How to Trade Gold in the UK | A Complete 2026 Guide for Investors & Traders

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer: How Can I Trade Gold in the UK?

To trade gold in the UK, choose an FCA-regulated broker, select an instrument such as spot gold, CFDs, ETFs, or gold stocks, and understand how gold markets move. Using charts, research tools, and clear risk management helps you trade confidently while limiting potential losses.

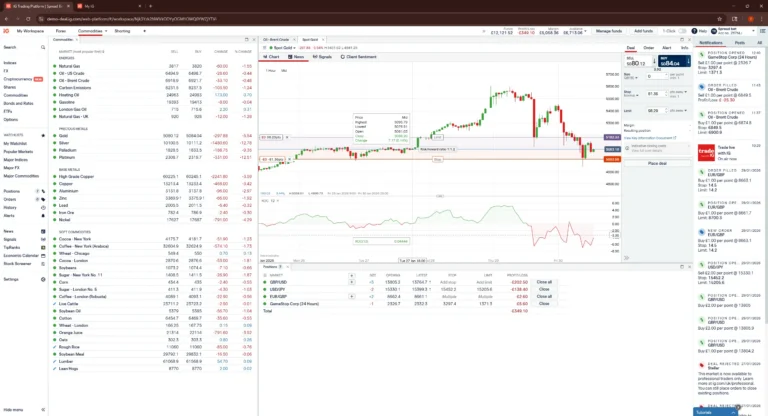

Which Broker is Best to Start Trading Gold?

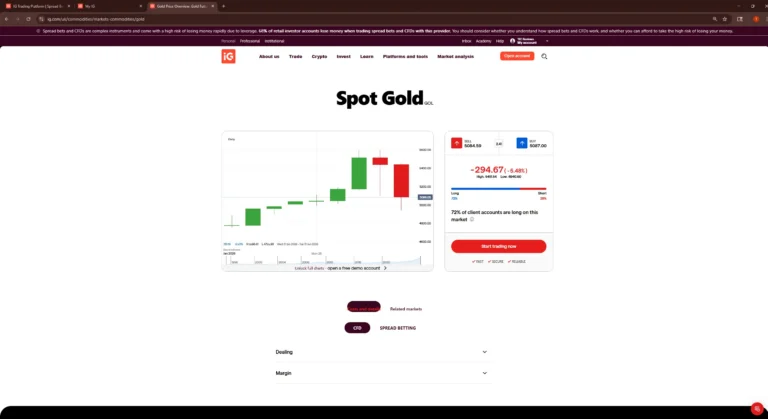

IG is the best broker for trading gold in the UK, offering spot gold, futures, options, ETFs, and 50+ mining shares from one FCA-regulated account (FCA #195355). IG's 0.30-point spread costs ~£24 per lot—CMC Markets is cheaper at £16/lot, but IG's instrument range is unmatched for serious gold traders.

Top Gold Brokers in the UK

Trading gold in the UK requires selecting a regulated broker, choosing the right instrument—spot, CFDs, ETFs, or gold stocks—and understanding market mechanics. Access to research, charts, and risk-management tools ensures informed trading decisions while maintaining control over potential losses.

| Broker | Account Types | FCA Regulated | Gold Instruments | Trading Fees | Key Feature |

|---|---|---|---|---|---|

| IG | Standard, SIPP, ISA | Yes | Spot, CFDs, Futures | 0.3%-0.5% spread | Advanced research & platform tools |

| eToro | Standard, ISA | Yes | ETFs, Spot CFDs | 0.75% spread | CopyTrading & ETF access |

| CMC Markets | Standard, SIPP, ISA | Yes | Spot, CFDs, Futures | 0.2%-0.5% spread | Professional charts & low spreads |

| Pepperstone | Standard, Razor | Yes | Spot, CFDs, Futures | 0.1%-0.4% spread | Tight spreads & fast execution |

What Accounts and Tools Will I Need?

You need a standard trading account, such as an ISA, SIPP, or general CFD account, depending on your strategy. Essential tools include real-time charts, economic calendars, leverage controls, stop-loss/take-profit functionality, and demo accounts to practice trading gold risk-free before committing real capital.

Top Rated

Top Rated

A globally recognized industry leader. Access over 17,000 markets worldwide with spread betting, CFDs, and share dealing all from one account.

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Step-by-Step: How to Start Trading Gold

Step 1: Choose Your Gold Market

Decide whether you want to trade gold in the spot market, via futures contracts, or through ETFs. Each market offers different risk levels, liquidity, and trading hours. Understanding the pros and cons helps you align your choice with your experience, strategy, and capital.

Spot Market vs Futures vs ETFs – Pros and Cons

- Spot: Immediate settlement, high liquidity, ideal for short-term trading; spreads can be wider.

