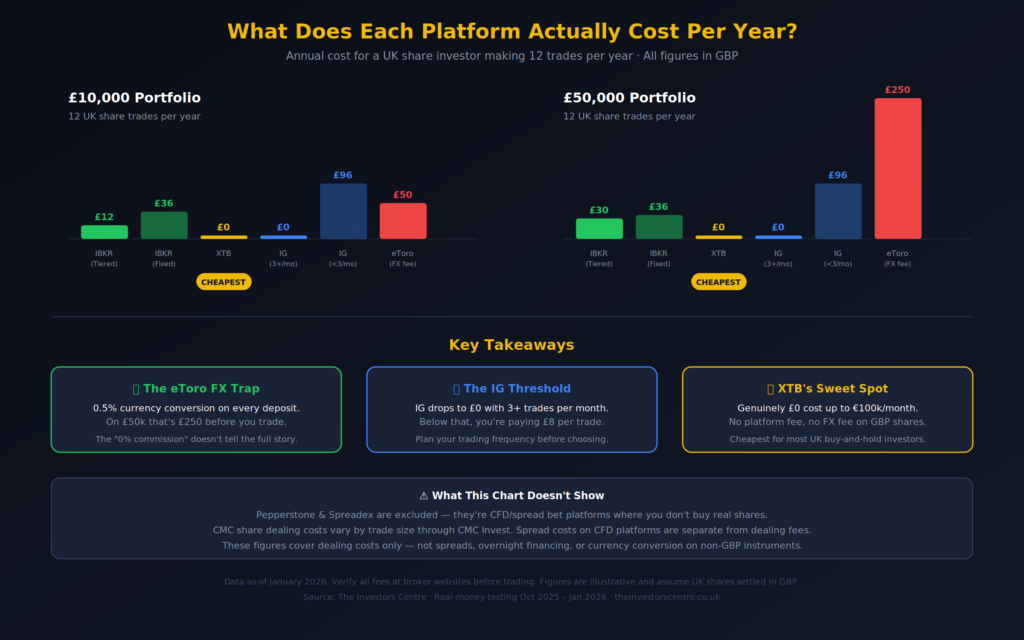

Do Fees Really Make That Much Difference?

Yes. More than most people realise, and in ways that aren’t obvious until you sit down with a calculator.

Take a concrete scenario: £10,000 portfolio, buy-and-hold strategy, 12 UK share trades per year, held for five years. On Interactive Brokers, your annual dealing cost is £36. On IG with fewer than three trades per month, it’s £96. On eToro, the 0.5% FX conversion on your initial £10,000 deposit costs you £50 before you’ve bought anything — and that cost repeats on every additional deposit. Compound those differences over five years and the drag on returns is measurable.

Then flip it for active traders: the Razor vs Standard cost comparison I referenced in the Pepperstone section is the clearest illustration. At small position sizes, the Standard account’s commission-free structure wins. As you scale up, the Razor account’s near-zero spreads plus £2.25 per side becomes cheaper. The crossover happens around £50,000 in notional value per trade.

But here’s what matters more than any single line item: a £3 saving per trade is meaningless if the platform’s execution quality costs you 2 pips in slippage. A 0% commission platform that charges 0.5% on FX conversion costs more than a £5-per-trade platform if you’re buying US stocks every month. Fees are a system, not a number. We’ve broken this down further in our cheapest online broker comparison, and for forex-specific costs, our lowest spread forex brokers guide.

Annual Cost Comparison by Scenario

| Scenario | IG (3+/mo) | IG (<3/mo) | CMC | XTB | IBKR (Tiered) | IBKR (Fixed) | eToro |

|---|---|---|---|---|---|---|---|

| £10k, 12 UK trades/yr | £0 | £96 | Varies | £0 | £12 | £36 | £50 (FX) |

| £50k, 12 UK trades/yr | £0 | £96 | Varies | £0 | £30 | £36 | £250 (FX) |

Illustrative. Assumes UK shares settled in GBP. eToro cost reflects 0.5% FX on initial deposit. Verify all fees at broker websites. Spreadex and Pepperstone not included in this as its specific to investing.

