Trading 212 Cash ISA Review 2026: Rates, Benefits & User Verdict

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

What’s New for 2026?

The Autumn Budget 2025 announced significant changes for Cash ISA savers. From April 2027, under-65s will only be able to contribute £12,000 per year to a Cash ISA (down from £20,000), with the remaining £8,000 of the ISA allowance reserved for Stocks & Shares ISAs. Over-65s retain the full £20,000 Cash ISA allowance. This makes 2026 an important year to maximise your Cash ISA contributions before the new limits take effect.

Additionally, FSCS protection has increased from £85,000 to £120,000 as of late 2024, giving savers greater peace of mind. Trading 212 continues to offer one of the most competitive flexible Cash ISA rates on the market for those looking to make the most of their tax-free savings before the rules change.

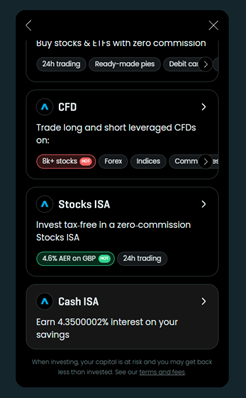

Trading 212 Overview

Use code ‘TIC’ to get a free fractional share worth up to £100

- Minimum Deposit: £1 (via bank transfer or card)

- Invest in stocks, ETFs, and forex with zero commission*

- FCA regulated and trusted by over 2 million users

- Intuitive mobile and web platforms with real-time data

- Interest on cash, ISA Account available

*Other fees may apply. See terms and fees.

Trading and investing involve risk. The value of your investments can go up or down, and you may lose all or part of your capital. These products may not be suitable for all investors. Please ensure you fully understand the risks involved.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

What is the Trading 212 Cash ISA?

Looking for a simple way to grow your savings tax-free in 2026? The Trading 212 Cash ISA offers a competitive interest rate, flexible access, and a sleek app experience. Here’s everything UK savers need to know before opening an account this year.

*Other fees may apply. See terms and fees.

How does a Cash ISA work?

A Cash ISA allows UK residents to save up to £20,000 yearly without paying tax on interest. It’s a simple, secure way to grow savings, ideal for anyone wanting a tax-free boost, whether for an emergency fund, future house deposit, or general savings.

Who is the Trading 212 Cash ISA best suited for?

It’s best for digital-first savers who value managing finances on their phone. If you like quick setup, transparent rates, and seeing investments and cash ISAs side by side in one app, this is built for you — without queues or in-branch hassle.

How Does the Trading 212 Cash ISA Work?

This flexible ISA is opened and run entirely through the Trading 212 app. You can start saving from £1, deposit instantly, and track daily interest growth. Withdrawals are simple and usually processed within three working days, letting you access funds when needed.

Opening an Account in Minutes

Sign up directly in the Trading 212 app using your email, provide your National Insurance number, and verify your ID. It’s a paperless process that takes only a few minutes, with most accounts approved almost instantly — perfect for those who value speed.

Funding and Managing Your ISA

Top up your Cash ISA with as little as £1 through instant bank transfers. Monitor your balance, see interest earned daily, and set up scheduled deposits all in the app. It’s designed for full control without needing to speak to anyone or fill in forms.

Flexible ISA Means More Control

Being a flexible ISA, if you withdraw funds and redeposit them within the same tax year, it doesn’t impact your annual allowance. This gives you freedom to manage cash flow — take money out when needed and replace it later without losing your tax benefits.

Trading 212 Cash ISA Interest Rates: How Much Can You Earn?

Trading 212 offers a strong variable rate — starting at 3.85% AER for new customers (including a 12-month bonus). Interest is paid monthly and compounded daily, so your money grows consistently without waiting for an annual payout.

Current Interest Rates Explained

New customers enjoy a 0.71% bonus for 12 months, giving a total of 4.81% AER. Existing customers earn 4.1%. Interest compounds daily and is credited monthly, so your balance grows steadily — all tax-free inside your annual ISA allowance.

How Does It Compare to Other ISAs?

Trading 212’s Cash ISA is among the highest flexible easy-access options available. While competitors offer attractive fixed rates, they often require locking up funds. Here’s how it stacks up:

| Provider | AER | Access | Notable Features |

|---|---|---|---|

| Trading 212 | 4.81% | Flexible | App-based, FSCS, tax-free growth |

| Santander | 4.25% | 1yr Fixed | £50 bonus on transfer in |

| Chase UK | 3.0% | Instant | Daily interest, app-only |

| Nationwide | 4.25% | 1yr Fixed | Online & branch access |

Are There Any Fees?

No — Trading 212’s Cash ISA is completely fee-free. There are no account setup costs, no monthly maintenance charges, and no penalties for withdrawing money*. You simply earn interest on your savings, with all tax benefits intact, without worrying about surprise deductions.

*Other fees may apply. See terms and fees.

How Fast Can You Withdraw Funds?

Withdrawals from the Trading 212 Cash ISA typically take up to three business days. There are no penalties or impacts on your annual ISA allowance thanks to its flexible status, meaning you can safely dip in and out without losing tax-free benefits.

