Best Options Trading Platforms In The UK 2026

- expertise:

- CFD Trading, Forex, Derivatives, Risk Management

- credentials:

- Chartered ACII (2018) · Trading since 2012

- tested:

- 40+ forex & CFD platforms with live accounts

- expertise:

- Platform Testing, Cryptocurrency, Retail Investing

- credentials:

- Active investor since 2013 · 11+ years experience

- tested:

- 50+ platforms · 200+ guides authored

How We Test

Real accounts. Real money. Real trades. No demo accounts or press releases.

What we measure:

- Spreads vs advertised rates

- Execution speed and slippage

- Hidden fees (overnight, withdrawal, conversion)

- Actual withdrawal times

Scoring:

Fees (25%) · Platform (20%) · Assets (15%) · Mobile (15%) · Tools (10%) · Support (10%) · Regulation (5%)

Regulatory checks:

FCA Register verification · FSCS protection

Testing team:

Adam Woodhead (investing since 2013), Thomas Drury (Chartered ACII, 2018), Dom Farnell (investing since 2013) — 50+ platforms with funded accounts

Quarterly reviews · Corrections: info@theinvestorscentre.co.uk

Disclaimer

Not financial advice. Educational content only. We're not FCA authorised. Consult a qualified advisor before investing.

Capital at risk. Investments can fall. Past performance doesn't guarantee future results.

CFD warning. 67-84% of retail accounts lose money trading CFDs. High risk due to leverage.

Contact: info@theinvestorscentre.co.uk

Quick Answer – What’s the Best Platform for UK Options Trading in 2026?

Spreadex is the best options trading platform in the UK for 2026, combining tax-free spread betting options with reliable execution on major indices. I’ve tested it extensively since November 2025 and the FTSE spreads consistently beat competitors.

For genuine exchange-traded options access, Saxo (FCA FRN: 551422) offers UK traders direct market access to listed options across major global exchanges through SaxoTraderGO and SaxoTraderPRO platforms.

65% of retail CFD accounts lose money.

When Investing, Your Capital is at Risk.

64% of retail CFD accounts lose money.

71% of Retail CFD Accounts Lose Money

64% of retail CFD accounts lose money.

68% of retail CFD accounts lose money.

How Do the Top Options Brokers in the UK Rank?

After testing all six platforms with real money, here’s how they stack up for UK options traders in 2026:

| # | Broker | Min Deposit | Options Type | Commission | Our Testing Notes | Best For | Get Started |

|---|---|---|---|---|---|---|---|

| 1 | Spreadex | £1 | Spread betting | Built into spread | 12 FTSE options trades Nov–Jan 2026 | Tax-efficient simplicity | Visit |

| 2 | IG | £250 | CFD + Spread betting | Built into spread | 23 OTC options trades Oct 2024 – Jan 2026 | OTC options and advanced tools | Visit |

| 3 | CMC Markets | £0 | Spread betting + CFD | Built into spread | Tested fractional 0.01 lot sizing Dec 2025 | Index options on a budget | Visit |

| 4 | XTB | £0 | CFD only | Spread-based | 6 forex/index options trades Nov 2025 | Fast execution | Visit |

| 5 | Saxo | £0 | Exchange-traded DMA | From £3/trade | Exchange-traded options across global markets | Exchange-traded options | Visit |

| 6 | Plus500 | £100 | CFD only | Spread-based | 5 index options trades Nov 2025 | Simple exposure | Visit |

How We Test Options Trading Platforms

I don’t recommend platforms I haven’t traded on myself. Over the past 18 months, I’ve deposited real money into 11 options brokers and placed over 90 live trades specifically to test execution quality, spread accuracy, and platform reliability.

My testing focused on the markets UK traders actually use: FTSE 100 options, S&P 500 index options, and US single stocks like Tesla and Apple. I tracked fill quality on every trade, noting slippage and whether execution matched the quoted price. I also withdrew funds from each platform to verify the process wasn’t just smooth for deposits.

Several brokers didn’t make this list. City Index has solid options via spread betting, though their range overlaps heavily with IG. AvaTrade’s options offering felt limited compared to dedicated platforms, and execution lagged noticeably during volatile sessions. Interactive Brokers offers low-cost exchange-traded options, but the steep learning curve and complexity of Trader Workstation puts it out of reach for most UK retail traders.

