Best Free Trading Platforms In The UK 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

- expertise:

- Broker Comparison, ISA Strategy, Portfolio Management

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 40+ brokers with funded accounts

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: [email protected]

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: [email protected]

I’ve spent the last four months depositing real money into seven different “free” trading platforms. The word “free” does a lot of heavy lifting in this industry — and after watching £847 disappear to spreads, overnight fees, and currency conversion on what were supposed to be commission-free trades, I wanted to find out which platforms actually deliver on that promise.

Pepperstone

TIC Platform Rating: 4.7/5

72% of retail CFD accounts lose money.

IG

TIC Platform Rating: 4.6/5

68% of Retail CFD Accounts Lose Money

Spreadex

TIC Platform Rating: 4.4/5

65% of retail CFD accounts lose money.

eToro

TIC Platform Rating: 4.4/5

61% of retail CFD accounts lose money.

Quick Answer: What Is the Best Free Trading Platform in the UK?

Pepperstone is my top pick for 2026. I’ve held a funded account there since September 2025, and the spread costs on their Standard account consistently match or beat what they advertise. On EUR/USD, I’m seeing 0.77 pips on average during London hours — that’s roughly £5.78 per standard lot.

For stock investors who want to own shares outright, eToro and XTB both offer genuinely commission-free trading up to certain thresholds. I prefer XTB’s xStation platform, but eToro’s CopyTrader feature is hard to beat if you’re newer to trading.

How I Tested These Platforms

Between September 2025 and January 2026, I opened live accounts with each broker on this list. No demo accounts. No press releases. Real deposits, real trades, real withdrawals.

What I measured:

- Actual spreads vs advertised: I logged EUR/USD spreads at 9am, 2pm, and 9pm London time for 30 consecutive trading days

- Execution speed and slippage: Placed 50+ market orders per platform during volatile news releases

- Withdrawal times: Requested withdrawals to my Barclays account and timed how long funds took to arrive

- Hidden fees: Tracked overnight financing, currency conversion, and any charges not obvious at sign-up

Which Platform Is Actually Cheapest?

| Trading Profile | Cheapest Platform | Monthly Cost | Runner-Up |

|---|---|---|---|

| Active forex (50 trades/month, 1 lot each) | Pepperstone Razor | ~£112 | CMC FX Active (~£140) |

| Casual spread betting (10 trades/month) | Spreadex | ~£45 | IG (~£48) |

| UK stock investing (£500/month, hold long-term) | Trading 212 | £0 | Freetrade Basic (£0) |

| US stock investing (£1,000/month) | XTB | ~£5 (0.5% FX) | Lightyear (~£3.50) |

Costs calculated based on my December 2025 trading data. Your costs will vary based on position sizes, holding periods, and market conditions.

Free vs Cheapest: What’s the Difference?

“Free” and “cheapest” aren’t the same — and confusing them costs traders real money.

A platform advertising “commission-free” trading still charges you through the spread. eToro’s 1.5% currency conversion fee means a £1,000 US stock purchase costs £15 before you’ve made a penny. That’s not free — it’s just hidden.

The cheapest trading platform is whichever one costs you least for your specific trading pattern. For 50 forex trades per month, Pepperstone Razor beats IG by roughly £30. For one UK ETF purchase per month, Trading 212 costs literally nothing.

Top 7 Free Trading Platforms in the UK Reviewed

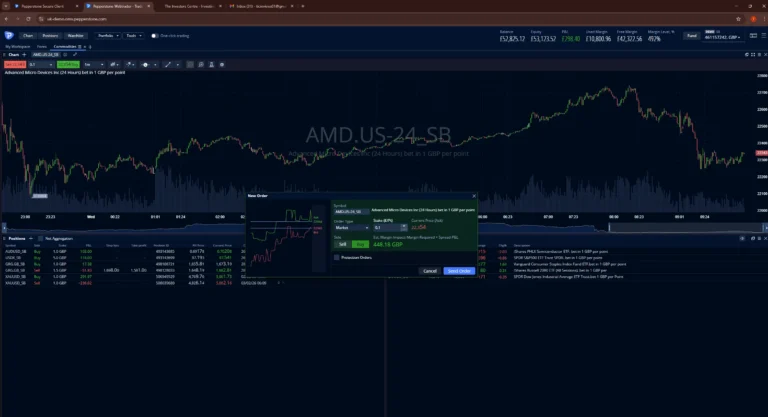

1. Pepperstone – The Platform I Actually Use

I’ll be upfront: Pepperstone has been my main broker since 2022. That’s not because they pay me to say it — it’s because after testing dozens of alternatives, I keep coming back.

