- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

Quick Answer — Trading 212 or Vanguard for Investing?

Trading 212 is better for flexibility, instant access, and modern tools. Vanguard wins for simplicity and long-term investing through funds and ETFs. Choose Trading 212 if you want hands-on control; choose Vanguard for a slower, low-cost, long-term approach.

Quick Summary – Trading 212 vs Vanguard (2026)

| Feature | Trading 212 | Vanguard |

|---|---|---|

| Regulator | FCA, ASIC, BaFin, CySEC | FCA |

| Platform Fee | None | 0.15% (min £48/year for balances under £32k) |

| FSCS Deposit Protection | £120,000 | £85,000 |

| Mobile App Usability | 4.5/5 | 3.5/5 |

| Variety of Assets | 12,000+ global stocks & ETFs, CFDs, forex | Vanguard funds, ETFs & bonds only |

| ISA Available | Yes (fee-free) | Yes (0.15% + min fee applies) |

| SIPP Available | No | Yes |

| Minimum Investment | None | £500 lump sum or £100/month |

| Trust Pilot Score | 4.6/5 | 4.8/5 |

| Overall Score | 4.5/5 | 3.8/5 |

What's New in 2026?

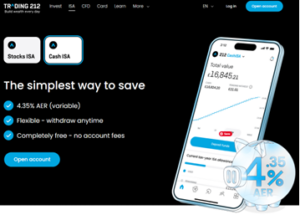

This comparison reflects significant changes to both platforms. Vanguard introduced a £48/year minimum fee (£4/month) from January 2025 for accounts under £32,000—impacting smaller investors who previously paid just 0.15%. Vanguard has also cut its Managed ISA fee from 0.30% to 0.20% and reduced fees on 13 ETFs throughout 2025.

Trading 212 continues with no platform fees and has grown to 4.5 million funded accounts with over £25 billion in client assets. FSCS deposit protection increased to £120,000 (December 2025) for Trading 212’s partner banks. Both platforms remain FCA-regulated with strong investor protections.

*Other fees may apply. See terms and fees.

What Type of Investor Is Each Platform Designed For?

Trading 212 appeals to investors who like to pick individual stocks, react to market trends, and diversify quickly. Vanguard, on the other hand, is ideal for hands-off investors aiming to build wealth gradually via funds and regular contributions.

Which Platform Offers a Better Range of Assets?

Trading 212 gives access to over 12,000 global stocks and ETFs, alongside CFDs, forex, and commodities. Vanguard limits its offering to funds, ETFs, and bonds — excellent for diversification, but far narrower than Trading 212’s multi-asset flexibility.

Trading 212 Pros and Cons

| Category | Pros | Cons |

|---|---|---|

| Fees | Commission-free trading on stocks and ETFs | FX fees on non-GBP trades |

| Usability | Fast, modern mobile and web platform | Limited advanced charting |

| Investment Range | Access to global stocks, ETFs, and CFDs | No bonds or mutual funds |

| Account Options | Includes ISA and Invest accounts | No SIPP or pension options |

| Support & Tools | User-friendly experience and community forum | Limited in-depth research or analytics |

Vanguard Pros and Cons

| Category | Pros | Cons |

|---|---|---|

| Fees | Low ongoing charges and fund expense ratios | 0.15% annual account fee up to £250,000 |

| Investments | Broad range of index funds and ETFs | No individual stock trading |

| Account Options | ISA, SIPP, and GIA available | Higher minimum investment requirements |

| Usability | Straightforward, beginner-friendly interface | Dated web design and limited mobile functionality |

| Support & Education | Excellent long-term investing resources | Few real-time trading tools or insights |

How Do Fees and Costs Compare?

Trading 212 is cheaper for frequent investors, offering commission-free trading and no account management fees. Vanguard’s costs are transparent but ongoing — investors pay a 0.15% annual platform fee and small fund charges. Over time, Vanguard’s model benefits larger, long-term portfolios.

*Other fees may apply. See terms and fees.

What Does It Cost to Trade or Invest?

Trading 212 charges no commission on trades but applies a 0.15% FX conversion fee on foreign transactions. Vanguard charges no dealing fees but applies its 0.15% annual account fee plus fund expense ratios averaging around 0.2%.

Which Platform Is Cheaper for Long-Term Investors?

For those making small, regular contributions, Trading 212 is usually cheaper since there’s no platform fee. Vanguard becomes more cost-effective for large portfolios invested in funds over several years due to low fund expense ratios and capped account fees.

