- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

A Stocks and Shares ISA and a pension are two of the UK’s most popular tax-efficient investment wrappers. Both help you grow wealth for the future, but they differ in access, tax treatment, and retirement suitability. This guide compares their features to help you choose.

IG

ISA Score: 4.6/5

68% of Retail CFD Accounts Lose Money

Interactive Investor

ISA Score: 4.5/5

Trading and investing involve risk. Capital at Risk

Quick Answer: Which is Better, a Stocks and Shares ISA or a Pension?

A pension generally delivers stronger long-term tax relief and retirement benefits, while a Stocks and Shares ISA provides greater flexibility and tax-free withdrawals. The best choice depends on your age, income, and savings goals, with many investors choosing to use both wrappers together.

What is the argument that a Stocks and Shares ISA might be better?

A Stocks and Shares ISA may be better for investors seeking flexibility and control. Withdrawals are tax-free and unrestricted by age, making them ideal for medium-term goals. ISAs also simplify tax planning, avoid withdrawal penalties, and appeal to those prioritising accessibility alongside investment growth.

Understanding the Basics

| Feature | Stocks and Shares ISA | Pension |

|---|---|---|

| Tax relief on contributions | No tax relief | Tax relief at marginal rate |

| Tax on withdrawals | Tax free | 25% tax free lump sum then taxed as income |

| Annual allowance | 20000 | 60000 or 100 percent of earnings (lower applies) |

| Access age | Anytime | 55 (57 from 2028) |

| Flexibility | High | Low |

| Employer contributions | Not available | Yes workplace pensions usually match contributions |

| Carry forward rules | No | Yes up to 3 years unused allowance |

| Inheritance rules | Transfers tax free | Passes tax free if under 75 then taxed |

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a UK tax-efficient investment account. You can invest up to the annual ISA allowance in shares, funds, or ETFs. Returns are free from income tax and capital gains tax, and withdrawals can be made anytime without penalties.

What is a Pension?

A pension is a long-term savings vehicle designed for retirement. Contributions often receive tax relief, and many employers match payments through workplace pensions. Funds grow tax-free, but withdrawals are generally restricted until at least age 55 (57 from 2028), with tax applied on most income taken.

How do tax rules differ between ISAs and pensions?

ISA investments grow free of income and capital gains tax, and withdrawals remain untaxed. Pensions provide upfront tax relief on contributions, boosting savings, but withdrawals are taxable beyond a 25% tax-free lump sum. ISAs prioritise flexibility, while pensions focus on maximising retirement-focused tax efficiency.

What are the contribution limits?

The ISA annual allowance is £20,000, usable across cash or stocks and shares ISAs. Pension contributions are capped at the lower of £60,000 or 100% of earnings, though high earners may face reduced allowances. Unused allowances can sometimes be carried forward for pension contributions.

ISA vs Pension – Which is a Better Investment?

How do their benefits compare in practice?

Pensions are stronger for retirement due to tax relief and employer contributions, which accelerate growth. Stocks and Shares ISAs offer flexibility, allowing withdrawals without penalties. Both deliver tax efficiency but serve different goals: pensions lock in long-term benefits, while ISAs provide accessible medium-to-long-term savings.

Which offers stronger tax advantages?

Pensions generally offer stronger tax advantages. Contributions benefit from tax relief at your marginal rate, and growth compounds tax-free. ISAs provide tax-free growth and withdrawals, but without upfront relief. For higher-rate taxpayers, pensions usually give a bigger boost, while ISAs still deliver strong, flexible tax efficiency.

Which is more flexible for withdrawals?

Stocks and Shares ISAs are more flexible because you can access funds at any time without penalties or taxes. Pensions restrict access until a minimum age and then tax withdrawals as income beyond a 25% tax-free allowance. ISAs suit flexible goals, pensions secure retirement needs.

Which is more suitable for retirement planning?

Pensions are usually more suitable for retirement planning because of upfront tax relief, employer contributions, and rules encouraging long-term savings. ISAs work well for supplementary investments or medium-term goals but lack matching contributions. Most retirement strategies prioritise pensions while also using ISAs for added flexibility.

