Saxo Review 2026 | Is It the Best Broker for Pros?

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer — Would We Recommend Saxo in 2026?

Saxo remains a high-quality, well-regulated broker with excellent platforms and market depth heading into 2026. However, it’s best suited to serious traders and investors with larger balances. Fees are higher than rivals like IG or Pepperstone, but the execution quality and reliability justify the premium for professionals.

What’s Our Overall Take on Saxo Right Now?

Saxo stands out for its advanced tools, range of assets, and bank-level security. It’s not the most beginner-friendly option, but for experienced traders seeking a professional-grade environment in 2026, it performs exceptionally well. A trusted broker — though not the cheapest or simplest.

Quick Summary — How Saxo Scores Across Key Categories

| Category | Score (out of 5) | Comment |

|---|---|---|

| Regulation & Safety | 5.0 | Strong global oversight, FCA-regulated |

| Platform & Tools | 4.5 | Professional-grade design and speed |

| Fees & Commissions | 3.5 | Premium pricing tiers |

| Market Range | 5.0 | Outstanding global access |

| Education & Research | 4.0 | Solid, data-rich content |

| Overall Experience | 4.0 | Excellent but not ideal for all traders |

64% of retail investor accounts lose money when trading CFDs with this provider.

What Is Saxo and Who Is It Really For?

Saxo is a Danish investment bank offering multi-asset trading across global markets. It caters to sophisticated retail and professional clients who value range, precision, and security. It’s ideal for traders who want more control and access than typical CFD brokers provide.

Is Saxo a Good Choice for Beginners?

Not really. Saxo’s platform is powerful but complex for newcomers. The learning curve can feel steep, and the higher minimum deposits deter casual traders. Beginners may find simpler brokers like IG or Spreadex more approachable while still staying within regulated UK options.

Does Saxo Offer a Demo Account for Practice?

Yes, Saxo provides a free demo account that mirrors live-market conditions. It’s available for 20 days, allowing users to test SaxoTraderGO and SaxoTraderPRO platforms risk-free. It’s ideal for exploring platform depth before committing real funds.

Who Does Saxo Suit Best — Active Traders or Long-Term Investors?

Saxo is best for active traders, wealth managers, and investors with larger portfolios. Its institutional-grade access, bond trading, and advanced charting make it perfect for those managing multi-asset strategies or long-term investments rather than short-term speculative trading.

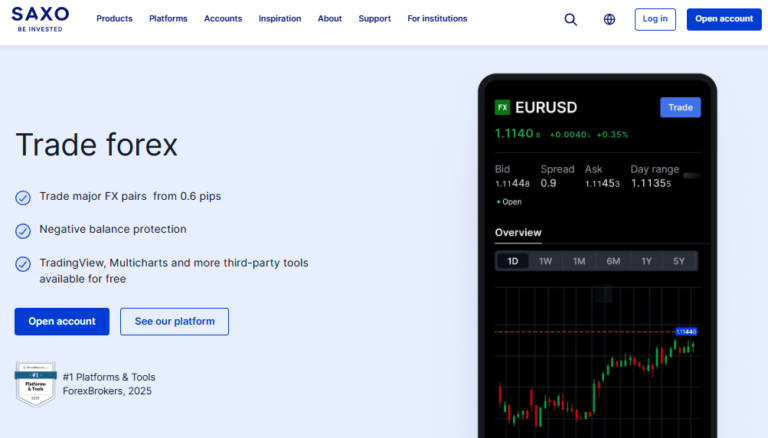

What Can You Trade on Saxo in the UK?

Saxo gives UK traders exceptional market access, covering nearly every major asset class. From forex and global equities to ETFs, bonds, and commodities, it’s built for investors who value variety and depth. Few brokers match its international reach or product range.

Which Asset Classes Are Available to UK Clients?

UK clients can trade forex, indices, shares, commodities, ETFs, bonds, futures, and options. Saxo offers direct share ownership alongside leveraged CFD trading. This dual access makes it appealing for those managing diversified portfolios across global and domestic markets.