Fee Comparison – Trading 212 vs Vanguard

| Fee Type | Trading 212 | Vanguard | Winner | Notes |

|---|---|---|---|---|

| Platform/Account Fee | £0 | 0.15% (min £48/year, max £375) | Trading 212 | Vanguard minimum fee hits portfolios under £32k |

| FX Conversion Fee | 0.15% per trade | None | Vanguard | Trading 212 fee applies to non-GBP trades |

| Fund Charges | N/A | ~0.10%–0.30% average | Vanguard | Ultra-low fund expense ratios |

| Trading Commission | £0 | £0 | Tie | Both offer commission-free investing |

| Withdrawal Fee | Free | Free | Tie | No withdrawal charges |

| Minimum Deposit | None | £500 or £100/month | Trading 212 | Trading 212 more accessible |

| Breakeven Point | N/A | £32,000 | — | Below £32k, Vanguard costs £48/year minimum |

| Cost Rating | 4.6/5 | 3.6/5 | Trading 212 | Trading 212 now cheaper for most investors |

How Easy Is It to Open an Account with Trading 212 or Vanguard?

Both platforms make account setup simple, but Trading 212 is faster. It offers instant online verification with no minimum deposit, while Vanguard’s process takes longer and requires an initial investment. Trading 212 is better for quick access and first-time investors.

What Are the Minimum Investment Requirements?

Trading 212 has no minimum deposit for its Invest or ISA accounts — you can start with as little as £1. Vanguard requires £500 upfront or a £100 monthly contribution, which suits long-term savers but can be restrictive for new or casual investors.

Account Comparison – Trading 212 vs Vanguard

| Account Type | Trading 212 | Vanguard | Notes |

|---|---|---|---|

| ISA | Available with no fees | Available with 0.15% annual fee | Both offer tax-efficient investing; Trading 212 cheaper |

| SIPP | Not available | Available | Vanguard supports retirement investing; Trading 212 does not |

| GIA (General Account) | Yes | Yes | Both platforms offer flexible taxable investing |

| CFD | Available | Not offered | Trading 212 includes leveraged trading; Vanguard excludes high-risk products |

| Minimum Deposit | £0 | £500 or £100 monthly | Trading 212 accessible for beginners |

| Verification Time | Instant (under 10 minutes) | 1–2 business days | Trading 212 faster to set up |

Which Assets Can You Trade or Invest In?

Trading 212 provides over 12,000 global stocks, ETFs, forex, and CFDs. Vanguard focuses on long-term investments, offering funds, ETFs, and bonds. Trading 212 wins for active investors seeking variety, while Vanguard suits those committed to steady portfolio growth.

Which Platform Offers Better Tax-Efficient Investing?

Both platforms offer ISAs, but Vanguard’s SIPP gives it an edge for retirement savings. However, Trading 212’s ISA has no platform fee, making it more appealing for investors seeking flexibility without ongoing costs.

Does Trading 212 or Vanguard Provide a SIPP?

Trading 212 does not currently offer a SIPP. Vanguard provides both an ISA and a SIPP, ideal for long-term investors saving for retirement. Its pension product allows regular contributions and access to a wide range of low-cost funds.

ISA and SIPP Comparison – Trading 212 vs Vanguard

| Feature | Trading 212 | Vanguard | Winner |

|---|---|---|---|

| Stocks & Shares ISA | Yes (free) | Yes (0.15% annual fee) | Trading 212 |

| SIPP | No | Yes | Vanguard |

| Tax Efficiency | High (ISA wrapper) | High (ISA + SIPP) | Vanguard |

| Minimum Deposit | £0 | £500 or £100 monthly | Trading 212 |

| Ease of Use | Instant setup | Longer verification | Trading 212 |

| Best For | Active investors seeking flexibility | Long-term savers building retirement funds | Depends |

Which App Is More User-Friendly?

Trading 212 provides a fast, modern, and intuitive app experience suited to active traders and beginners alike. Navigation is smooth, and order execution is instant. Vanguard’s app is functional but basic, aimed at long-term investors who make infrequent trades rather than daily portfolio adjustments.

Does Either Platform Offer Research or Advanced Tools?

Trading 212 includes basic charting, price alerts, and a demo account, but lacks deep research or technical screening tools. Vanguard offers detailed fund data and performance summaries, better for portfolio planning than trading analytics. Overall, Trading 212 feels more dynamic day to day.

Platform Experience Summary – Trading 212 vs Vanguard

| Feature | Trading 212 | Vanguard | Notes |

|---|---|---|---|

| Mobile App Experience | Modern, responsive, and intuitive | Functional but dated | Trading 212 offers better design and usability |

| Web Platform Speed | Fast, live data updates | Basic navigation and slower load times | Trading 212 performs better for active use |

| Research Tools | Basic analytics and charts | Strong fund data, limited analysis | Vanguard better for long-term research |

| Demo Account | Yes, full-featured practice mode | No demo or trial mode | Trading 212 ideal for beginners |

| User Experience Rating | 4.6/5 | 3.9/5 | Trading 212 delivers a smoother, more modern interface |

What Learning Tools Does Each Platform Offer?

Trading 212 provides a strong educational suite through its Learning Centre — videos, tutorials, and a demo account. Vanguard focuses on financial literacy and long-term investing, offering articles and guides but no interactive learning tools. Both support investors at different stages.