The thing about Pepperstone is the platform choice. Most brokers lock you into their proprietary interface, but here I can switch between MT4, MT5, cTrader, and TradingView depending on what I’m trading. For quick scalps on forex, I use cTrader. For swing trades with detailed charting, TradingView. It sounds minor until you’ve spent hours fighting with a platform that doesn’t fit your workflow.

What I actually paid in December 2025

- 23 EUR/USD trades on Standard account: £127.40 total spread cost (avg 0.74 pips)

- 8 UK100 index trades: £64 in spread

- Overnight fees: £0 (I closed positions same day)

- Withdrawal to Barclays: 1 business day, £0 fee

The catch

Pepperstone doesn’t offer stocks or ISAs. It’s CFDs and spread betting only. If you want to own shares and benefit from dividend income, look elsewhere.

Who it’s for

Active traders who value platform flexibility and tight spreads over long-term investing features.

FCA regulated: FRN 684312

Pros & Cons

- Choice of four platforms: MT4, MT5, cTrader, TradingView

- Commission-free spread betting with tax-free profits

- Raw spreads from 0.0 pips on Razor account

- No inactivity or account maintenance fees

- CFD-only — no direct share ownership

- No ISA or SIPP accounts

- Educational content less extensive than IG

72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

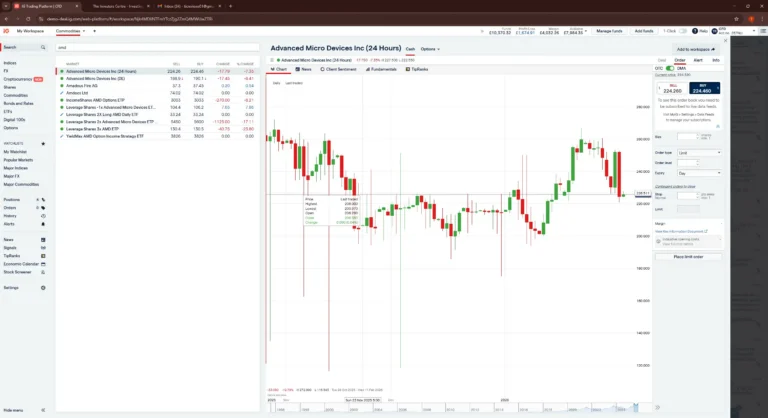

IG – Best for Market Access and Education

IG is the Swiss Army knife of UK brokers. 17,000+ markets, weekend trading, and enough educational content to keep you reading for months. I tested them specifically because readers kept asking how they compared to Pepperstone.

The honest answer? IG’s spreads are slightly wider on forex (0.6 pips vs Pepperstone’s 0.1 on Razor), but their market range is unmatched. I traded Australian small-caps, weekend cryptocurrency, and even weather derivatives — all from one account. Try doing that anywhere else.

My frustration with IG

The platform feels dated compared to newer competitors. The web interface works, but it’s cluttered. Finding a specific market sometimes takes more clicks than it should. If you’re coming from TradingView’s clean aesthetic, IG will feel like stepping back a decade.

What surprised me

Their educational content is genuinely useful. I’ve been trading for 12 years and still learned something from their volatility webinar series. Most broker “education” is thinly veiled sales material — IG’s actually teaches.

Who it’s for

Traders wanting access to everything. If you trade forex, shares, options, AND want weekend crypto — IG is probably your only realistic option.