- Futures: Contract-based, leveraged trading, good for hedging; requires margin and carries higher risk.

- ETFs: Trades like stocks, low leverage, suitable for beginners; long-term decay may affect returns.

Step 2: Decide Whether to Trade or Invest

Determine if your goal is short-term trading for frequent gains or long-term investing for portfolio protection. Trading is active and requires monitoring, while investing focuses on holding gold for capital appreciation.

Short-Term vs Long-Term Considerations

- Short-Term: Leverage, frequent trades, requires market monitoring.

- Long-Term: Buy-and-hold, lower stress, hedges inflation.

- Decision Tip: Assess risk tolerance, capital, and time available to manage positions effectively.

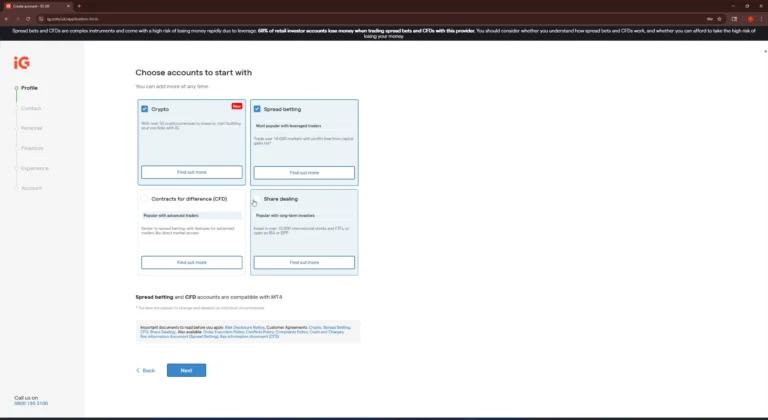

Step 3: Open a Gold Trading Account

Select an FCA-regulated broker and open an account suitable for your strategy. Complete identity verification, fund your account, and configure risk settings. Choose between demo or live accounts depending on experience.

Step-by-Step Account Setup Guide

- Choose a regulated broker (IG, eToro, CMC, Pepperstone).

- Complete KYC verification with ID and proof of address.

- Fund your account via bank transfer, card, or e-wallet.

- Set up risk management tools like stop-losses and alerts.

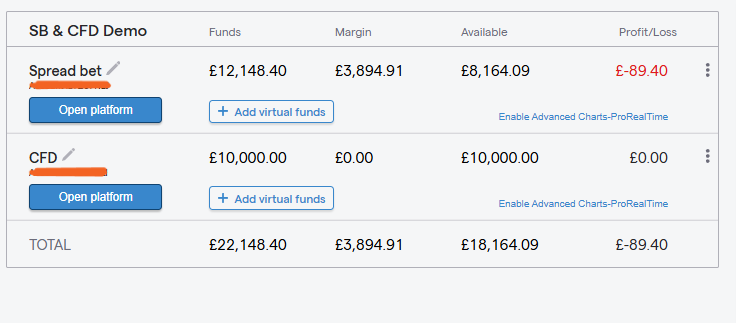

Why Demo Accounts Are Essential for Beginners

Demo accounts allow risk-free practice, familiarisation with platforms, and testing strategies. They help traders understand leverage, spreads, and order execution without losing real money. Practicing with a demo reduces mistakes when transitioning to live gold trading.

Step 4: Open and Manage Your First Trade

Enter your first gold position with careful planning. Set entry points, stop-loss, and take-profit levels. Monitor market movements, news, and economic indicators regularly. Adjust positions if necessary to protect capital while taking advantage of gold price fluctuations.

Entry, Position Sizing, and Risk Management Table

| Category | Action | Details |

|---|---|---|

| Risk Management | Position Sizing | Determine position size based on account balance and risk tolerance |

| Risk Management | Stop-Loss | Set stop-loss to limit potential losses |

| Risk Management | Take-Profit | Use take-profit to lock gains |

| Risk Management | Monitoring | Continuously review economic events, technical signals, and volatility to manage your trade effectively |

What is Gold Trading?