Which Is Better for Beginners?

Trading 212 is better for beginners who want hands-on practice through simulated trading and in-app tutorials. Vanguard is better for those looking to understand investing principles and long-term planning but offers less practical engagement.

Education & Support Summary – Trading 212 vs Vanguard

| Category | Trading 212 | Vanguard | Winner |

|---|---|---|---|

| Learning Resources | Comprehensive tutorials and demo mode | Educational articles and guides | Trading 212 |

| Beginner Support | Interactive and visual learning | Theory-focused content | Trading 212 |

| Community Presence | Active online and social channels | Minimal community engagement | Trading 212 |

| Customer Support | In-app chat and email | Email and phone support | Vanguard |

| Overall Accessibility | 4.4/5 | 4.0/5 | Trading 212 |

What Learning Tools Does Each Platform Offer?

Trading 212 provides a strong educational suite through its Learning Centre — videos, tutorials, and a demo account. Vanguard focuses on financial literacy and long-term investing, offering articles and guides but no interactive learning tools. Both support investors at different stages.

Which Is Better for Beginners?

Trading 212 is better for beginners who want hands-on practice through simulated trading and in-app tutorials. Vanguard is better for those looking to understand investing principles and long-term planning but offers less practical engagement.

Education & Support Summary – Trading 212 vs Vanguard

| Category | Trading 212 | Vanguard | Winner |

|---|---|---|---|

| Learning Resources | Comprehensive tutorials and demo mode | Educational articles and guides | Trading 212 |

| Beginner Support | Interactive and visual learning | Theory-focused content | Trading 212 |

| Community Presence | Active online and social channels | Minimal community engagement | Trading 212 |

| Customer Support | In-app chat and email | Email and phone support | Vanguard |

| Overall Accessibility | 4.4/5 | 4.0/5 | Trading 212 |

Are Both Platforms FCA-Regulated?

Yes, both are authorised and regulated by the Financial Conduct Authority (FCA) in the UK, ensuring client funds are protected under the FSCS up to £85,000. Both maintain segregated client accounts, meaning your money is held separately from company funds.

Security Comparison – Trading 212 vs Vanguard

| Security Feature | Trading 212 | Vanguard | Notes |

|---|---|---|---|

| Regulation | FCA regulated | FCA regulated | Both covered by FSCS up to £85,000 |

| Data Protection | 256-bit encryption and biometric login | Two-step verification and secure login | High standards on both platforms |

| Client Fund Segregation | Yes | Yes | Funds held separately from company assets |

| Account Verification | Instant online KYC | Manual ID verification | Trading 212 faster for onboarding |

| Fraud Protection | Active transaction monitoring | Strong compliance oversight | Both platforms maintain high protection levels |

| Overall Security Rating | 4.5/5 | 4.4/5 | Tied in safety; Trading 212 slightly more seamless for users |

Final Verdict – Which Platform Should You Choose?

The 2026 landscape favours Trading 212 for cost-conscious and active investors. With no platform fees, 4.5 million users, and FSCS deposit protection now at £120,000, it delivers exceptional value for hands-on stock and ETF investing. Vanguard’s new £48 minimum fee makes it less competitive for portfolios under £32,000—a significant shift from its previous ultra-low-cost positioning.

Trade Smarter, not Harder

- Invest as little as £1

- Earn daily interest

- Earn 4.9% AER on GBP

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

FAQs

What is a General Investment Account and how does it differ from an ISA or SIPP?

A General Investment Account (GIA) offers a flexible way to invest in stocks, bonds, and funds without the tax-free benefits of an ISA or the retirement focus of a SIPP. Unlike ISAs, there’s no annual contribution limit, but taxes on dividends and capital gains may apply.

Can you provide information on Vanguard Funds available for investment?

Vanguard Funds are renowned for their low-cost, broad-market index and active mutual funds. Investors can choose from a variety of options, including equity, bond, and balanced funds, catering to different risk tolerances and investment goals.

How user-friendly is the Vanguard Platform for new investors?

The Vanguard Platform is designed with simplicity and ease of use in mind, making it accessible for new investors. It offers a straightforward approach to investing in Vanguard’s wide array of mutual funds and ETFs, complete with educational resources to guide decision-making.

What types of Retail Investor Accounts does Vanguard offer?

Vanguard offers several types of Retail Investor Accounts including Individual Savings Accounts (ISAs), General Investment Accounts (GIAs), and Self-Invested Personal Pensions (SIPPs), each designed to meet different financial goals and investment needs.

How do Trading Platforms like Trading 212 compare to Vanguard in terms of fees and services?

Trading Platforms like Trading 212 offer commission-free trading on stocks, ETFs, and other securities*, appealing to active traders. In contrast, Vanguard focuses on long-term investing with low-cost mutual funds and ETFs, charging an annual platform fee based on account balance, but providing extensive educational and planning tools.

*Other fees may apply.