- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

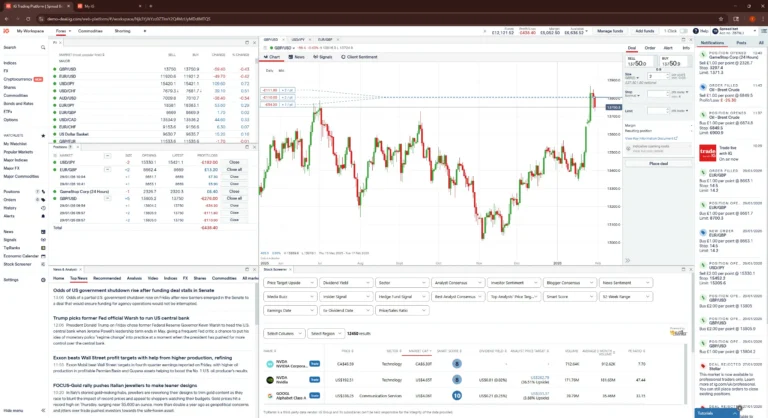

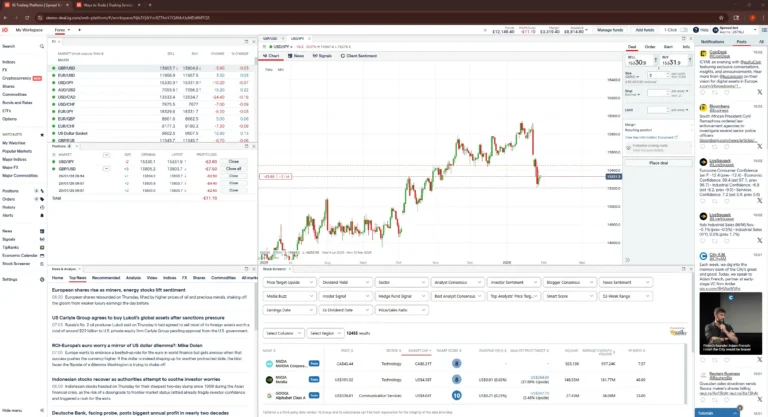

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer:To Short a Currency, You’ll Need to…

To short a currency, you sell a currency pair anticipating its price will fall, then repurchase it lower. Using a forex broker, margin account, and clear strategy, you aim to profit from declining values while protecting capital through disciplined risk management.

What Exactly Does Short Selling in Forex Mean?

Short selling in forex means betting against a currency’s strength. You sell a currency pair, expecting its value to decline, then buy it back at a lower price. This practice leverages global news, technical signals, and economic fundamentals to capture profits from downward movements.

How Can I Short a Currency Step by Step?

Step 1 – Choose and Analyse the Right Currency Pair

Start by selecting liquid pairs like EUR/USD or GBP/USD, where market trends are clearer. Analyse global news, economic reports, and price charts. Combining technical and fundamental perspectives helps identify currencies likely to weaken, giving traders stronger setups when entering short positions with confidence.

What Tools Can Help Me Analyse Currency Movements?

Useful tools include forex calendars, economic news feeds, trading platforms with charting software, and sentiment indexes. Platforms like MetaTrader or TradingView provide real-time data, indicators, and alerts. These resources give traders actionable insights into momentum shifts, volatility, and potential entry points for short trades.

Step 2 – Select the Best Trading Strategy

Choosing the right short-selling strategy depends on goals, risk tolerance, and time horizon. Swing traders may ride multi-day trends, while scalpers capture quick moves. Strategy alignment ensures consistency, reduces emotional trading, and helps traders exploit bearish opportunities across varied forex market conditions.

What Are the Most Common Short-Selling Strategies in Forex?

Popular methods include trend following, breakout trading, news trading, and carry trades. Each approach targets specific market behaviours, from riding sustained downtrends to reacting quickly to volatility. Selecting the right method enhances trade accuracy and provides structure when betting against a currency’s strength.

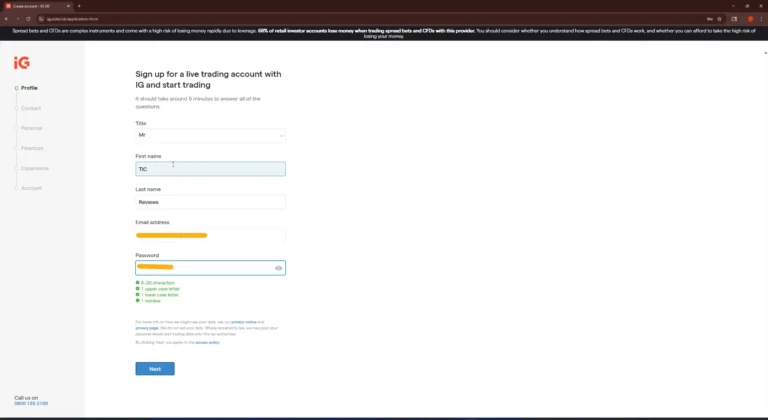

Step 3 – Open and Set Up a Forex Trading Account

To short currencies, open a forex account with a regulated broker. Complete verification, deposit funds, and configure trading platforms. Starting with a demo account builds confidence, while transitioning to live trading introduces real risks and rewards. Proper setup ensures smoother execution of short trades.

What Are the Steps to Opening a Trading Account?

Choose a regulated broker, complete registration, and verify identity with documents. Fund the account, then download the trading platform. Adjust settings, add indicators, and test execution. This process equips traders with a reliable environment to short currencies safely under legal and financial protections.

Why Is It Smart to Start with a Demo Account First?

