- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: To Short the Pound, You’ll Need to...

To short the British Pound (GBP), open a forex trading account, choose a GBP currency pair (like GBP/USD), and place a sell order. This strategy allows you to profit if the Pound’s value drops relative to the other currency. Remember that forex markets are volatile, so it’s crucial to understand the risks before entering a trade.

Heading into 2026, the Pound faces continued uncertainty from UK fiscal policy, inflation trends, and global market conditions. Whether you use forex pairs, CFDs, or inverse ETFs, make sure your approach fits your goals, risk tolerance, and experience level. And always protect your downside.

What Does It Mean to Short the Pound?

Why Might Investors Want to Short the Pound?

I’ve shorted the Pound a few times—usually when there’s economic trouble or political chaos brewing in the UK. During Brexit, for example, the uncertainty was through the roof. It was the perfect storm for a short position, and I took advantage of it.

Slowing growth, bad economic data, or expectations that the Bank of England might cut interest rates—these all tend to put pressure on GBP. When that happens, traders often jump in, expecting the Pound to slide.

But it’s not risk-free. Markets can be unpredictable, especially around major events. I always set stop-losses and keep a close eye on open positions. It’s all about protecting the downside while giving yourself a shot at the upside.

How to Short the Pound – Step-by-Step

Shorting the Pound isn’t complicated once you know the process. Here’s how I go about it:

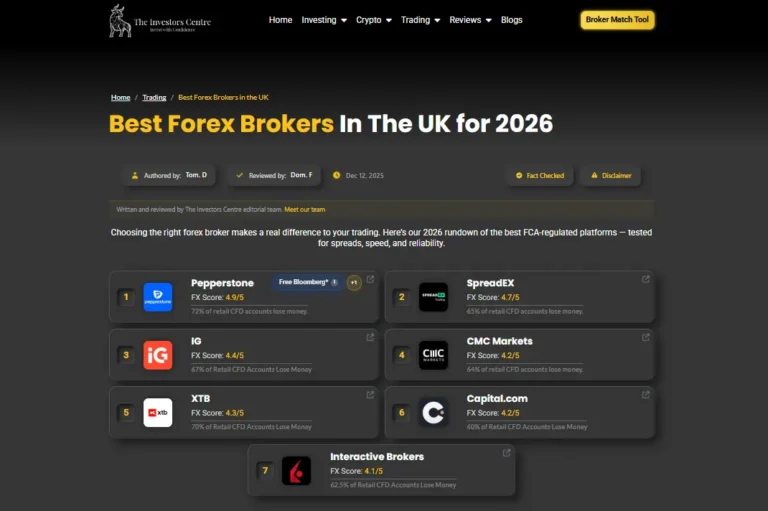

Step 1: Pick a Forex Broker

Your broker choice matters a lot. I tried a few when I was starting out, but eventually settled on one that was regulated, had tight spreads on GBP pairs, and offered solid customer support. Trust me—when you’re trading actively, having a platform that’s easy to use and responsive makes a big difference.

Step 2: Choose Your Currency Pair

I usually short the Pound through GBP/USD because it’s liquid and reacts quickly to economic news. But you can also go with GBP/EUR or GBP/JPY—it depends on what markets you’re comfortable with and what news you’re tracking.

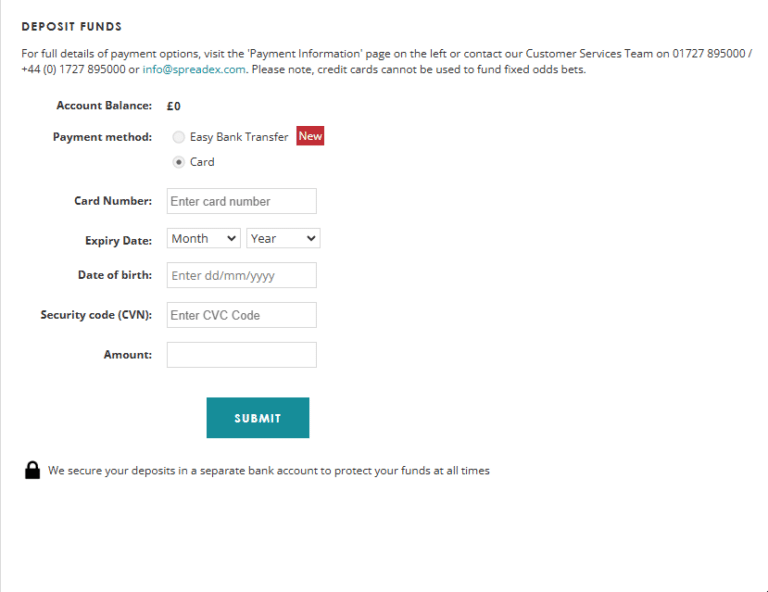

Step 3: Fund Your Account

You’ll need to deposit money to meet the margin requirements. Forex is typically leveraged—I’ve used 30:1 and even 100:1 in the past. But I learned the hard way that too much leverage can wreck a trade fast. These days, I play it safer and keep risk tightly controlled.