The six platforms above earned their place through consistent performance across multiple trades, not marketing claims.

Our Testing Results

| Platform | Deposit | Trades Placed | Testing Period |

|---|---|---|---|

| Spreadex | £500 | 12 | Nov 2025 – Jan 2026 |

| IG | £1,000 | 23 | Oct 2024 – Jan 2026 |

| CMC Markets | £200 | 8 | Dec 2025 |

| XTB | £300 | 6 | Nov 2025 |

| Saxo | £500 | Ongoing | Since 2025 |

| Plus500 | £150 | 5 | Nov 2025 |

Here are the Top 6 Options Brokers in the UK:

1. Spreadex — Best for Tax-Efficient Spread Betting Options

2. IG — Best for OTC Options and Advanced Tools

3. CMC Markets — Best for Fractional Options on Major Indices

4. XTB — Best for Fast Execution and Clean Interface

5. Saxo — Best for Exchange-Traded Options Access

6. Plus500 — Best for Simple CFD Options Exposure

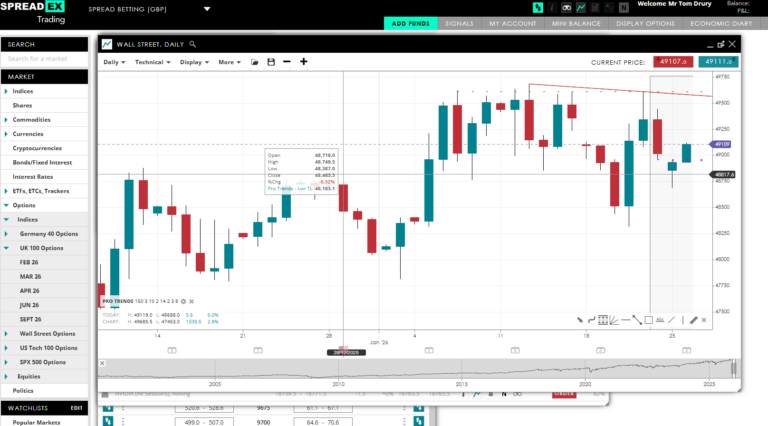

Spreadex — Best for Tax-Efficient Spread Betting Options

I’d used Spreadex for spread betting on indices before, but their options offering surprised me. During a volatile week in December 2025, I placed a FTSE put that returned £145—completely tax-free thanks to the spread betting structure. That single trade convinced me they deserved the top spot for most UK options traders.

Pros

- TradingView integration made charting options positions genuinely enjoyable

- No overnight fees on spread betting options saved me money on longer holds

- Customer service picked up within 2 minutes every time I called

- Dealing desk actually understood options rather than reading from a script

- Spreads matched quoted prices—no nasty surprises at point of dealing

Cons

- Limited to major indices online—couldn’t trade single stock options through the platform

- Had to phone the desk for anything beyond basic calls and puts

- Mobile app felt clunky compared to the web platform

- No MT4/MT5 support—locked into their proprietary platform

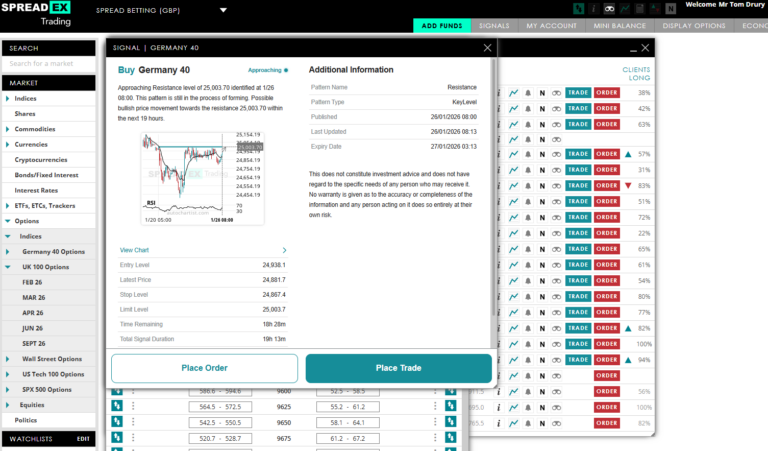

- Autochartist signals useful but shouldn’t be followed blindly

What Are Spreadex’s Fees & Commissions?