Trading 212 Cash ISA vs Stocks & Shares ISA

Trading 212’s Cash ISA keeps your money secure and accessible, earning steady interest. By contrast, their Stocks & Shares ISA invests in markets, aiming for higher long-term returns but with more risk. Both are tax-free up to your £20,000 allowance.

| Feature | Cash ISA | Stocks & Shares ISA |

|---|---|---|

| Risk | Low | Medium to High |

| Returns | Interest only | Dividends & capital growth |

| Access | Immediate | Need to sell investments first |

| FSCS Protection | Yes | Yes |

| Best For | Emergency, short-term | Long-term investing |

Why many investors use both

Using both ISAs helps balance financial goals. The Cash ISA offers instant, low-risk savings for emergencies, while the Stocks & Shares ISA targets growth over years. This approach combines security with the potential for higher long-term returns.

Is the Trading 212 Cash ISA Safe?

Trading 212’s Cash ISA is secure, combining regulatory safeguards with strong platform security. Your money is protected up to £85,000, and advanced encryption plus two-factor authentication keep your account safe from fraud.

FSCS Protection

Your deposits are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000. This means if Trading 212 or its partner banks fail, your money is still secure under UK regulations.

Trading 212 Platform Security

Trading 212 employs encryption, mandatory two-factor authentication (2FA), and holds funds with regulated banking partners. These layers of protection help safeguard your account against hacking and unauthorised access.

How Are My Taxes Affected by this ISA?

Interest earned in your Trading 212 Cash ISA is completely tax-free. You won’t pay income tax or report it to HMRC. Remember, your £20,000 annual ISA allowance is “use it or lose it” each tax year—so maximise it while you can.

What Do Real Users Think?

Real customers generally praise the Trading 212 Cash ISA for its easy setup, sleek app and hassle-free withdrawals that don’t eat into your ISA allowance. However, reviews note withdrawals aren’t instant (up to 3 days) and highlight the lack of branches or phone support.

Highlights from Reviews & Forums

- Easy to set up, smooth app interface

- Flexible withdrawals without impacting allowance

- Not instant withdrawals (3 days)

- No in-person service

Trading 212 Cash ISA Pros and Cons

- Tax Efficiency: Reinvested dividends aren’t immediately taxable, which can defer taxes until the investment is sold.

- Compounding Growth: Reinvestment leads to potential higher returns over time due to compound interest.

- No Regular Income: Investors do not receive periodic cash payouts.

- Complex Tax Calculation: Investors must account for reinvested dividends when calculating capital gains tax upon sale.

How to Open a Trading 212 Cash ISA

Opening a Trading 212 Cash ISA takes just minutes.

- Download the Trading 212 app on iOS or Android.

- Sign up and verify your identity by uploading a photo ID and adding your National Insurance number.

- Select “Cash ISA” from the menu, link your bank, and make your first deposit — starting from as little as £1.

- That’s it! You can track your savings instantly in the app.

Tip: Use a referral code like TIC to get a free share worth up to £100, boosting your overall savings right from the start.

Final Verdict: Is the Trading 212 Cash ISA Worth It?

If you’re looking for a flexible, tax-free savings option managed entirely through your phone, the Trading 212 Cash ISA is a very strong choice. Its competitive interest rates (especially for new customers), lack of fees, and easy integration with other Trading 212 products make it stand out.

It’s perfect for tech-friendly savers who want hassle-free, on-the-go management of their money without branch visits. However, it’s not for you if you prefer fixed rates, face-to-face service, or a traditional high street bank feel. For many, it strikes a smart balance between convenience and earning tax-free interest.

UK New Clients

UK New Clients

61% of retail CFD accounts lose money when trading CFD’s with this provider.

FAQs

Is the Trading 212 Cash ISA flexible?

Yes. It’s officially classed as a flexible ISA, which means you can withdraw funds and redeposit them within the same tax year without impacting your £20,000 annual ISA allowance. This makes it ideal if you want to keep your cash accessible for emergencies or short-term needs.

Is my money protected by FSCS?

It is. Like other reputable UK banks and building societies, Trading 212’s Cash ISA comes with FSCS (Financial Services Compensation Scheme) protection. This means up to £120,000 of your savings is safeguarded per person, per institution, if Trading 212 or their banking partners were ever to fail.

Can I transfer an existing ISA in?

Yes. Trading 212 allows you to transfer existing ISAs from other providers directly into your new Cash ISA account. This is done within the app and helps keep your ISA savings all in one place. However, keep in mind that transferred funds typically won’t qualify for the new customer bonus interest rate.

What’s the difference between AER and APY?

In the UK, interest on savings is usually shown as AER — Annual Equivalent Rate. This figure factors in compounding and shows how much you’d earn over a year. APY is the US term for the same concept. Both help you compare savings accounts on equal footing by accounting for the effect of interest-on-interest.

Who should pick a Cash ISA vs Stocks & Shares?

A Cash ISA is best for short- to medium-term goals where you want security and easy access, like building an emergency fund. Your money earns interest without market risk. A Stocks & Shares ISA is geared for long-term growth, ideal if you’re comfortable with market ups and downs. Many people use both — keeping their savings safe in a Cash ISA while investing for future wealth in a Stocks & Shares ISA.

References

- Trading 212 Cash ISA Page – Stocks ISA with zero account fees

- Trading 212 – Official Terms and Conditions

- Trading 212 ISA Fees – Fees in Invest and ISA Accounts

- FSCS Home page – Financial Services Compensation Scheme | FSCS