Step 4: Place Your Sell Order

Once you’re set, pick your pair, enter the trade size, and place a sell order. I always set take-profit and stop-loss levels from the start. They help keep emotions out of the equation, especially during wild market swings.

Step 5: Monitor and Exit

After entering the trade, I stay on top of it—especially around big news events. I tweak my stop-loss or take-profit levels if needed, depending on how things unfold. Knowing when to exit is just as important as getting in.

| Step | Action | Purpose |

|---|---|---|

| 1. Choose Broker | Select a forex broker | Essential for forex trading |

| 2. Currency Pair | Choose a GBP-based pair | Select based on strategy and analysis |

| 3. Fund Account | Deposit margin funds | Meet margin requirements |

| 4. Sell Order | Initiate the short trade | Execute trade on selected pair |

| 5. Monitor | Track and close the position | Adjust stop-loss and take profit |

Following these steps carefully can help you navigate the forex market and make informed decisions when shorting the Pound. As with any trading, understanding each step and applying proper risk management can improve your chances of success.

What Are the Risks of Shorting the Pound?

Shorting the Pound can be rewarding, but it definitely comes with risks I’ve had to learn to manage over time.

- Exchange Rate Volatility

The forex market moves fast—sometimes way faster than expected. I’ve seen the Pound swing sharply within minutes during UK GDP announcements or surprise BoE comments. If you’re short and the Pound suddenly strengthens, you can be in the red quickly. That’s why I always keep an eye on the news and set alerts when trading GBP.

- Leverage and Margin Calls

Leverage is a double-edged sword. It lets you control big positions with less capital, but it also magnifies losses. I made the rookie mistake of overleveraging early on, which led to a painful margin call when the trade went the wrong way. Since then, I’ve kept my leverage moderate and always use stop-losses to protect my downside.

- Economic and Political Risk

The Pound reacts strongly to UK-specific events—interest rate changes, inflation data, political drama… you name it. I remember trading during the Brexit saga, and GBP was all over the place. These events can catch you off guard, so if I’m trading around big news, I prepare for sudden reversals and size my positions accordingly.

Different Ways I’ve Shorted the Pound

There’s more than one way to short the Pound, and I’ve tried most of them. Each method has its own pros and cons, so the best choice depends on your strategy and risk tolerance.

1. Shorting GBP Through Forex Pairs

The most straightforward way is trading GBP pairs like GBP/USD or GBP/EUR. When I short GBP/USD, I’m betting the Pound will fall against the Dollar.

- Pros: High liquidity and 24/5 market access let me react quickly to news.

- Cons: It’s leveraged, so both gains and losses can pile up fast. Plus, volatility can shake you out if you’re not careful.

Here’s an example: Shorting GBP/USD After a Weak UK Jobs Report (Forex)

I was watching for the UK employment data release one morning. The report came in —unemployment was up, and wage growth slowed. Right after the news, GBP/USD started to dip.

Here’s what I did:

- I entered a short position on GBP/USD at 1.2600.

- Set a stop-loss at 1.2650 and a take-profit at 1.2500.

- The trade hit my take-profit later that day, as the weak data weighed on the Pound and USD strengthened with risk-off sentiment.

Profit: 100 pips gain on a standard lot = approx. $1,020 profit.

2. Using CFDs to Short the Pound

CFDs let me speculate on the Pound’s moves without owning it. I just enter a contract with a broker based on price direction.

- Pros: Lower entry cost, no need to own the currency, and super flexible.

- Cons: Leverage risk is still there, and CFDs aren’t available in every country.

I often use CFDs for short-term trades—they’re quick and efficient, but I don’t push the leverage too far.

Here’s an example: Using a CFD to Short the Pound During BoE Rate Cut Speculation

Before a Bank of England meeting, markets were pricing in a possible rate cut. I figured that if they did cut, the Pound would take a hit.

My move:

- I opened a CFD short position on GBP/USD through my broker.

- Entry: 1.2750

- Leverage: 30:1

- Set a tight stop-loss at 1.2800 to protect against a surprise hike.

- BoE did cut rates by 25bps, and GBP/USD dropped to 1.2630 the same day.

Profit: 120 pips on a mini lot = approx. $120 profit (but much more if using higher volume).

3. Shorting with Futures Contracts

Futures are more structured—you agree to sell the Pound at a set price in the future.

- Pros: Great for planning around specific events like BoE meetings, and they’re traded on regulated exchanges.

- Cons: Less liquid than forex, and costs can be higher.

I like using futures when I’m confident about timing. But they’re not as nimble as spot forex, so you need a solid plan.