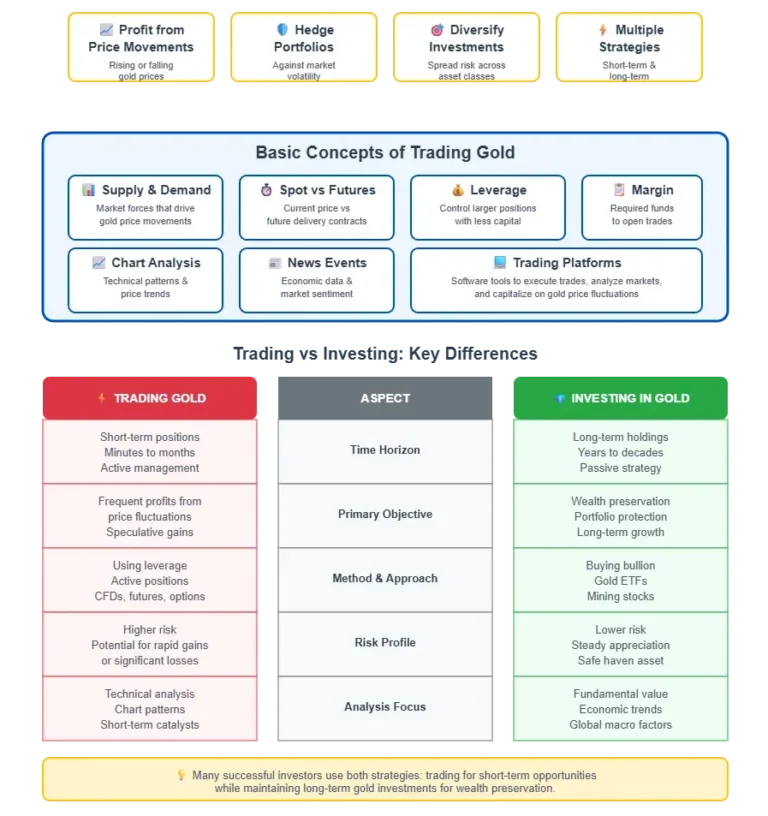

Gold trading involves speculating on the price movements of gold using various financial instruments. It allows traders to profit from rising or falling gold prices, hedge portfolios against market volatility, and diversify investments using both short-term trading and long-term strategies.

What Are the Basic Concepts of Trading Gold?

Gold trading centres on understanding supply and demand, spot versus futures prices, leverage, and margin requirements. Traders need to know how to analyse charts, interpret news events, and use trading platforms effectively to capitalize on gold price fluctuations.

How Does Trading Differ from Investing?

Trading gold focuses on short-term price movements using leverage and active positions, aiming for frequent profits. Investing in gold typically involves buying bullion, ETFs, or stocks for long-term growth and portfolio protection, emphasizing wealth preservation rather than rapid speculative gains.

How Are Gold Markets and Prices Determined?

Gold prices are set by global supply and demand, economic indicators, and market sentiment. Spot, futures, ETFs, and gold stocks each reflect different mechanisms. Prices fluctuate with inflation expectations, interest rates, the US dollar, and geopolitical events, offering multiple trading opportunities for UK investors.

How Are Spot Prices Determined?

Spot gold prices represent the immediate market value of physical gold, quoted in USD per ounce. They are influenced by global supply, demand, central bank purchases, and investor sentiment. UK traders monitor spot prices for real-time trading decisions and to time entry or exit points.

What Are Gold Futures and Options?

Futures are contracts agreeing to buy or sell gold at a set price on a future date, offering leverage and hedging. Options provide the right, not obligation, to buy or sell. Both allow UK traders to speculate on price moves without owning physical gold.

How Can I Trade Gold ETFs and Stocks?

Gold ETFs track the price of gold and can be bought via stockbrokers, while gold stocks represent mining companies. Both provide exposure without holding physical gold. They suit beginners and long-term investors, offering liquidity and ease of trading through standard UK brokerage accounts.

Pros and Cons of ETFs vs Stocks

| Category | Instrument | Pros | Cons |

|---|---|---|---|

| Gold ETFs | ETFs | Tracks gold directly; liquid; easy to trade; low capital required | Management fees; no dividends; subject to market volatility |

| Gold Stocks | Stocks | Potential dividends; leverage company growth; indirect exposure | Company-specific risk; stock market correlation; more complex valuation |

What Moves the Price of Gold?

Gold prices fluctuate due to macroeconomic, political, and currency factors. Economic instability, inflation, interest rates, and US dollar strength all play a role. Global supply-demand dynamics, central bank policies, and investor sentiment also influence trading opportunities for UK investors.

How Do Economic and Political Uncertainties Affect Gold?

Gold is a safe-haven asset; economic crises, recessions, elections, and geopolitical tensions boost demand. Political instability often drives short-term price spikes. UK traders should monitor news events and fiscal policies to anticipate volatility and optimize entry and exit points in gold markets.

How Do Inflation and Interest Rates Impact Gold Prices?

Rising inflation typically increases gold's appeal as a hedge, while higher interest rates can reduce demand by making bonds more attractive. Traders monitor CPI, central bank statements, and bond yields to gauge how interest rate shifts affect gold prices and short-term trading strategies.

Why Does the US Dollar and Global Demand Matter?

Gold is inversely correlated with the US dollar; a weaker USD makes gold cheaper in other currencies. Global consumption by central banks, ETFs, and jewellery markets drives demand. UK traders should watch currency trends and international purchasing activity to anticipate price movements.