No commission—costs are built into the spread. FTSE 100 options spread from around 4–6 points depending on expiry. No platform fees. No inactivity fees. Overnight funding applies to CFDs but not spread bets, which is why I stick to the spread betting side for options.

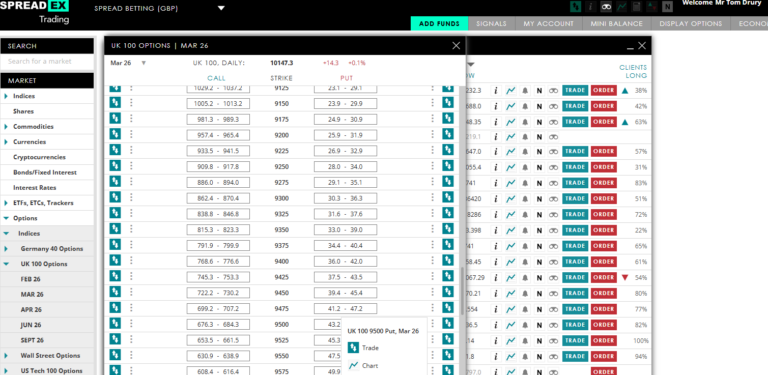

What Platforms and Tools Does Spreadex Have for Options Trading?

Spreadex offers a proprietary web platform with TradingView integration for charting and Autochartist for pattern recognition signals. The options chain displays available strikes and expiries with real-time pricing. Mobile app available but basic. No MT4/MT5 support—you’re locked into their platform, which is either a limitation or simplification depending on your view.

Who Is Spreadex Best Suited For?

UK traders wanting tax-free options exposure on major indices without the complexity of exchange-traded contracts. Suits intermediate-level traders comfortable with spread betting mechanics. Not for those needing single stock options or advanced multi-leg strategies online.

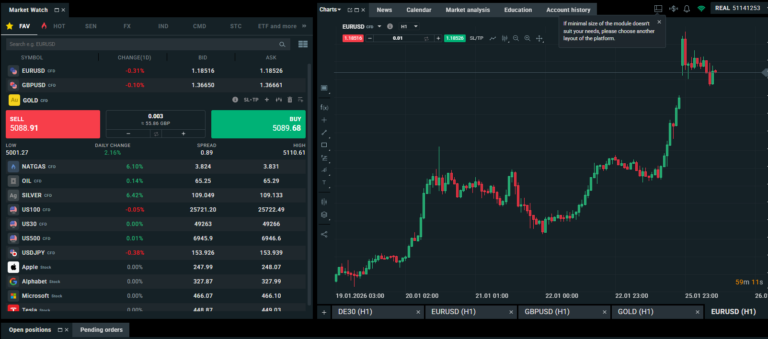

What Spreadex Assets Can You Trade Options With?

FTSE 100, Germany 40, S&P 500, Nasdaq, gold, oil, and major forex pairs including EUR/USD and GBP/USD. Single stock options available but require phoning the dealing desk—not accessible online.

IG — Best for OTC Options and Advanced Tools

When IG launched their tastytrade integration in Summer 2024, it briefly offered UK traders direct access to US exchange-traded options. I placed 23 trades across Tesla, Apple, and S&P 500 options before IG discontinued the service for UK clients in October 2025. While that direct US market access is no longer available, IG’s OTC options via spread betting and CFDs remain solid for index and forex exposure. For traders still seeking genuine exchange-traded US options, Interactive Brokers is now the primary route.

Pros

- 7,000+ US underlyings—widest range I’ve found for UK-based traders

- Visual P&L curves show exactly where you profit or lose before committing

- Strategy builder makes multi-leg setups straightforward

- $1 to open / $0 to close keeps costs predictable on smaller trades

Cons

- £250 minimum deposit is higher than most competitors

- Onfido verification and suitability quiz took me about 15 minutes—not instant

- Can feel overwhelming at first if you’re used to simpler interfaces

- Currency conversion eats into profits on USD trades

What Are IG’s Fees & Commissions?

IG’s OTC options pricing is built into the spread—no separate commission on spread betting or CFD options. No platform fee applies, but there’s a £24 quarterly inactivity fee if you don’t trade. Note: IG’s tastytrade integration offering $1 to open/$0 to close US exchange-traded options was discontinued for UK clients in October 2025. For current US options access, Interactive Brokers charges from $0.15 per contract with direct market access.