4. Buying Inverse ETFs or ETNs

Inverse ETFs (like those from ProShares) are a hands-off way to bet against GBP. They move opposite to the Pound and can be bought like regular stocks.

- Pros: No margin, easy to buy and sell, and good for quick exposure.

- Cons: They come with fees and don’t always track perfectly, especially if held too long.

I use these when I want a lower-risk play against the Pound, especially when I don’t want to deal with forex directly.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Forex Pairs | Trade GBP directly in forex market | High liquidity, real-time trading | Leverage risk, currency volatility |

| CFDs | Contracts on GBP/USD, GBP/EUR | No ownership needed, flexible trades | Leverage amplifies risk, not available in all regions |

| Futures | Trade GBP futures contracts | Set expiry dates, standardized contracts | Limited liquidity, higher costs |

| Inverse ETFs/ETNs | Bet against GBP via funds | Easy access, no need for margin accounts | Management fees, less direct exposure |

Each of these methods offers different levels of exposure, flexibility, and risk. Choosing the right approach depends on your experience, trading goals, and risk tolerance.

Which Method of Shorting the Pound Is Right for You?

The best way to short the Pound really depends on your style and comfort level with risk. I’ve used different methods over the years, and here’s how I see them:

- Forex Pairs: Perfect if you want direct exposure and don’t mind fast-paced markets. I use GBP/USD often for quick, short-term trades because of its liquidity and reaction to news.

- CFDs: Great if you want flexibility without holding the actual currency. I turn to CFDs when I’m looking for short-term moves but don’t want to tie up too much capital.

- Futures: Better suited to experienced traders. I use futures for more structured trades—usually when I have a clear thesis tied to a specific event, like a BoE decision.

- Inverse ETFs/ETNs: These are ideal if you want a simple, lower-risk way to bet against the Pound. I sometimes use them as a passive hedge, especially when I don’t have time to actively monitor the market.

Bottom line: Pick the method that fits your goals and how hands-on you want to be. For me, it’s a mix—forex for short-term plays, ETFs for longer-term hedges.

My Key Tips for Shorting the Pound

Shorting the Pound can work well, but only if you manage risk smartly. Here’s what I’ve learned:

- Watch UK Economic Data: Reports like GDP, inflation, and jobs numbers can move GBP fast. I always set calendar alerts so I’m not caught off guard.

- Use Stop-Loss Orders: These are non-negotiable for me. They’ve saved me from bigger losses more times than I can count.

- Don’t Over-Leverage: It’s tempting, but I learned early that using max leverage is a fast way to burn your account. I stick to modest levels so I can survive losing trades.

- Trade Around Major Events: I pay close attention to BoE meetings and political news. These moments often bring big moves—and big opportunities—if timed right.

Final Thoughts

Shorting the Pound has definitely opened up opportunities for me—especially during times of economic or political upheaval in the UK. But it’s not for everyone. The volatility, leverage, and potential for quick reversals mean you need to be prepared and disciplined.

If you’re comfortable managing risk and keeping up with market news, it can be a useful strategy. But if you’re new to forex or unsure about how it all works, it’s worth speaking with a financial advisor first. When I was starting out, getting a second opinion helped me avoid some costly mistakes.

At the end of the day, make sure your approach fits your goals, risk tolerance, and experience level. And always protect your downside.

Seamless Trading Across Platforms

- Low Spreads and Fast Execution

- Multiple Account Types

- Advanced Trading Platforms

72% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Why would someone want to short the Pound?

Investors may short the Pound if they anticipate a decline in the UK economy, expect lower interest rates, or foresee political events that could weaken GBP. It’s a way to profit from expected downturns in the currency’s value.

What are the risks involved in shorting GBP?

Shorting GBP involves risks such as exchange rate volatility, leverage-related losses, and the potential for margin calls. Additionally, unexpected positive economic or political developments in the UK could lead to rapid GBP appreciation, causing losses for short sellers.

Can I short GBP with minimal risk?

To minimise risk, consider using put options or inverse ETFs, which limit potential losses to the premium or investment amount. Additionally, setting stop-loss orders can help manage risk in forex trades.

What factors influence GBP’s value on the forex market?

The Pound’s value is influenced by UK economic indicators, Bank of England policy decisions, political events, and global market trends. Staying informed about these factors is essential for traders looking to short GBP.

References

- Bank of England – Monetary Policy and Economic Releases

- Investopedia – Understanding Forex

- Bank of England – Official Publications

- Trading Economics – GBP Historical Data

- Investopedia – Short Selling in the Forex Market

- IG Group – How to Short the Pound

- CMC Markets – What Are CFDs and How Do They Work?

- DailyFX by IG – GBP/USD Forecasts & Analysis

- Financial Times – UK Economic News & GBP Updates