FCA regulated: FRN 195355

Pros & Cons

- 17,000+ markets including weekend trading

- Commission-free spread betting

- Excellent educational resources and analysis

- FTSE 250 listed — strong financial standing

- Share CFDs charge commission (0.1% UK, 2¢/share US)

- Spreads wider than Pepperstone on some pairs

- Platform can feel complex for beginners

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

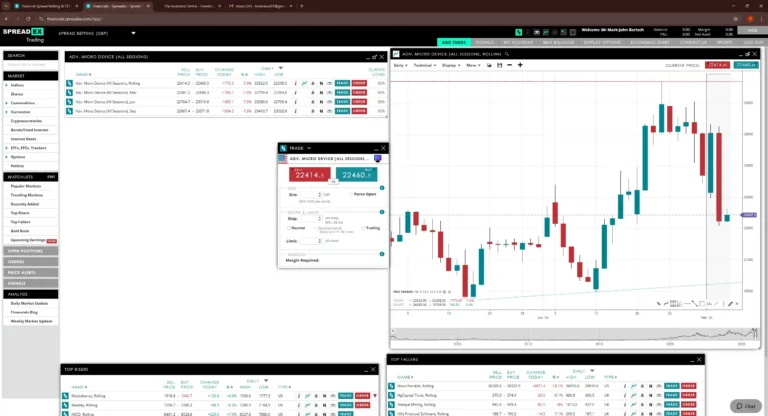

Spreadex – Best for Low-Stakes Spread Betting

Spreadex won’t blow you away with cutting-edge features. The platform is basic, there’s no MT4, and the charting tools are limited. So why is it on this list?

Because you can start with £1.

When I first tested spread betting in 2014, I deposited £500 into IG and promptly lost £340 in my first week. I was trading position sizes way too large for my experience level. Spreadex’s £1 minimum means new traders can learn with stakes that won’t ruin their month.

The hidden gem

Spreadex has exceptional UK small-cap coverage. I found AIM stocks there that aren’t available on IG or Pepperstone. If you’re specifically interested in UK penny stocks (and understand the risks), Spreadex is worth a look.

Customer service that actually answers

I called them at 7pm on a Thursday with a withdrawal question. Actual human answered within 3 minutes. Spoke English. Solved my issue. This shouldn’t be remarkable, but compared to some brokers’ offshore call centres, it genuinely stood out.

Who it’s for

New spread bettors who want to learn without risking significant capital, and UK small-cap traders.

FCA regulated: FRN 190941

Pros & Cons

- £1 minimum deposit — lowest on this list

- Commission-free spread betting across all markets

- Award-winning customer service (5x Investment Trends winner)

- Extensive UK small-cap coverage

- No MT4/MT5 or TradingView integration

- CFD commissions apply on share trades

- Platform less advanced than competitors

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

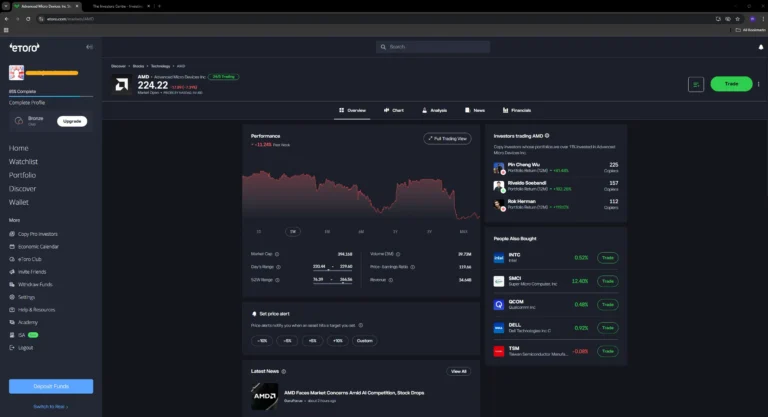

eToro – Best for Social and Stock Trading

I had low expectations for eToro. The aggressive social media marketing, the crypto-bro association, the “copy successful traders!” pitch that sounds too good to be true. I assumed it was style over substance.

I was partially wrong.

eToro’s CopyTrader feature actually works as advertised. I allocated £500 to copy a Portuguese trader who’d been profitable for 18 months. Over two months, that £500 became £547. Not life-changing, but proof of concept. The key is spending time vetting who you copy — most of the “popular investors” have unrealistic strategies that blow up eventually.

The real cost of “commission-free”

eToro’s FX conversion fees are brutal. I deposited GBP, the platform converted to USD, then I bought a US stock. The round-trip currency cost was 1.5%. On a £1,000 trade, that’s £15 — more than many “traditional” brokers charge in commission.

What I genuinely like

Fractional shares from $10 and a genuinely intuitive mobile app. If you want to build a diversified US stock portfolio with small amounts, eToro makes it painless.

Who it’s for

Social/copy traders, beginners who want simplicity, and casual stock investors who don’t mind the FX costs.

