- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer: To Trade Oil, you’ll need to…

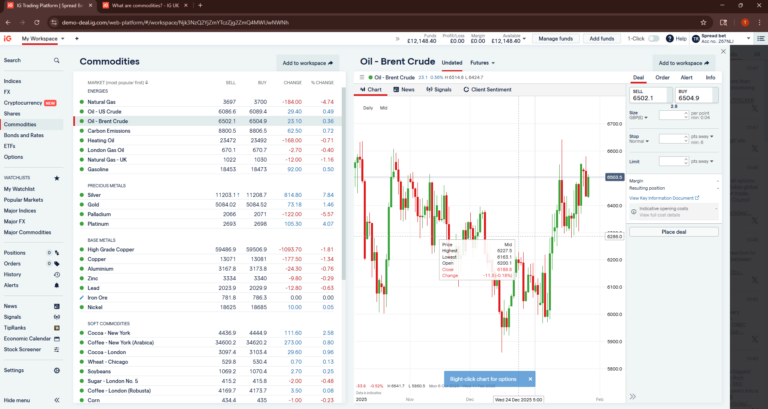

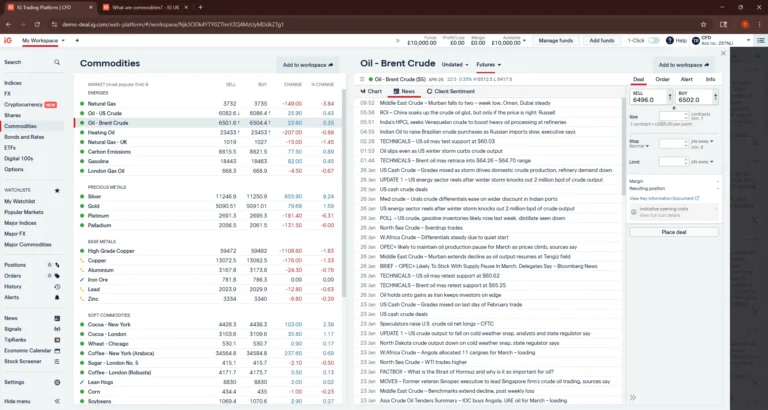

Featured Broker – IG

IG is a globally recognized broker with a comprehensive trading platform trusted by traders around the world. Offering a powerful suite of tools for trading shares, indices, forex, and options, IG is known for its deep liquidity, robust educational resources, and advanced risk management features. Regulated by the FCA and boasting decades of experience, IG is ideal for both beginner and experienced traders seeking a reliable trading environment.

- Minimum Deposit: £0 (Bank Transfer) / £50 (Card, Apple Pay)

- Invest tax-free with a flexible Stocks and Shares ISA

- Options trading via CFDs and turbo warrants

- FCA regulated and globally recognized

- Award-winning web and mobile trading platforms

- Comprehensive educational resources for all experience levels

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

What Is Oil Trading and How Does It Work?

Oil trading involves speculating on the price of crude oil without needing to store or transport the physical commodity. Traders use instruments such as futures, options, or ETFs to gain exposure, aiming to profit from price changes in global energy markets.

What’s the Difference Between Physical Oil and Financial Instruments?

Physical oil trading means buying barrels of crude for delivery, usually reserved for refiners and industrial users. Financial instruments, like futures or ETFs, let traders speculate on oil prices without owning the commodity, making it more accessible for retail investors.

What Are the Steps to Start Trading Oil?

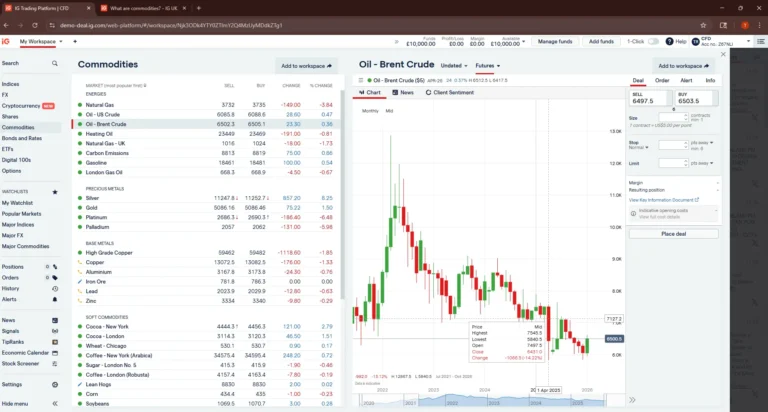

Step 1: Choose the Right Oil Market

Traders typically focus on two benchmarks: WTI and Brent. These global reference points shape most oil prices. Understanding their differences helps investors decide which market to follow, as each responds to unique supply, demand, and geopolitical factors.

What Is WTI (West Texas Intermediate)?