Who Are the Key Market Participants in Gold Trading?

- Central banks controlling reserves

- Institutional investors (hedge funds, ETFs)

- Retail traders and brokers

- Mining companies

- Jewellery and industrial demand participants

What Are the Best Strategies for Trading Gold?

Effective gold trading combines technical, fundamental, and risk-management strategies. Spot trading suits short-term traders, while long-term investment provides wealth protection. Position sizing, stop-losses, and portfolio hedging help manage risk, allowing traders to capitalize on gold price movements safely.

How Does Spot Trading Work?

Spot trading involves buying or selling gold at current market prices. Traders can capitalize on short-term volatility with leverage or direct purchases. It provides immediate exposure to gold movements but requires careful timing, monitoring, and risk management to avoid losses.

What Are the Benefits of Long-Term Investing in Gold?

Long-term investing in gold protects against inflation, diversifies portfolios, and preserves wealth during economic uncertainty. UK investors can use ETFs, stocks, or physical gold for gradual exposure. Patience allows compounding and reduced risk from short-term market fluctuations.

How Can I Manage Risk Effectively When Trading Gold?

Traders must use stop-loss and take-profit orders, diversify exposure across instruments, and monitor leverage. Position sizing, hedging strategies, and regular portfolio reviews help mitigate losses from unexpected market movements while maximizing potential gains.

Key Risk Management Tools for Trading Gold: Actions, Benefits, and Examples

| Category | Action | Purpose | Example |

|---|---|---|---|

| Risk Management | Stop-Loss | Automatically limit losses on trades | Set stop-loss at 2% below entry price |

| Risk Management | Take-Profit | Lock in gains at pre-set levels | Take-profit at 5% above entry price |

| Risk Management | Hedging | Reduce overall portfolio risk | Use ETFs, options, or correlated assets |

January 2026 Gold Price Market Update

Gold entered 2026 with steady momentum after a volatile but broadly positive 2025. Last year, prices were supported by persistent inflation concerns, central bank buying, and periods of geopolitical tension, while higher interest rates capped upside at times. Heading into January 2026, gold continues to attract safe-haven demand, trading in a stable range as investors balance slowing growth risks against expectations of future monetary easing.

Conclusion: What Should I Remember About Trading Gold?

Trading gold in the UK requires understanding markets, instruments, and macroeconomic drivers. Use FCA-regulated brokers, combine trading strategies with risk management, and consider both short-term trading and long-term investment approaches. Informed decisions and proper hedging protect capital while maximizing opportunities.

FAQs

What is the Best Time to Trade Gold?

The best time to trade gold is during periods of high market activity, as this is when liquidity and volatility are at their peak. The London and New York sessions are particularly important because they represent the largest trading hubs for gold. The overlap between these two sessions, between 1 pm and 4 pm GMT, offers the most opportunities for price movements due to the high volume of trades. Personally, I've found this overlap to be the best window for spotting lucrative short-term trades because the market is most active and responsive to global news events.

Can I Trade Gold for Portfolio Diversification?

Yes, gold is an excellent asset for portfolio diversification. Compared to stocks and forex, which can be highly volatile and directly influenced by company performance or currency fluctuations, gold tends to hold its value during times of economic uncertainty. While stocks may experience sharp declines during recessions, gold often rises as investors seek a safe haven. Forex markets, on the other hand, are susceptible to global economic and political shifts, making them more unpredictable. In my own portfolio, I like to use gold as a stabilizing force, particularly when the stock market gets rocky or the currency markets fluctuate wildly.

What Moves Gold Prices the Most?

Several key factors influence gold prices, but the most significant are inflation, political crises, and the US dollar. When inflation rises, gold becomes more attractive as a hedge, driving up demand and prices. Similarly, during times of political uncertainty, like the 2008 financial crisis or the recent COVID-19 pandemic, gold tends to rise as investors flock to safe-haven assets. The US dollar also plays a crucial role, as gold typically moves inversely to it—when the dollar weakens, gold prices often go up. Understanding these relationships helps traders anticipate potential gold price movements.

References

- "What Drives Gold Prices?" – Federal Reserve Bank of Chicago

https://www.chicagofed.org/publications/chicago-fed-letter/2021/462 - "Gold Prices: Impact of The U.S. Dollar" – APMEX

https://learn.apmex.com/investing/gold/gold-prices-impact-of-the-u-s-dollar/ - "What Moves Gold Prices?" – Investopedia

https://www.investopedia.com/articles/investing/052513/factors-influence-gold-prices.asp - "Gold Mid-Year Outlook 2022" – World Gold Council

https://www.gold.org/goldhub/research/gold-mid-year-outlook-2022

- ✓ 17,000+ markets including shares & forex

- ✓ ProRealTime & MT4 platform access

- ✓ Weekend & out-of-hours trading

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.