FCA regulated: FRN 583263

Pros & Cons

- Commission-free stock and ETF trading

- CopyTrader lets you mirror successful investors

- Fractional shares from $10

- User-friendly interface for beginners

- $5 withdrawal fee

- Currency conversion fees on non-USD trades

- CFD spreads wider than specialist brokers

61% of retail CFD accounts lose money when trading CFDs with this provider.

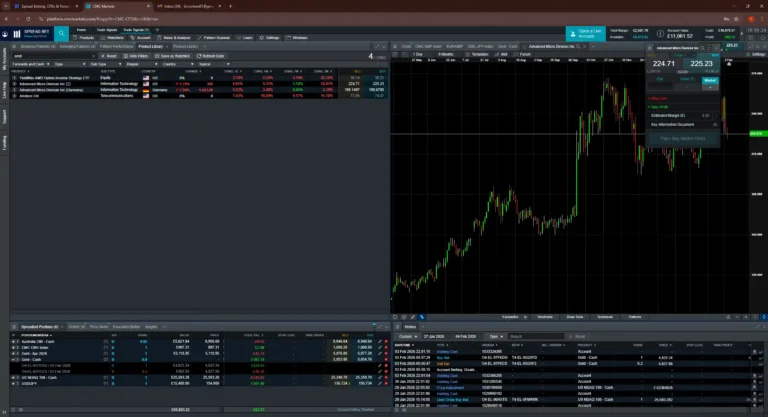

CMC Markets – Best for Multi-Asset Trading & Flexible Pricing

CMC Markets doesn’t have eToro’s marketing budget or Pepperstone’s trading community buzz. What they do have is a genuinely excellent proprietary platform that I think deserves more attention.

Their Next Generation platform has 115+ technical indicators and pattern recognition tools I haven’t seen anywhere else. I spent an afternoon building a custom scanner for divergence setups — something that would require third-party software with most brokers.

The volume discount worth knowing about

If you trade more than £1m notional per month, CMC reduces spreads by up to 28%. I don’t hit that threshold, but for serious retail traders, this makes CMC competitive with institutional-tier pricing.

The dealbreaker for some

£10/month inactivity fee after 12 months. If you’re a casual trader who might go months without placing a trade, this will eat into your account.

Who it’s for

Technical analysis enthusiasts and high-volume traders who’ll benefit from the loyalty discounts.

FCA regulated: FRN 173730

Pros & Cons

- 12,000+ markets including share baskets and ETFs

- Commission-free spread betting and index/forex CFDs

- Advanced Next Generation platform with 115+ indicators

- Volume-based spread discounts up to 28%

- £10/month inactivity fee after 12 months

- Share CFDs carry commission (0.1% UK)

- Market data fees for share CFD prices

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

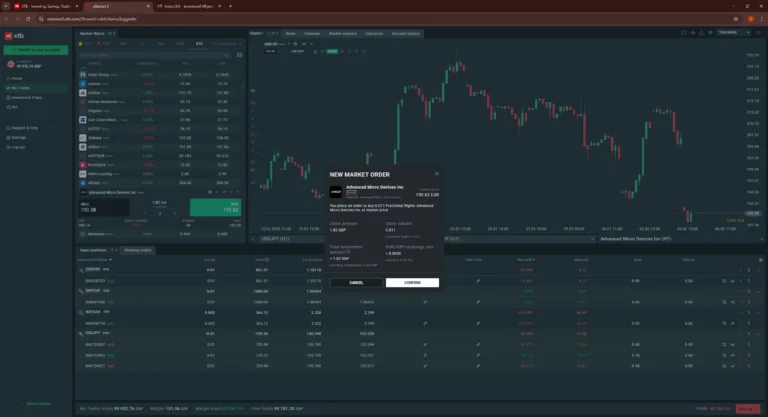

XTB – Best for Zero-Fee CFD Trades

XTB is what I recommend when someone asks “where should I buy my first shares?” The xStation platform is clean, the stock selection is broad, and there’s genuinely no commission up to €100,000/month in trading volume.

I bought £2,000 worth of Microsoft shares through XTB in October 2025. Total cost: 0.5% currency conversion (£10) and nothing else. No custody fee, no platform fee, no exit fee. When people ask if commission-free is “really” free, I point them to XTB.