How Broad Is Saxo’s Market Access Compared to Rivals?

Saxo outpaces most UK brokers in asset diversity. While IG and Pepperstone focus mainly on CFDs, Saxo extends into physical shares, government and corporate bonds, and multi-currency portfolios. It feels closer to a private bank experience than a standard trading account.

Can You Trade Crypto, Bonds, or ETFs with Saxo?

Yes. Saxo lets UK clients trade a limited range of crypto ETPs, not direct coins. Bond and ETF access is exceptional, spanning thousands of instruments globally. It’s ideal for investors seeking exposure across markets while staying under a single regulated account.

| Asset Class | Availability for UK Clients | Comment |

|---|---|---|

| Forex | Available | Major and minor currency pairs supported |

| Shares | Available | Direct access to global stock exchanges |

| Commodities | Available | Metals, energy, and agriculture via CFDs |

| ETFs | Available | Extensive global ETF selection |

| Bonds | Available | Government and corporate bonds offered |

| Crypto ETPs | Limited | Access through regulated exchange products only |

| Options/Futures | Available | Professional-grade derivatives trading |

| Spread Betting | Not available | Saxo does not provide spread betting accounts |

How Good Are Saxo’s Platforms and Tools?

Saxo’s platforms remain world-class. Both SaxoTraderGO and SaxoTraderPRO deliver exceptional speed, depth, and precision. They’re designed for serious traders, offering institutional-grade charting, order control, and data visualisation. Beginners may find them complex, but professionals will appreciate their refinement and reliability.

What Features or Tools Set Saxo Apart?

Saxo’s standout features include advanced charting, direct market access, portfolio analytics, and institutional-level execution. Traders can access in-depth research, sentiment tools, and algorithmic trading through SaxoTraderPRO. It feels more like a professional terminal than a retail app.

How Smooth Is the Experience Across Web, Mobile, and Desktop?

The user experience is seamless. SaxoTraderGO syncs perfectly across desktop, tablet, and mobile. Performance is stable, order execution is fast, and the design is consistently clean. It’s built for precision trading without lag or clutter.

| Platform | Best For | Key Features | User Experience |

|---|---|---|---|

| SaxoTraderGO | Everyday and active traders | Multi-asset access, synced layouts, advanced charting | Smooth, responsive, and highly intuitive |

| SaxoTraderPRO | Professional and institutional users | Deep liquidity, algorithmic trading, advanced risk tools | Complex but extremely powerful |

| Mobile App | On-the-go traders | Watchlists, live charts, order management | Clean interface with strong stability |

| Research Hub | All users | Real-time news, sentiment, and technical analysis | Data-rich and reliable |

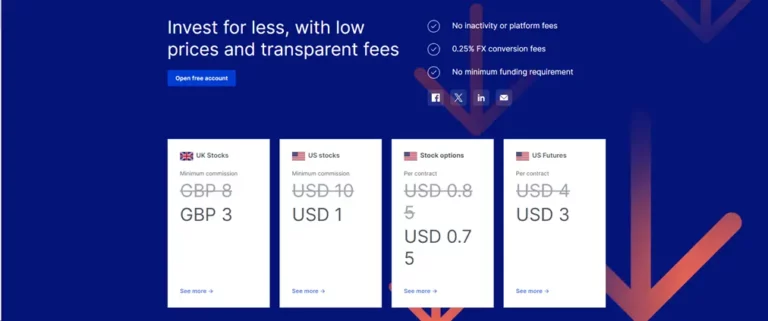

How Much Does It Cost to Use Saxo?

Saxo is a premium-priced broker. Trading fees are competitive for large accounts but higher for smaller traders. The tiered pricing structure rewards volume. Despite higher entry costs, clients get professional execution, tighter spreads at higher tiers, and solid transparency.

Are Saxo’s Fees Competitive or Premium-Priced?