WTI is a light, sweet crude oil mainly sourced from the U.S. Its pricing reflects domestic supply, infrastructure, and U.S. energy policy. WTI is highly liquid and often preferred by traders focusing on American market trends and short-term price movements.

What Is Brent Crude and Why Does It Matter?

Brent crude is extracted from the North Sea and is considered the global oil benchmark. It influences two-thirds of world oil contracts, reflecting international demand and supply. Traders often favour Brent for its global relevance and broader market impact.

Step 2: Decide How You Want to Trade Oil

There are several ways to trade oil without owning barrels. You can choose spot trading, futures, options, or ETFs. Each method offers different risk levels, costs, and accessibility, so selecting the right instrument depends on your goals and experience.

What Are Spot Prices in Oil Trading?

Spot trading reflects the current price of oil for immediate delivery. While physical settlement rarely occurs for retail traders, spot contracts track real-time market conditions. They’re a straightforward way to speculate on short-term price moves.

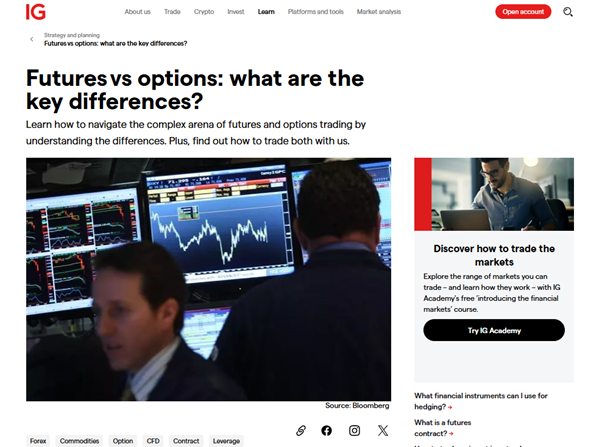

How Do Oil Futures Contracts Work?

Futures contracts are agreements to buy or sell oil at a set price on a future date. They’re widely used for hedging and speculation, but carry higher risk due to leverage and potential obligations if contracts aren’t closed before expiry.

Step 3: Open a Trading Account

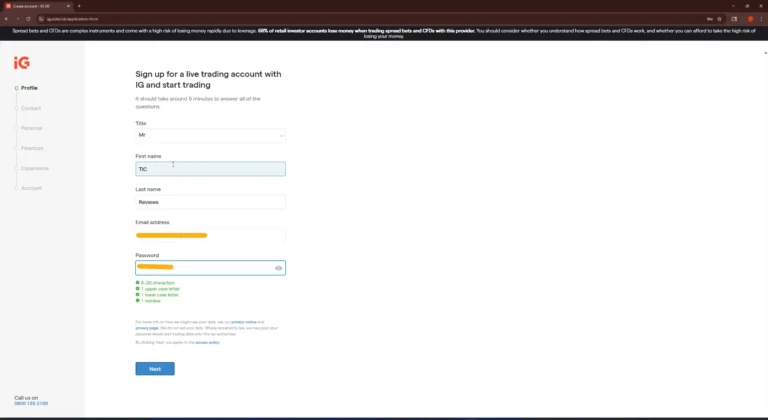

To trade oil, you’ll need a regulated broker account. Opening one provides access to oil instruments such as futures, options, or ETFs. Choosing an FCA-regulated broker ensures security, transparency, and compliance with UK standards, which is vital for beginner traders.

What Are the Steps to Opening an Account?

Opening an account involves completing an online application, verifying your identity, and funding with a debit card, bank transfer, or PayPal. Reputable brokers will run KYC checks for compliance. Once approved, you can access live trading platforms with real-time oil pricing.

Note: IG have made the signup process really straightforward, while also ensuring that they understood what kind or trader I was and how aware of the potential risks with trading and investing. Also, if you selected crypto under the accounts to start with section, you may be asked to complete a quick crypto quiz. Again, this was straightforward to complete, and while it may be tempting to cheat your way through it, the quiz is designed to ensure you have at least a basic understanding of crypto before getting involved with it.

Why Should Beginners Use Demo Accounts First?

Demo accounts let you practise trading oil with virtual funds. They replicate live market conditions without financial risk, helping beginners build confidence and test strategies. Using a demo first reduces costly mistakes before transitioning into real money trading environments.