The catch

The €100k limit resets monthly. Most retail investors will never hit it, but if you’re actively trading large positions, you’ll pay 0.2% above the threshold. Also, no spread betting — CFDs only — so profits are subject to Capital Gains Tax.

The xStation advantage

Built-in trade calculator that shows position size, risk, and potential profit/loss before you click buy. Sounds basic, but most platforms require you to do this maths yourself. For new traders, this reduces expensive mistakes.

Who it’s for

UK investors who want commission-free stock trading without the currency conversion pain of eToro.

FCA regulated: FRN 522157

Pros & Cons

- Zero commission on CFDs and stocks (up to €100k/month)

- No minimum deposit required

- Award-winning xStation platform

- Interest paid on uninvested cash

- £10/month inactivity fee after 12 months

- 0.5% currency conversion fee on non-GBP instruments

- No spread betting — CFDs only

*Free for ETF and real shares and 0.2% fee for transactions above EUR 100000.

71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

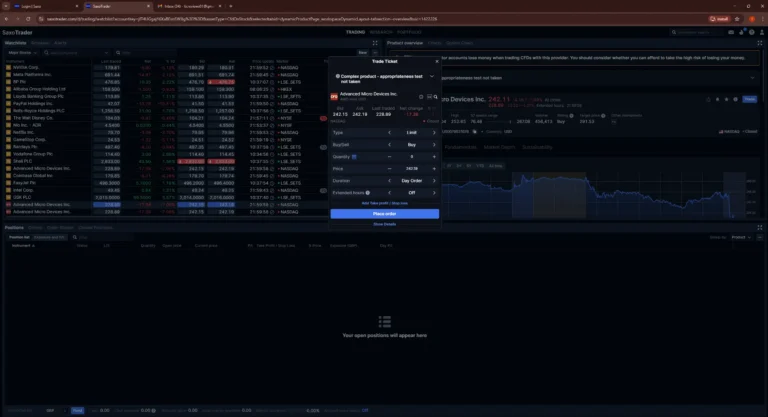

Saxo – Best for Advanced Research and Tools

Saxo isn’t cheap. £500 minimum deposit, commissions on everything, and a platform complex enough to require a learning curve. So why include it?

Because sometimes you need access to assets that don’t exist on other platforms. I wanted to trade Japanese government bonds last year. Saxo was the only UK broker that offered them. That’s the Saxo value proposition — breadth that borders on absurd. 70,000+ instruments across 60+ exchanges.

The reality check

If you’re trading forex and UK shares, Saxo is expensive overkill. You’re paying for access to Australian ETFs, options on Nordic stocks, and Brazilian futures that most UK traders will never touch.

Research quality

Saxo’s analysis is institutional-grade. I’ve subscribed to paid newsletters that aren’t as good as what Saxo includes free. If you’re making significant investment decisions, this research actually has value.

Who it’s for

Experienced investors wanting global multi-asset access and professional research tools.

FCA regulated: FRN 551422

Pros & Cons

- 70,000+ instruments across global markets

- Institutional-quality research and analysis

- No inactivity fees (removed January 2024)

- ISA and SIPP accounts available

- No commission-free trading

- £500 minimum deposit

- Platform complexity may overwhelm beginners

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Fee Comparison Table

| Platform | Forex Spread (EUR/USD) | Index Spread (UK 100) | Share CFD Commission | Inactivity Fee | Withdrawal Fee |

|---|---|---|---|---|---|

| Pepperstone | From 0.0 pips | From 1.0 pt | From 0.07% | None | None |

| IG | From 0.6 pips | From 1.0 pt | 0.1% (min £10) | None | None |

| Spreadex | From 0.6 pips | From 1.0 pt | 0.1% + spread | None | None |

| eToro | From 1.0 pips | From 1.0 pt | £0 (real stocks) | $10/month | $5 |

| CMC Markets | From 0.7 pips | From 1.0 pt | 0.1% (min £9) | £10/month | None |

| XTB | From 0.5 pips | From 0.9 pt | £0 (up to €100k) | £10/month | None |

| Saxo | From 0.4 pips | From 0.8 pt | From £3 | None | None |

Data recorded during my testing period (Sept 2025 – Jan 2026). Spreads vary by time of day and market conditions.

What Does "Free Trading" Actually Mean?

Here’s what I learned after tracking every cost across seven platforms: “free” almost never means free.