Premium. Saxo’s spreads and commissions are higher than Pepperstone or IG but reflect its institutional execution and data access. High-volume traders benefit most, while casual users might find the cost less attractive compared to mainstream CFD brokers.

What’s the Minimum Deposit for UK Clients?

The standard UK account requires a £500 minimum deposit. Saxo Platinum and VIP tiers require £200,000 and £1 million respectively, offering tighter pricing, dedicated support, and advanced research. Entry-level clients still access the same core platform and asset range.

| Broker | Average Forex Spread | Share Commission | Withdrawal Fee | Inactivity Fee | Overall Cost Rating |

|---|---|---|---|---|---|

| Saxo | 0.8 pips (EUR/USD) | From £3 per trade | None | £25 quarterly | 4.0/5 |

| IG | 0.6 pips (EUR/USD) | £3 per trade | None | £12 after 24 months | 4.2/5 |

| Pepperstone | 0.1–0.3 pips (Raw account) | None | None | None | 4.6/5 |

| Spreadex | 0.6 pips (EUR/USD) | No commission | None | £1 per month after inactivity | 4.3/5 |

Is Saxo Secure and Well-Regulated?

Yes — Saxo is one of the most secure brokers globally. It’s a fully licensed bank regulated by the FCA in the UK and other Tier-1 authorities. Client funds are held separately, and the company’s 30-year track record reinforces its reliability.

| Protection Area | Details | Rating |

|---|---|---|

| Regulation | FCA (UK) & Danish FSA oversight | 5/5 |

| Fund Segregation | Client funds held at Tier-1 banks | 5/5 |

| Investor Compensation | FSCS up to £85,000 | 5/5 |

| Data Encryption | Bank-grade SSL and MFA | 5/5 |

| Financial Stability | Strong global balance sheet | 5/5 |

| Overall Security Rating | — | 5.0 / 5 — Excellent |

Final Verdict — Is Saxo Worth It in 2026?

Saxo remains one of the most professional trading environments available to UK investors in 2026. Its precision, asset range, and regulatory strength make it a serious choice for experienced traders. However, its higher costs and complex platform mean it’s not ideal for beginners.

Where Could Saxo Still Improve?

Fees remain high for smaller accounts, and the platform can feel dense for new users. Adding simplified layouts and lowering entry barriers would broaden its appeal. 24/7 support would also help it compete better with rivals like IG and Pepperstone.

How Does Saxo Rate Overall?

Overall, Saxo earns a 4.0 out of 5 for 2026. It scores highly for safety, execution, and asset diversity but loses points on accessibility and pricing. It’s a premium broker designed for clients who value quality over low-cost trading.

- Premium Trading Platform

- Institutional-Grade Asset Access

- Trusted Global Regulation

64% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Is Saxo good for beginners?

Saxo isn’t ideal for beginners due to its high minimum deposits, advanced tools, and lack of commission-free trading. It’s best suited for experienced, confident investors.

What is the minimum deposit to open a Saxo account?

The minimum deposit starts at £500 for the Essential account. To unlock better pricing and features, you’ll need £2,000 for Classic, £50,000 for Platinum, or £200,000+ for VIP.

Does Saxo offer commission-free trading?

No, Saxo charges commissions on stock trades and spreads on forex. However, the pricing becomes more competitive with higher account tiers.

Can I trade cryptocurrency with Saxo?

Saxo doesn’t offer direct crypto trading, but you can gain exposure through regulated crypto ETPs — ideal for investors who prefer indirect, exchange-listed products.

What platforms does Saxo provide?

Saxo offers two platforms: SaxoTraderGO (web/mobile) and SaxoTraderPRO (desktop), both built for professional-level trading with powerful tools and charting.

References

- ✓ 0% Commission (other fees apply)

- ✓ 5,000 Markets — FX, Stocks

- ✓ Free to open · £20 minimum deposit

62% of retail investor accounts lose money when trading CFDs with this provider.