Should I Invest in a Stocks and Shares ISA or Pension? Pros and Cons

Stocks and Shares ISA pros and Cons

Withdraw anytime without penalties

Tax-free growth and withdrawals

Wide investment choice

Simpler rules than pensions

No age restrictions on access

No tax relief on contributions

No employer contributions

Annual allowance capped at £20,000

Funds may be too accessible, risking early spending

Less suited for retirement-only savings

Favouring an ISA over a pension provides flexibility and tax-free withdrawals but sacrifices upfront tax relief and employer contributions. ISAs suit medium-term investors and those seeking control, while pensions are usually more efficient for retirement. Many investors combine both to balance access and long-term growth.

Pension Pros and Cons

Upfront tax relief on contributions

Employer contributions boost savings

Larger annual allowance than ISAs

Funds grow tax-free until withdrawal

Encourages disciplined long-term saving

Restricted access until minimum pension age

Withdrawals taxed beyond 25% tax-free lump sum

Lifetime allowance implications may apply

Complex rules and tapering for high earners

Less flexible for short-term needs

Will I Make More Money from an ISA or Pension?

Pensions usually generate more money long term due to upfront tax relief, employer contributions, and decades of compounding. ISAs can match returns on investments but lack these boosts. For retirement, pensions often win financially, while ISAs suit goals needing flexible access to capital.

Investment opportunities and growth potential

Both ISAs and pensions allow investment in shares, funds, and ETFs, so growth potential is similar. Pensions typically outperform long term because of employer contributions and tax relief. In the UK, pension funds averaged nearly 8% annual growth over five years, reinforcing retirement-focused potential (FTAdviser 2024).

Charges and fees comparison

ISAs and pensions often have similar investment charges, including fund fees and platform costs. Workplace pensions may benefit from lower negotiated fees. Personal pensions and ISAs both vary widely, making cost comparison essential. Long-term compounding means even small fee differences significantly impact outcomes.

Can I Access My ISA or Pension When I Need the Money?

Can I access my Stocks and Shares ISA whenever I want?

Stocks and Shares ISAs allow withdrawals anytime without penalties or tax, making them highly flexible. Over 22 million UK adults now hold an ISA, highlighting their popularity for accessible tax-free savings (Tax Foundation). Flexibility makes ISAs attractive for shorter-term or supplementary investment goals.

When can I access my pension savings?

Pensions are generally inaccessible until at least age 55 (rising to 57 from 2028). Early access is only possible in limited circumstances, such as severe ill health. In 2023, 88% of eligible employees participated in workplace pensions, reflecting strong adoption for long-term retirement security (GOV.UK).

Which option is better for flexibility, ISA or pension?

ISAs are far more flexible, as funds can be withdrawn at will. Pensions deliberately restrict access to safeguard retirement savings. Flexibility suits investors who may need liquidity, while pensions suit those prioritising retirement planning with discipline enforced through access restrictions.

What Are the Best Stocks and Shares ISA Platforms?

Which are the top ISA platforms in the UK?

Leading ISA investment platforms include IG, Interactive Investor, and eToro. Each provides different strengths, from wide investment choice to low-cost dealing and strong trading tools. Your best option depends on whether you prioritise affordability, advanced features, or simple access to global markets.

What fees and features should I compare?

Compare platform fees, dealing charges, and fund costs carefully. IG offers competitive trading tools, Interactive Investor provides a flat-fee structure, and eToro includes commission-free share dealing with social trading features. Assess features against your goals and investing style before choosing.

Which ISA platforms are best for beginners?

Beginners may find eToro attractive for simplicity and social trading, while Interactive Investor suits those wanting a straightforward flat-fee model. IG appeals to investors ready for advanced trading tools. For a full breakdown, see our best stocks and shares ISA guide.

How Are ISAs and Pensions Treated for Tax and Retirement?

Do pensions offer tax relief and ISAs tax-free withdrawals?