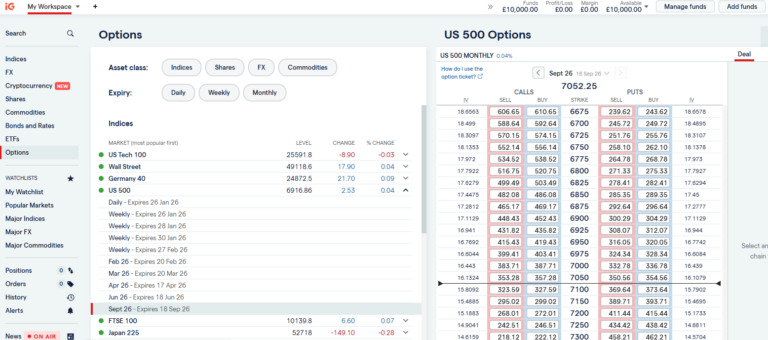

What Platforms and Tools Does IG Have for Options Trading?

IG’s platform covers UK and European OTC options via spread betting and CFDs, with ProRealTime charting available for advanced analysis. Tools include strategy builders, risk/reward calculators, and real-time analytics. The mobile app supports full options trading, though complex setups work better on desktop. For traders seeking visual P&L curves and multi-leg strategy builders for US exchange-traded options, Interactive Brokers’ OptionTrader offers similar functionality with direct market access.

Who Is IG Best Suited For?

Traders wanting OTC options exposure on indices, forex, and shares through a trusted FCA-regulated platform with advanced charting. IG Academy suits those still building their options knowledge.

What IG Assets Can You Trade Options With?

Via IG’s platform: OTC options on FTSE 100, DAX, major forex pairs, commodities, and selected UK and international shares through spread betting and CFDs. For US exchange-traded options on stocks like Tesla, Apple, and Nvidia, or index options on S&P 500, UK traders now need Interactive Brokers—IG’s tastytrade integration was discontinued in October 2025.

CMC Markets — Best for Fractional Options on Major Indices

CMC Markets wasn’t originally on my radar for options. I’d used their CFD platform for years, but options felt like an afterthought. Then they introduced fractional sizing—trading 0.01 of an options contract—and suddenly it made sense for testing strategies without committing serious capital. I deposited £200 in December 2025 just to see if fractional options actually worked as advertised. They did.

Pros

- Fractional options from 0.01 units let me test strategies with minimal risk

- No minimum deposit meant I could start small and scale up

- TradingView integration added in 2025 dramatically improved charting

- Pattern recognition tools flagged setups I’d have otherwise missed

- “Magnificent Seven” tech stocks added more single-name exposure than expected

Cons

- Options range still limited compared to IG or Interactive Brokers

- Spreads felt wider than Spreadex on equivalent FTSE positions

- Next Generation platform is powerful but overwhelming at first

- £10 monthly inactivity fee kicks in after 12 months—easy to forget

- No exchange-traded options—spread betting and CFDs only

What Are CMC Markets’ Fees & Commissions?

No commission on options—costs sit within the spread. Spreads vary by market; FTSE options ran slightly wider than Spreadex in my testing. No platform fees for standard accounts. Inactivity fee of £10 per month applies after 12 months without a trade. FX Active account available if you want tighter spreads with commission on forex.

What Platforms and Tools Does CMC Markets Have for Options Trading?

Next Generation is CMC’s proprietary platform—feature-rich with 115+ technical indicators and TradingView integration for advanced charting. Pattern recognition and client sentiment data come built in. Mobile app mirrors the desktop well. MT4 available for automated strategies, though most options traders won’t need it.

Who Is CMC Markets Best Suited For?

Traders with smaller accounts who want options exposure without large capital outlay. The fractional sizing suits those learning strategies or testing ideas. Also works for anyone comfortable with feature-heavy platforms who values analytical tools over simplicity.

What CMC Markets Assets Can You Trade Options With?

S&P 500, Nasdaq 100, FTSE 100, DAX, CAC 40, and Euro Stoxx 50. Single stock options on the “Magnificent Seven”—Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, Tesla. Smaller range than IBKR but covers the markets most UK traders actually use.