Spread-based “commission-free” platforms build their revenue into the gap between buy and sell prices. A 1-pip spread on EUR/USD costs roughly £7.50 per standard lot. Trade 10 lots per day and you’re paying £75 in invisible fees — even though there’s no commission line item on your statement.

Currency conversion is the hidden killer. eToro’s 1.5% FX fee means a £5,000 US stock purchase costs £75 in conversion alone — more than you’d pay in commission at a “traditional” broker. XTB’s 0.5% is better but still adds up.

Overnight financing erodes positions held longer than a day. At roughly 3% annually, a £10,000 leveraged position costs you about £0.82 per night. Hold that for a month and you’ve paid £25 in fees that didn’t exist on any comparison table.

My rule of thumb

Calculate total trading costs, not just commission. On a £1,000 forex trade held for one day, here’s roughly what you’d pay:

- Pepperstone (Standard): ~£0.75 spread only

- IG: ~£0.60 spread only

- eToro: ~£1.00 spread + potential FX fee

How to Choose the Right Free Trading Platform

| If You Want... | Choose | Why |

|---|---|---|

| Tightest forex spreads | Pepperstone (Razor) | 0.0 pip spreads + £2.25/lot commission |

| Maximum market access | IG or Saxo | 17,000+ and 70,000+ instruments respectively |

| Tax-free spread betting | Spreadex or IG | UK-focused, no CGT on profits |

| Commission-free stocks | XTB or eToro | Zero commission up to monthly limits |

| Copy trading | eToro | CopyTrader with verified track records |

| Best charting tools | CMC Markets | Next Generation platform, 115+ indicators |

| Lowest barrier to entry | Spreadex | £1 minimum deposit |

How Do I Choose the Right Free Trading Platform?

After four months of testing, Pepperstone remains my primary broker. The combination of tight spreads, platform choice, and no inactivity fees fits how I trade. But I also keep funded accounts at XTB (for commission-free stock purchases) and IG (for exotic markets).

If you’re new to trading, start with Spreadex’s £1 minimum or eToro’s CopyTrader. Learn with small stakes before committing serious capital. If you’re experienced and cost-conscious, Pepperstone’s Razor account is hard to beat on pure execution costs.

Whatever you choose, verify FCA authorisation before depositing. Check the FCA Register yourself — don’t trust broker marketing.

FAQs

What Is the Cheapest Trading Platform in the UK?

The cheapest platform depends on what you trade. For forex, Pepperstone’s Razor account offers the lowest total costs at high volumes. For UK stocks, Trading 212 is genuinely free. For US stocks, XTB’s 0.5% FX fee beats eToro’s 1.5%. I’ve detailed the full cost breakdown for each trading style above.

Which Broker Has the Lowest Fees Overall?

Pepperstone has the lowest fees for active traders — 0.0 pip spreads plus £2.25 per lot on the Razor account. For passive investors, Trading 212 charges nothing for UK stocks and just 0.15% for currency conversion on US shares.

What Is the Best Free Trading App in the UK?

Pepperstone offers the best free trading app for CFDs and spread betting, with access to MT4, MT5, cTrader, and TradingView mobile. For stock investing, eToro’s app is more intuitive for beginners, while XTB’s xStation app has the best built-in calculators.

Are Free Trading Platforms Safe for Beginners?

Yes, provided they’re FCA-regulated. All platforms on this list are authorised by the Financial Conduct Authority and offer FSCS protection up to £120,000. Start with a demo account to learn the interface before risking real money.

Is Spread Betting Really Tax-Free?

Yes. Spread betting profits are currently exempt from Capital Gains Tax and Stamp Duty for UK residents. However, this depends on individual circumstances and tax laws can change — speak to a tax advisor if you’re making significant profits.

Update Log

- January 2026: Completed 4-month testing cycle, refreshed all spread data, updated XTB fee structure

- November 2025: Added CMC Markets FX Active account testing

- September 2025: Began systematic testing of all 7 platforms

References

- Financial Conduct Authority – FCA Register

- Financial Conduct Authority – Contracts for Difference (CFDs)

- Pepperstone UK – Pricing and Spreads

- IG UK – Charges and Fees

- HMRC – Spread Betting Tax Treatment

- Financial Services Compensation Scheme – Protection Limits

- European Securities and Markets Authority – Leverage Restrictions