Pensions provide upfront tax relief on contributions, making every pound invested more powerful. ISAs lack this but compensate with tax-free withdrawals. Pension withdrawals are taxed as income, beyond the 25% tax-free lump sum, while ISAs remain tax-free at every stage of investment.

Which is more tax-efficient, ISA or pension?

For retirement-focused savers, pensions are usually more tax-efficient, especially for higher-rate taxpayers benefitting from greater relief. ISAs, however, offer complete tax-free flexibility at withdrawal. Many investors maximise pension contributions to capture relief, then use ISAs for additional, flexible, tax-free savings.

Final Thoughts

Stocks and Shares ISAs provide flexibility, tax-free withdrawals, and accessibility, while pensions deliver upfront tax relief and powerful retirement growth. The right choice depends on goals, income, and timelines. Many investors benefit from using both, combining pensions for retirement security with ISAs for flexible, tax-free investing.

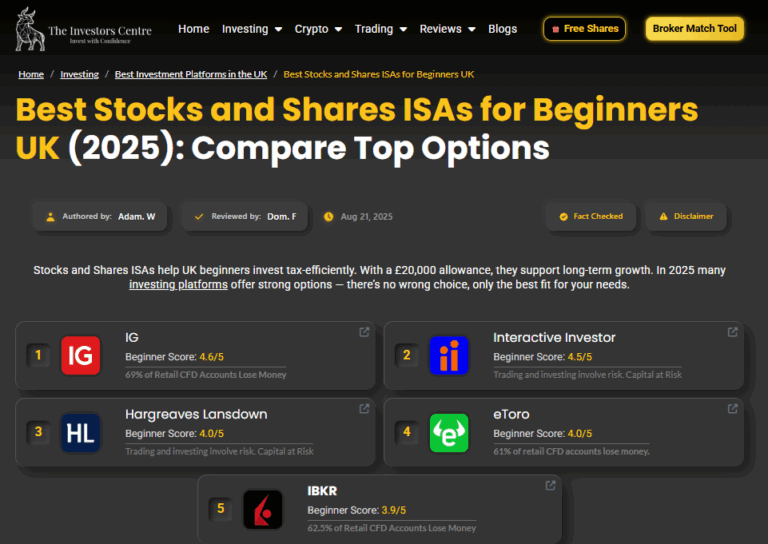

Top 5 Platforms

1

IG

68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

2

interactive investor

Trading and investing involve risk. Capital at Risk

3

Hargreaves Lansdown

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

4

eToro

61% of retail CFD accounts lose money when trading CFD’s with this provider.

5

IBKR

62.5% of Retail CFD Accounts Lose Money

Still Not Sure Which Platform?

FAQs

Which investment platform is best for Stocks and Shares ISA's in the UK?

You cannot directly transfer funds between an ISA and a pension. Withdrawals from an ISA could be contributed into a pension, subject to limits. Similarly, pension withdrawals can be invested into an ISA, but tax and age rules apply.

Is it better to max out my ISA or pension first?

For most retirement-focused investors, maximising pension contributions is more efficient due to tax relief and employer matching. ISAs should be funded for flexibility or additional savings. The balance depends on your tax position, goals, and access needs before retirement age.

What happens if I exceed contribution limits?

Exceeding ISA allowances leads to penalties and removal of excess funds. Pension contributions beyond the annual allowance may lose tax relief and incur charges. Monitoring contributions ensures compliance and avoids costly penalties while maximising available allowances effectively each year.

Can I invest in the same funds in both?

Yes, many of the same funds and ETFs are available in both ISAs and pensions. The difference lies in tax treatment and accessibility, not investment choice. Investors often hold similar portfolios in both wrappers to diversify across time horizons and tax advantages.

References

FSCS – What we cover (protection details)

https://www.fscs.org.uk/what-we-cover/FCA guidance for firms explaining ISA vs pension to customers

https://www.fca.org.uk/firms/helping-firms-provide-more-support-customers-making-investment-decisionsFSCS – Pension investment protection and advice claims

https://www.fscs.org.uk/what-we-cover/pensions/