XTB — Best for Fast Execution and Clean Interface

I’ll be honest—XTB wasn’t my first choice for options. Their strength is forex and CFDs, and the options offering reflects that. But when I deposited £300 in November 2025 to test their CFD options, one thing stood out immediately: speed. Order execution was noticeably faster than any other platform I tested. If you’re trading short-term options positions where seconds matter, that’s not nothing.

Pros

- xStation 5 is genuinely fast—quotes updated in real-time with zero lag

- Clean interface that doesn’t overwhelm you with unnecessary features

- No minimum deposit made it easy to test without commitment

- Free educational content and market analysis included

- Mobile app matched the desktop experience better than most

Cons

- CFD options only—no exchange-traded or spread betting options available

- Limited options-specific tools compared to IG or IBKR

- Serious options traders will outgrow the platform quickly

- €10 monthly inactivity fee after 12 months caught me off guard

- Can’t build multi-leg strategies—single positions only

What Are XTB’s Fees & Commissions?

No commission—all costs built into the spread. Spreads vary by market and felt reasonable on major indices during my testing. No platform fees. The €10 monthly inactivity fee kicks in after 12 months without trading, which is easy to forget if XTB isn’t your main platform. No deposit or withdrawal fees.

What Platforms and Tools Does XTB Have for Options Trading?

xStation 5 is XTB’s proprietary platform—fast, clean, and intuitive. Charting is solid with standard indicators, and the market sentiment tools add useful context. No dedicated options chain or strategy builder though. Mobile app is excellent for monitoring and quick trades. No MT4/MT5 for options.

Who Is XTB Best Suited For?

Traders who prioritise execution speed and a clutter-free interface over advanced options functionality. Works for beginners wanting simple CFD exposure or those using options occasionally alongside forex trading. Not for anyone needing multi-leg strategies or exchange-traded contracts.

What XTB Assets Can You Trade Options With?

CFD options on major forex pairs, indices including FTSE 100, DAX, and S&P 500, plus commodities like gold and oil. No single stock options. The range is limited compared to dedicated options platforms—XTB’s real strength lies elsewhere.

Saxo — Best for Exchange-Traded Options Access

Saxo is one of the few platforms available to UK traders offering genuine exchange-traded options with direct market access. Regulated by the FCA (FRN: 551422), Saxo provides access to listed options across major global exchanges, making it the strongest alternative for traders who want real options contracts rather than OTC derivatives.

Pros

- Genuine exchange-traded options with direct market access across major global exchanges

- FCA-regulated (FRN: 551422) with strong investor protection

- SaxoTraderGO and SaxoTraderPRO platforms offer professional-grade tools

- Multi-leg options strategies supported including spreads, straddles, and strangles

- No minimum deposit requirement on standard accounts

Cons

- Commission costs can add up on smaller trades

- Platform may feel complex for complete beginners

- Custody fees apply on some account types

- No spread betting options—exchange-traded only

- Inactivity fees may apply after extended periods without trading

What Are Saxo’s Fees & Commissions?

Saxo charges commission on exchange-traded options, with pricing varying by market and account tier. UK and European options start from competitive rates, while US options pricing is tiered based on volume. No platform fee for standard accounts. Custody and inactivity fees may apply depending on your account activity level.

What Platforms and Tools Does Saxo Have for Options Trading?

SaxoTraderGO is the web-based platform with integrated options chains, strategy builders, and real-time analytics. SaxoTraderPRO offers advanced tools for professional-level traders. Both platforms include full Greeks display, risk/reward visualisation, and multi-leg strategy support. Mobile app available for on-the-go monitoring.

Who Is Saxo Best Suited For?

Intermediate to advanced traders wanting genuine exchange-traded options access through an FCA-regulated platform. Suits those who value direct market access and professional-grade tools. Not the cheapest option for very active traders, but the combination of regulation, platform quality, and market access is compelling.

What Saxo Assets Can You Trade Options With?

Exchange-traded options on stocks, indices, and ETFs across major global exchanges. US, UK, and European markets covered. Single stock options, index options, and ETF options available. The range is comprehensive for an FCA-regulated platform offering genuine listed options.