What Type of Account Should You Actually Open?

The account type you choose matters more than which broker you pick.

A General Investment Account (GIA) has no limits and full flexibility, but profits above the £3,000 annual exemption (2025/26 tax year) are subject to Capital Gains Tax. A Stocks and Shares ISA allows up to £20,000 per tax year, with all gains and dividends completely tax-free — we compare ISA-offering platforms in our best investment platforms guide. A SIPP (Self-Invested Personal Pension) offers tax-free growth plus tax relief on contributions, but your money is locked until age 55 — rising to 57 from April 2028. If you’re curious how your pot compares, we’ve published the latest data on the average pension pot in the UK.

My honest view: if you’re investing rather than trading, and you haven’t filled your ISA allowance, you should be using an ISA before you consider a GIA. The tax savings compound over time in ways that are easy to underestimate. On a £20,000 portfolio growing at 7% annually, the difference between ISA and GIA over 20 years runs into five figures — and that’s before accounting for dividend tax.

Account Type Availability

| Platform | GIA | Stocks & Shares ISA | SIPP |

|---|---|---|---|

| Pepperstone | CFD account only | No | No |

| IG | Yes | Yes | Yes |

| Spreadex | Spread bet & CFD account only | No | No |

| CMC Markets | Yes | Yes (CMC Invest) | No |

| XTB | Yes | Yes | No |

| Interactive Brokers | Yes | Yes | Yes |

| eToro | Yes | Yes (eToro Money) | No |

What Tax Will You Pay When You Trade?

Stamp Duty Reserve Tax (SDRT): 0.5% on UK share purchases settled electronically through CREST. It’s automatically deducted by your broker — you won’t see a separate charge, but it’s built into the transaction. SDRT doesn’t apply to CFDs, spread bets, ETFs traded on overseas exchanges, or AIM-listed shares. If you’re on Pepperstone or Spreadex, you’ll never encounter this because you never own the underlying asset.

Capital Gains Tax (CGT): 18% for basic-rate taxpayers and 24% for higher-rate taxpayers on gains above the £3,000 annual exemption (2025/26 tax year). This does not apply to gains inside an ISA or SIPP — which is precisely why the account type table above matters so much.

Dividend Tax: 8.75% (basic rate), 33.75% (higher rate), and 39.35% (additional rate) on dividend income above the £500 annual allowance (2025/26). From April 2026, basic and higher rates are scheduled to rise to 10.75% and 35.75% respectively [verify against latest Finance Act before publication]. Again — none of this applies inside an ISA. This is why the ISA column keeps coming up, and why our investing hub focuses heavily on tax-efficient wrappers.

Spread betting: Profits are currently tax-free under HMRC rules for speculators. But — and this is important — if HMRC decides trading is your primary income source, the exemption may not apply. Get professional advice if this is relevant to your situation.

Sources: HMRC CGT rates (gov.uk) · FSCS (fscs.org.uk)

Is Your Money Safe if a Broker Goes Bust?

Every platform on this list is authorised and regulated by the FCA. In practice, that means: client funds must be held in segregated accounts separate from the broker’s own money, conduct-of-business rules apply, and the broker has a legal obligation to treat customers fairly.

Then there’s the FSCS. The Financial Services Compensation Scheme covers up to £85,000 per eligible person per firm for investment claims. You can verify any broker’s FCA authorisation at register.fca.org.uk. I’ve included the specific FRN numbers in each broker’s fact table above — if those numbers aren’t on the register, don’t use the platform.

The nuance most people miss: FSCS protects you if the broker fails financially. It does not protect you against market losses. If you buy £10,000 of shares and they fall to £6,000, that’s your risk. If the broker goes bust and your £10,000 is in a segregated account, the administrator should return it. If there’s a shortfall, FSCS covers up to £85,000. That’s a meaningful safety net — but it isn’t insurance against bad trades. Regulation is one of the core criteria in how we test every platform, and you can read more about our editorial standards on our corporate governance page.

Final Thoughts

There’s no single best trading platform — and anyone who tells you otherwise is either selling something or hasn’t used enough of them. What I can tell you after two years of funded testing is that the right platform depends entirely on what you’re actually doing with your money.