A demo account simulates real trading without risking money. It lets traders practice shorting currencies, test strategies, and understand platform tools. By mastering execution in a risk-free environment, traders avoid costly mistakes when transitioning to live accounts with real capital at stake.

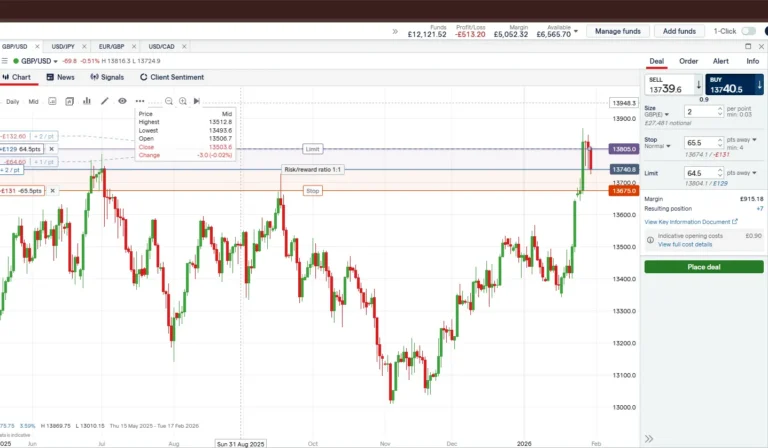

Step 4 – Apply Proper Risk Management Techniques

Risk management protects traders from heavy losses while shorting currencies. By limiting exposure per trade, setting stop-loss levels, and applying leverage wisely, you ensure long-term sustainability. Balancing risk and reward keeps emotions in check and prevents short-selling from becoming dangerously over-leveraged speculation.

What Lot Size and Leverage Should I Use?

Use small lot sizes relative to account equity and keep leverage conservative, often under 10:1. High leverage amplifies both gains and losses. Controlled position sizing ensures manageable risk, allowing traders to withstand volatility while keeping capital safe in unpredictable forex market conditions.

What Are Some Real-World Examples of Currency Shorting?

Studying real-world shorting examples highlights how traders profit from currency declines. Events like Brexit and historic trades by professionals reveal how economic shifts, speculation, and timing drive opportunities. These cases show the power of analysis, discipline, and risk control when shorting volatile forex markets.

How Did Traders Profit by Shorting the Pound Before Brexit?

Ahead of the 2016 Brexit vote, uncertainty weakened the British pound. Many traders shorted GBP/USD as polls indicated economic instability. When the referendum confirmed Brexit, the pound collapsed, rewarding bearish positions. This case illustrates how political risk can fuel profitable forex short-selling opportunities.

What Advanced Strategies Can Make Short Selling More Effective?

Advanced shorting strategies combine precision, technology, and hedging to reduce risks. Scalping, high-frequency trading, and derivative instruments allow traders to maximize efficiency. These methods suit experienced forex traders who want to fine-tune timing, protect portfolios, and exploit both short-term volatility and long-term macroeconomic shifts.

How Do Scalping and High-Frequency Trading Work in Forex Shorting?

Scalping and high-frequency trading involve executing rapid trades to capture tiny price movements. Automated systems or skilled manual scalpers exploit liquidity and volatility in major pairs. Though profits per trade are small, repetition magnifies returns. Success requires low spreads, advanced technology, and strict discipline.

How Can Options and Futures Help Hedge Risks in Short Selling?

Options and futures let traders hedge forex short positions. Options provide downside insurance by limiting risk to the premium paid, while futures contracts allow managing exposure with defined terms. These instruments balance speculation with protection, helping traders secure profits and minimize potential losses.

What Should I Keep in Mind Before Shorting a Currency?

Shorting currencies offers big opportunities but carries high risk. Always use stop-losses, manage leverage conservatively, and stay updated on economic news. Volatility can quickly reverse trades. Treat shorting as a disciplined strategy, not gambling, and never risk more capital than you can afford.

Transfer Offer

Transfer Offer

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Can I Short Currency Without Leverage?

Yes, you can short currency without leverage, but it requires more capital. Without leverage, your potential profits and losses are directly tied to the amount invested. While this reduces risk, it also limits the size of your returns compared to leveraged trades.

How Do Interest Rates Affect Currency Shorts?

Higher interest rates strengthen a currency, while lower rates weaken it. If a central bank raises rates, the currency may appreciate, negatively impacting short positions.. Monitoring central bank policies is crucial when shorting currencies.

Can beginners short currencies in forex?

Yes, beginners can short currencies, but it’s important to start small, use risk-management tools, and thoroughly understand concepts like leverage, volatility, and position sizing. Many brokers also offer demo accounts to practise without real money.

Which forex pairs are best for shorting?

Popular choices include major pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD due to their liquidity and tighter spreads. The “best” pair depends on market conditions and your analysis—look for clear trends, economic catalysts, and technical signals.

Do I need a special account to short currencies?

No, most standard forex trading accounts allow you to go both long and short. Just make sure your broker offers the currency pairs you’re interested in and supports features like stop-loss and take-profit orders.

What are the risks of shorting a currency?

Shorting involves high downside risk, especially if the market moves sharply against your position. Since there’s no limit to how much a currency can appreciate, your losses could be significant. That’s why stop-losses and leverage control are so critical.

References

- Investor.gov – Foreign Currency Exchange (Forex) Trading for Individual Investors

- CFTC – Customer Advisory: Eight Things You Should Know Before Trading Forex

- CFTC – Foreign Currency Trading

- SEC – Foreign Currency Transactions

- Investor.gov – Understanding Forex Trading Risks

- FCA (Financial Conduct Authority) – Understanding CFDs and Forex

- TradingView – Real-Time Forex Charts