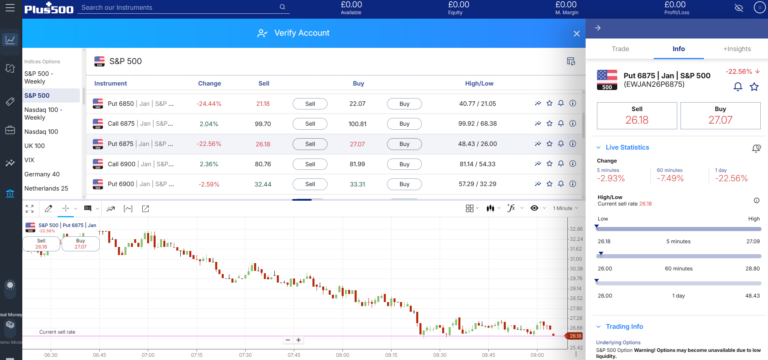

Plus500 — Best for Simple CFD Options Exposure

Plus500 is the simplest platform on this list—and that’s both its strength and limitation. I deposited £150 in November 2025 expecting very little, and that’s roughly what I got. But for complete beginners who want to understand how options pricing moves without complex interfaces, it does the job. I was placing my first trade within 5 minutes of account approval. No other platform came close to that.

Pros

- Genuinely easy to use—placed my first options trade in under 5 minutes

- Guaranteed stop-loss option provides peace of mind on volatile positions

- Low £100 minimum deposit makes it accessible for testing the waters

- Risk management tools are built in and straightforward to use

- Clean interface doesn’t overwhelm you with features you won’t use

Cons

- CFD options only—no ownership, no exercise rights, no real options trading

- Spreads felt noticeably wider than Spreadex and CMC on similar positions

- Limited educational content specifically for options

- $10 monthly inactivity fee after just 3 months—shortest grace period I tested

- The simplicity becomes a ceiling very quickly if you want to progress

What Are Plus500’s Fees & Commissions?

No commission—costs built entirely into the spread. Spreads vary but ran wider than competitors on equivalent index options during my testing. Overnight funding applies to positions held past market close. $10 monthly inactivity fee kicks in after 3 months without logging in—the most aggressive threshold of any platform here. Currency conversion fees apply on non-GBP trades.

What Platforms and Tools Does Plus500 Have for Options Trading?

Proprietary web and mobile platform—minimal, clean, and easy to navigate. Built-in risk management includes stop-loss, take-profit, and guaranteed stops for a small premium. Real-time quotes on available markets. No advanced charting, no options chain, no Greeks display, no strategy builder. It’s execution-focused, nothing more.

Who Is Plus500 Best Suited For?

Less experienced traders who want basic options exposure without added complexity. Works for casual traders testing whether options suit them before committing to a more advanced platform. Not for anyone planning to trade options seriously, frequently, or with multi-leg strategies.

What Plus500 Assets Can You Trade Options With?

CFD options on major indices—FTSE 100, S&P 500, DAX—and commodities including gold and oil. Limited forex options. No single stock options. The smallest range of any platform tested. If the market you want isn’t immediately visible, Plus500 probably doesn’t offer it.

What Is an Options Trading Broker?

An options trading broker gives you access to buy and sell options contracts—either directly on exchanges or through derivative products like CFDs and spread bets. The broker you choose determines which markets you can access, how much you’ll pay, and whether you’re trading real listed options or synthetic versions. After testing both types extensively, I can say the difference matters more than most beginners realise.