If you’re actively trading CFDs or forex and execution speed matters to you, Pepperstone is where I’d start. If you want one platform that handles share dealing, an ISA, and spread betting under the same roof, IG is the most complete option I’ve tested. And if you’re opening your first account tomorrow and want something that won’t overwhelm you, XTB makes the most sense.

Most people reading this will be better served by two platforms rather than one — a trading account for short-term positions and an ISA for long-term holdings. That’s exactly what I do, and it’s the setup I’d recommend to anyone asking.

Whatever you choose, check the FCA register before you deposit a penny, make sure you understand the fee structure beyond the headline number, and start with an amount you can genuinely afford to lose. The platforms on this list are all regulated and legitimate — but the risk is real, and no ranking can change that.

What's Changed Since the Last Update?

February 2026: Complete rewrite. Added real-share ownership and ISA availability data. Added tax section covering SDRT, CGT, dividend tax, and spread betting exemption. Added account type guidance (GIA vs ISA vs SIPP). Replaced broker marketing screenshots with dated screenshots from our funded accounts. Verified FSCS figure. Expanded from ~3,200 words to ~6,000 words. Rewrote individual broker assessments with updated Q4 2025/Q1 2026 testing data.

December 2025: Updated fee tables for 2026. Changed year references. Minor text updates.

FAQs

Which platform is best for day trading in the UK?

Pepperstone for forex and indices — execution speed is its core advantage, and I’ve consistently recorded fills under 40ms during high-volatility sessions. IG for equities — the Level 2 order book via ProRealTime gives you depth-of-market data that most retail platforms don’t offer. If you want a tax advantage, spread betting on either Spreadex or IG means profits are currently CGT-exempt under HMRC rules. For a full breakdown, see our best day trading platforms guide.

Is Trading 212 or eToro better?

I haven’t included Trading 212 in the main list because I haven’t tested it with funded accounts long enough to have a confident opinion. But for a direct comparison based on publicly available data: Trading 212 has no withdrawal fee and no FX conversion fee on GBP accounts. eToro charges $5 per withdrawal and 0.5% FX on every GBP deposit. Trading 212 offers a stocks and shares ISA directly in-app. eToro’s copy trading has no equivalent on Trading 212. For a passive buy-and-hold investor, Trading 212’s fee structure is hard to beat. For someone who wants social features, eToro.

What is the 7% rule in stock trading?

It’s a risk management principle from William O’Neil’s CAN SLIM methodology — sell if a position falls 7% below your purchase price to cap losses. Whether it’s useful depends on your timeframe. For a buy-and-hold investor in an ISA, a 7% dip in a diversified portfolio is routine and shouldn’t trigger panic selling. For a leveraged CFD trader, 7% of the notional position could mean substantially more than 7% of your actual capital. I use stop-losses on every CFD trade, but I don’t apply a blanket 7% rule to my ISA holdings.

What happens to my shares if my broker goes bust?

If you hold real shares — not CFDs — you own the underlying asset. In administration, those shares should be identifiable, ring-fenced, and transferable to another broker. The process takes time, but the asset is legally yours. CFD positions are different — they’d likely be closed at prevailing market prices during the administration process. FSCS covers up to £85,000 per person if there’s a shortfall between what you’re owed and what the administrator can return.

Can I hold accounts on multiple platforms at the same time?

Yes, and I’d actively recommend it. I use Pepperstone for short-term CFD trading and IG for long-term ISA investing — different tools for different jobs. The only restriction to be aware of is that you can only pay into one Stocks and Shares ISA per tax year (though you can hold multiple ISAs from previous years with different providers). There’s no limit on the number of general trading accounts you can hold simultaneously.

References

- XTB Official Website – Trading Platform & Fees

- IG Group – Share Dealing & Trading Platform

- CMC Markets – Next-Generation Trading Platform

- Spreadex – Spread Betting & CFD Trading

- Interactive Brokers – IBKR Global Trading

- eToro – Investing & Copy Trading Platform

- Pepperstone – Forex and CFD Broker

- FCA Register – Financial Services Register

- Trustpilot – User Reviews for Trading Platforms