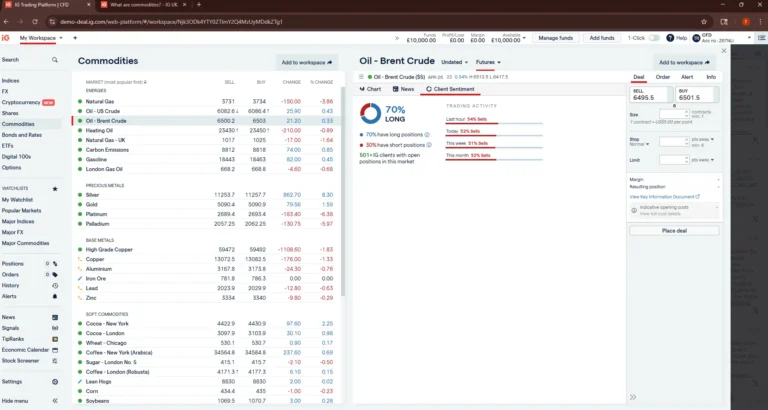

Step 4: Conduct Market Analysis

Analysing oil markets is essential before placing trades. This involves studying both fundamental drivers, like supply and demand, and technical signals from price charts. Combining both methods gives traders a clearer picture of market direction and potential entry or exit points.

What Is Fundamental Analysis in Oil Trading?

Fundamental analysis considers real-world factors such as OPEC policy, geopolitical risks, inventory reports, and global demand. These drivers impact oil supply and pricing trends. Understanding fundamentals helps traders anticipate long-term moves and avoid surprises caused by economic or political shifts.

What Is Technical Analysis in Oil Trading?

Technical analysis uses price charts, indicators, and patterns to predict oil price movements. Traders look at support, resistance, moving averages, and momentum signals. While fundamentals show “why” prices move, technicals help decide “when” to enter or exit trades.

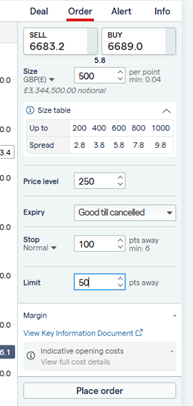

Step 5: Execute Your First Oil Trade

Once analysis is complete, traders can place their first oil trade. This involves selecting an instrument, setting position size, and managing risk. Execution should always include stop-loss orders and a clear plan for exits to avoid unexpected losses from volatility.

How Do You Place and Manage an Oil Trade?

To place a trade, choose the oil market, select buy or sell, and confirm your order. Manage trades using stop-loss and take-profit levels. Monitoring price action closely ensures discipline, while adjusting positions protects capital during volatile oil market swings.

What Factors Influence Oil Prices the Most?

Oil prices are shaped by global supply, demand, and political decisions. Geopolitical tensions, OPEC production targets, economic conditions, and the rise of renewable energy all create volatility. Traders must stay alert to these drivers, as they directly impact short- and long-term market trends.

How Do Geopolitical Events Affect Oil Prices?

Conflicts, sanctions, or instability in oil-producing regions often disrupt supply and trigger price spikes. Conversely, peace deals or production increases can lower prices. Geopolitics is one of the most unpredictable factors in oil trading, creating both opportunities and risks for investors.

Should You Trade Oil Futures or Options?

Choosing between futures and options depends on your trading style. Futures offer direct, liquid exposure but carry higher risk and obligations. Options provide flexibility, limiting losses to premiums paid. Beginners often prefer options, while experienced traders use futures for leverage and hedging.

What Are the Most Common Mistakes in Oil Trading?

Common mistakes include overleveraging, ignoring stop-losses, and trading without research. These errors magnify losses in volatile markets like oil. Beginners should avoid emotional decisions, practise with demos, and focus on disciplined strategies to improve long-term results and protect their capital effectively.

Conclusion: What Should Beginners Remember About Trading Oil?

New Clients

New Clients

You Invest

£300

You Get Up To

£1,000*

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

FAQs

Can beginners trade oil safely?

Yes, beginners can trade oil safely if they use regulated brokers, start with demo accounts, and manage risk carefully. Avoid overleveraging and only trade money you can afford to lose.

Which oil market should I trade: WTI or Brent?

Brent is the global benchmark and often preferred by international traders, while WTI reflects U.S. supply and policy. The choice depends on whether you want broader global exposure or a focus on U.S. energy trends.

Is trading oil the same as buying physical barrels?

No. Retail traders typically use futures, options, or ETFs to speculate on oil prices. This avoids handling physical barrels while still gaining exposure to price movements.

What is the minimum capital needed to start trading oil?

It depends on the broker, but many allow trading with small deposits starting from £100–£250. Beginners should start with small positions to reduce risk exposure.

Is oil trading suitable for long-term investing?

Oil can be highly volatile, making it better for short- to medium-term trading. Long-term investors may prefer ETFs or energy stocks for steadier exposure rather than direct futures or leveraged oil positions.

References

Global importance of crude oil – Oil and cracking – https://www.bbc.co.uk/bitesize/guides/zh8tng8/revision/2

How To Invest In Oil – Forbes Advisor UK – https://www.forbes.com/uk/advisor/investing/how-to-invest-in-oil/

Commodity market – Wikipedia – https://en.wikipedia.org/wiki/Commodity_market

Introduction To Trading In Oil Futures – https://www.investopedia.com/articles/active-trading/040615/introduction-trading-oil-futures.asp