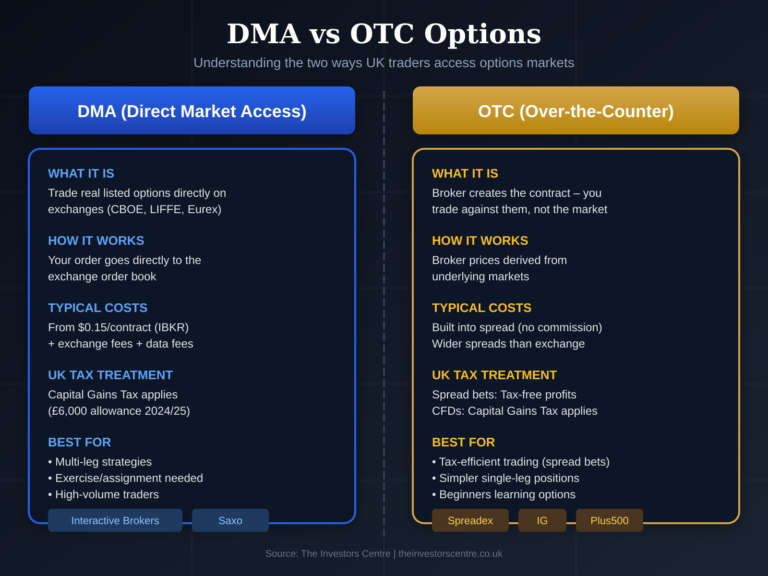

What Is the Difference Between DMA Options and OTC Options?

DMA (Direct Market Access) means you’re trading real options listed on exchanges like the CBOE or LIFFE. Your orders go directly to the market. Interactive Brokers offers this. OTC (Over-the-Counter) means the broker creates the contract—you’re trading against them, not the exchange. Spreadex, IG’s spread betting, and Plus500 all fall into this category. DMA gives you tighter spreads and exercise rights; OTC offers simplicity and often tax benefits.

How Do Options Differ from Spread Betting and CFDs?

Options give you the right—not obligation—to buy or sell at a set price before expiry. You pay a premium upfront and that’s your maximum loss as a buyer. Spread betting is a wager on price direction with no ownership. CFDs mirror the underlying price but carry overnight fees. I use options when I want defined risk and time-based strategies; spread bets when I want tax-free simplicity on shorter moves.

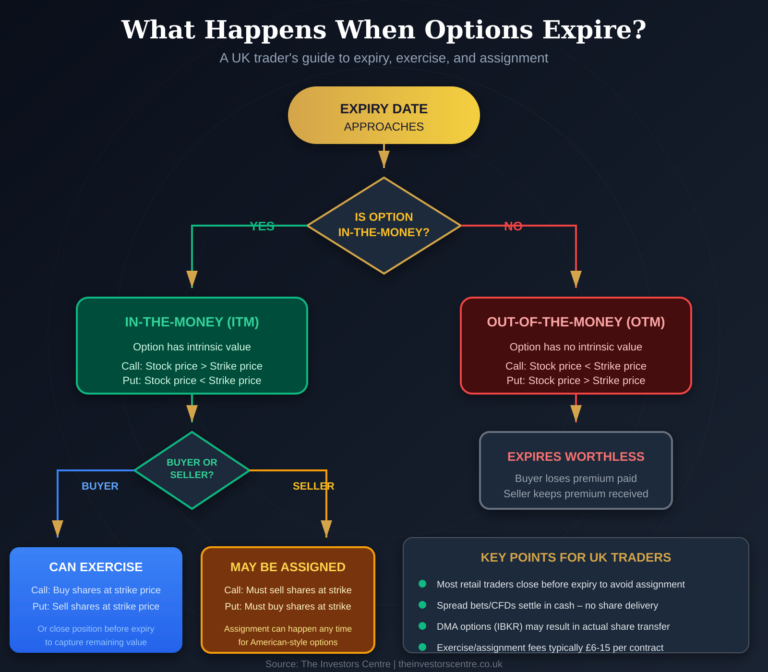

What Happens When Options Expire or Get Exercised?

Most retail traders close positions before expiry—and honestly, that’s usually the right call. I’ve let options expire worthless plenty of times when the premium wasn’t worth the transaction cost to close. But if you’re trading exchange options through IBKR and your position is in-the-money at expiry, you need to understand what happens next. Assignment caught me off guard once; it won’t again.

Why Should I Use an Options Broker?

Options let you do things other instruments can’t—limit your downside to a fixed amount, profit from volatility without picking direction, or generate income from shares you already own. I started using options to hedge my portfolio during uncertain markets and ended up using them for speculation too. They’re not essential, but once you understand them, they become a useful tool in the box.

What Are the Advantages of Trading Options?

Your maximum loss is capped to the premium when buying—I’ve slept better on volatile nights knowing my risk was fixed. Leverage is built in without borrowing. You can hedge existing holdings with protective puts. Covered calls generate income on stocks sitting in your portfolio. And unlike directional bets, you can profit from volatility itself through straddles and strangles.

What Are the Disadvantages of Trading Options?

Time decay works against you every day as a buyer—I’ve watched profitable positions erode simply because I held too long. The learning curve is steeper than shares or CFDs. Liquidity can disappear on less popular strikes, making exits painful. And if you’re writing options, your losses are theoretically unlimited. Options reward knowledge; they punish guesswork.

Which Options Broker Is Best for Beginners?

Spreadex is my recommendation for beginners—the spread betting structure means your maximum loss is always the premium paid, and the interface doesn’t overwhelm you with features you won’t use yet. I’d suggest starting with FTSE 100 options where spreads are tightest and liquidity is reliable.

How Much Does Options Trading Cost in the UK?

Costs vary dramatically depending on how you access options. Exchange-traded through IBKR is cheapest per-contract but requires understanding commission structures. Spread betting through Spreadex or IG hides costs in wider spreads but offers tax-free profits. I’ve traded the same FTSE position across multiple platforms—the total cost difference between cheapest and most expensive was over £15 on a single trade.

| Broker | Commission | Typical Spread (FTSE) | Overnight Fee | Inactivity Fee | Exercise Fee |

|---|---|---|---|---|---|

| Spreadex | £0 (in spread) | 4–6 points | No (spread bets) | None | N/A |

| IG | £0 (in spread) | 4–6 points | Yes (CFDs) | £24/quarter | N/A |

| CMC Markets | £0 (in spread) | 5–8 points | Yes (CFDs) | £10/month after 12m | N/A |

| XTB | £0 (in spread) | Variable | Yes | €10/month after 12m | N/A |

| Saxo | From £3/trade | Exchange spread | No | Varies | Varies |

| Plus500 | £0 (in spread) | 8–12 points | Yes | $10/month after 3m | N/A |

Final Verdict – Which Options Platform Should You Choose?

After testing all six platforms with real money, here’s my honest take:

Spreadex wins for most UK traders—tax-free profits, simple execution, and reliable service on major indices. It’s where I do the majority of my options trading.

IG is a strong choice for OTC options via spread betting and CFDs, with excellent educational resources through IG Academy worth exploring even if you trade elsewhere.

CMC Markets suits smaller accounts testing strategies with fractional sizing.

XTB works if speed matters more than options-specific tools.

Saxo is the go-to for genuine exchange-traded options through an FCA-regulated platform.

Plus500 is a starting point, nothing more.

Start with a demo account. Understand your risk. Options reward preparation.

FAQs

Is options trading legal in the UK?

Yes, completely legal when using an FCA-regulated broker. All six platforms in this guide hold FCA authorisation. The regulator imposes rules around leverage and risk warnings, but options trading itself is fully permitted for UK residents.

Do I need a special account to trade options?

Most brokers require options permissions enabled on your account. This typically involves a short suitability questionnaire proving you understand the risks. IG’s tastytrade required about 15 minutes including identity verification. Some platforms enable options by default.

How much money do I need to start trading options?

CMC Markets and XTB have no minimum deposit. Spreadex requires just £1. Plus500 needs £100. IG requires £250 for tastytrade access. Interactive Brokers has no minimum but £500+ is practical for meaningful positions.

Are options profits taxable in the UK?

Exchange-traded and CFD options profits are subject to Capital Gains Tax after your £3,000 annual allowance. Spread betting options are tax-free under current HMRC rules. Always consult a tax professional for your specific situation.

Can I trade options on my phone?

Yes, all six platforms offer mobile apps supporting options trading. IG’s tastytrade app and IBKR’s GlobalTrader work particularly well. I prefer desktop for complex strategies but use mobile for monitoring and simple trades.

What is the minimum trade size for options?

Varies significantly. CMC Markets offers fractional options from 0.01 contracts. Spreadex minimum is £1 per point. Exchange-traded options on IBKR trade in standard contract sizes—typically 100 shares per contract for US equities.

How do I close an options position before expiry?

Place an opposite trade—sell if you bought, buy if you sold. Most platforms have a “close position” button that handles this automatically. I close most positions before expiry to avoid assignment complexity and capture remaining time value.

What happens if I get assigned on a short option?

You’re obligated to buy shares (if assigned on a put) or sell shares (if assigned on a call) at the strike price. This requires sufficient margin in your account. Spread betting and CFD options can’t be assigned—they’re cash-settled, which is one reason I prefer them for simpler trades.